2 November 2021

Having been a seismic event in capital markets, we should not be surprised that the pandemic continues to deliver aftershocks. It was the turn of bond markets last week, with gut-wrenching rises in interest rate expectations all around the world. Such was the unstoppable momentum that, at one point, investors were able to observe - in real time - the President of the European Central Bank explaining at length why the ECB would not be raising rates anytime soon while, simultaneously, Eurozone bond yields rocketed into orbit. It was like a visit to the Hall of Mirrors.

The damage was not confined to European bond markets, however. Short-term yields from the United States to Australia jumped by the most in decades as investors simultaneously decided to ignore central bankers, driven by the concern that inflation will force them to abruptly raise rates. The credibility of central bankers is teetering on the brink here: they have been maintaining for months that inflation will prove transitory, even while it has risen in leaps and bounds, propelled by the rebound in post-lockdown activity to begin with, followed by increases in the prices of raw materials, shipping, energy and, more recently, labour.

Unrestrained inflation in labour costs would really put paid to easy monetary policy, because it would signal that inflation had become ingrained in workers’ and employers’ expectations. Historically, such expectations have been very difficult to shift, and could lead to long-term higher inflation. In this respect, the data last week was not encouraging: Eurozone inflation breached 4% in October for only the second time in its history, driven partly by an unexpected uptick in the cost of services, whose main input cost is labour. And a key measure of US employment costs registered its largest gain in over three decades of data.

But things got worse for bond market professionals when the explosion in short-term yields was accompanied by a deflation in long-term yields. In effect, bond markets are saying not only that central banks will have to raise rates quickly, but this will stifle economic growth. Many investors, on the other hand, had been betting on an era of stronger economic growth following on from the pandemic and, specifically, from the boost provided by government stimulus. At stake is the question of how sensitive consumers and companies will be to rising interest rates.

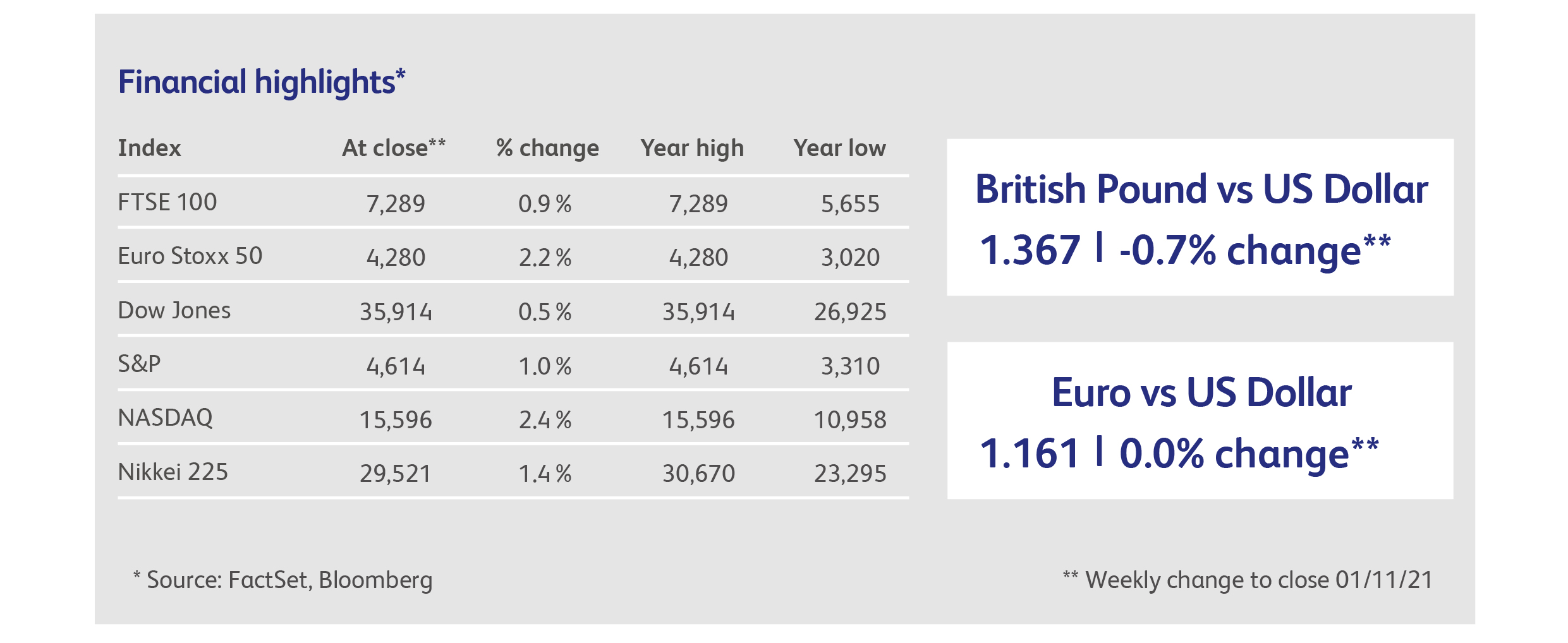

After fifteen years of relying on ultra-low rates to boost economic growth and asset prices, one would have to be heroically brave to assume that a sudden reversal will be easy to digest. But the bullish scenario is still favoured in other capital markets, where rampant enthusiasm for everything from commodities to equities to microcaps to cryptocurrencies has reappeared over the last few weeks. Despite the earthquake in bond markets, equities moved serenely higher. In an echo of last year’s historic, early-November surge, smaller-US companies surged 2.7% in a day, the technology-heavy Nasdaq Composite index rose 2.4% on the week and, in Europe, the Euro Stoxx 50 index rose 2.2% to a new all-time high. Investors bought now but they may pay later, as the impact of inflation on consumer spending, company revenues and on staff costs is unlikely to be uniformly benign.

Drivers can now invest directly in Volvo Cars after its IPO this week. The SEK 20 billion raised ($2.3 billion) will contribute to the company’s plans to sell fully electric vehicles by the end of this decade. The IPO was made more investor-friendly after Chinese owner Geely Holding Group relaxed its grip on voting rights, and the shares leapt a healthy 20% on their first day of trading.

Shares in Ford Motor Co also soared after the company upped its profit forecast and reinstated its dividend. Management attributed the surge in profits to a let-up in the shortage of semiconductors that has been affecting the industry, but forecast that the company’s factories won’t be running at maximum capacity until the end of next year. Industry analysts estimate that, due to car shortages caused by problems with supply chains, Ford was able to increase average selling prices by 13%.

Amazon and Apple bucked the trend among companies for reporting record profits for the third calendar quarter. Amazon has hired another 628,000 employees to cope with additional demand since the start of the pandemic, and warned that increasing wage costs could wipe out profits for the fourth quarter. Nevertheless, Amazon shares were flat on the week. Apple reported lower revenue than expected, having lost $6 billion in potential sales as a result of the shortage of semiconductors. Apple shares managed to rise slightly over the week.

Fertiliser is the latest commodity to crash upwards in price, after European prices for ammonia reached a 13-year high. The rise has been partly prompted by soaring natural gas prices, which is a key input. North American fertiliser prices reached an all-time high earlier this month. A scarcity of fertiliser threatens both the prices and yields of grain crops.

The European banking industry, having been spared an avalanche of defaults by the actions of governments and central banks during the pandemic, rushed to join the share buy-back bonanza. BNP Paribas and BBVA announced buy-backs last week and, in total, the big Eurozone banks will be returning over EUR23 billion to shareholders. In Asia, even Nomura managed to announce a JPY50 billion buyback programme despite a 95% slump in profits for the second calendar quarter.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.