23 November 2021

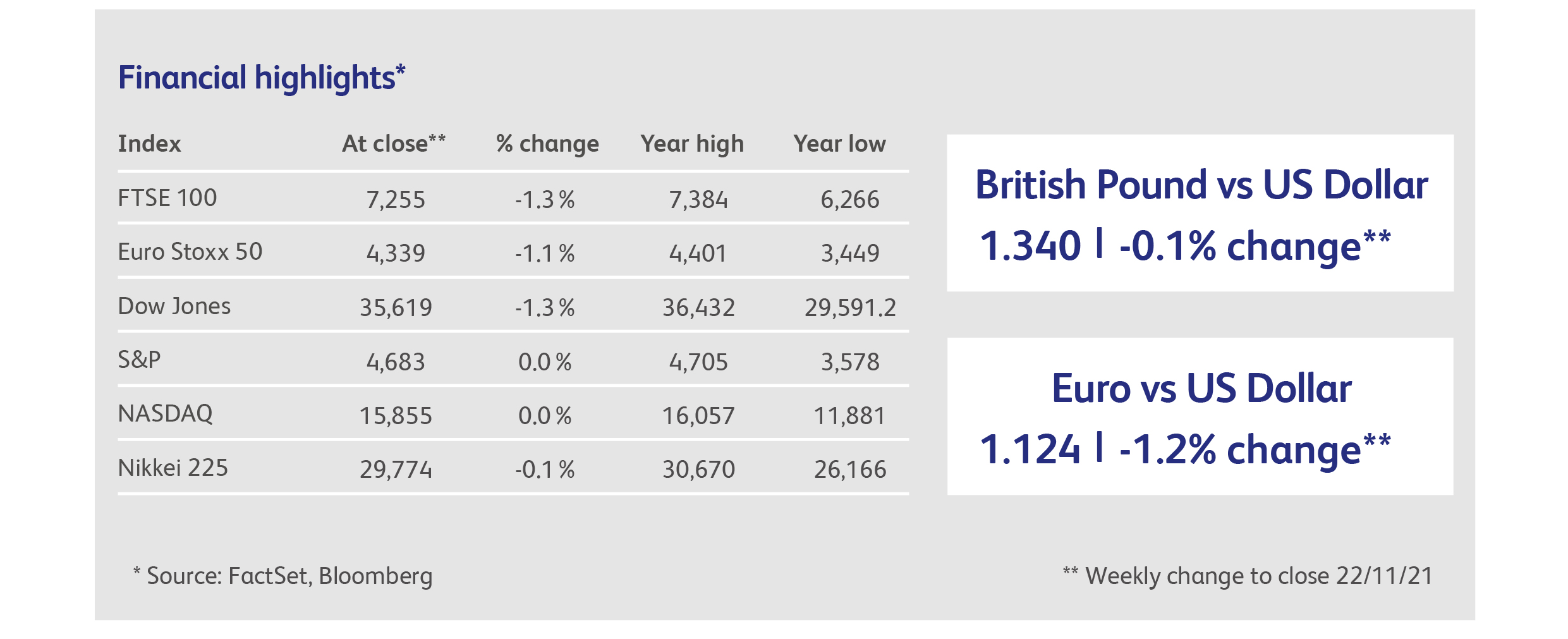

Following hot on the heels of last week’s rampant inflation data, US Federal Reserve governors were queuing up to signal a faster withdrawal from the Fed’s $120 billion a month bond-buying programme. The constant drumbeat from one governor after another, including the Fed’s vice-chairman, took a little of the shine off US stocks but ensures that no investor will be surprised when the news is formally announced. The Dow Jones Industrial Average joined the FTSE 100 in being down on the week, and both have fallen about 2% from their recent highs.

The technology heavy Nasdaq Composite index has been going in the opposite direction, however, as investors have sought the relative safe haven of growth stocks. It reached another all-time high during the week, and is now over 60% above its pre-pandemic level, which was itself an all-time high at the time. European equities continued their recent run of outperformance, despite rapidly-rising Covid cases across continental Europe. Lockdowns have already been reimposed in Austria and the Netherlands, and Germany is expected to follow. With private consumption expected to be the major contributor to growth over the next few months, the European economic outlook is now deteriorating.

The recent run of relatively strong economic data in the US is also under threat from a resurgence of Covid cases. The national trend in cases is rising, driven by a combination of low vaccination rates in some states, waning immunity in others, and colder weather in the north of the country forcing activity indoors. Right now, less than 10% of the US population has received vaccine boosters.

Some commentators, on the other hand, are pointing to the arrival of effective antiviral medications, which should become widely available next year, as evidence that the pandemic will soon be downgraded from a crisis to a mere nuisance. Merck’s antiviral treatment has already been approved for use in the UK, and trials of Pfizer’s Paxlovid pill were stopped recently because it was so effective that it was considered unethical to continue giving a placebo to half the patients in the trial sample. The problem for investors is that equity prices downgraded the pandemic as a concern over a year ago.

Japan’s stock market was buoyed by the announcement of the new Prime Minister’s stimulus package, jumping nearly one percent on the news. The JPY50 trillion (£327 billion) package is equivalent to 5.7% of the Japanese economy, and includes substantial payments to families with children, as well as support for investments in manufacturing computer chips. Prime Minister Kishida gave no details of how the package would be funded, saying instead that “Reviving the economy, then thinking about the fiscal situation; that’s the order”. Last week’s GDP data had revealed the dire state of the Japanese economy, which shrank by 3% between the second and third calendar quarters. Growth was dragged down by falling consumption in the private sector and businesses unwilling to invest. The Nikkei stock market index, meanwhile, is up 24% from its pre-pandemic level.

Walmart headed a long list of US retailers in reporting a squeeze on margins despite revenues exceeding expectations. Some retailers have been unwilling to pass rising costs, due to supply chain problems, onto customers. Supply problems include scarce transportation capacity, as well as increased labour and energy costs. Walmart shares fell over 3%, their biggest daily decline in nearly nine months.

Shares of upmarket Walmart competitor Macy’s soared after the company reported strong sales and profits. Macy’s didn’t see much impact from supply chain issues and regards a rise in the cost of labour as being merely temporary. The shares jumped 20% on the news, leaving the once-near defunct retailer’s share price up nearly 700% from its pandemic low.

A favourite from the last technology bubble got into trouble, as a disappointing revenue forecast by Cisco Systems sent the shares down as much as 10%. The company blamed a slowdown in corporate investment in computer networking equipment due to a shortage of components. The decline leaves Cisco shares about 30% below their highs of the late-90s internet boom.

Data compiled by financial data service Bloomberg showed that initial public offerings of stocks in 2021 have already smashed previous records. Nearly 3,000 businesses have taken advantage of plentiful cash amongst investors to raise more than $600 billion. The biggest offering was the $12 billion raised in the US by electric vehicle manufacturer Rivian. Asia’s biggest IPO was for China Telecom, while Polish parcel-storage provider InPost was Europe’s largest. These volumes were achieved despite efforts by US regulators to restrain the craze for Special Purpose Acquisition Vehicles (known as “SPACs”), and China’s crackdown on technology companies that effectively stopped dead the rush of Chinese companies wanting to list in the US.

Investor seeking distressed and “cheap” valuations have very few places to go at the moment, but the crisis in the Chinese property sector has created one such opportunity. Surging inflows have quadrupled the assets of the Singapore-listed iShares Asia High Yield Bond Index Exchange-Traded Fund, which tracks the benchmark Asian junk bond index

Highlights

UK inflation surged to a 10-year high in October of 4.2%, beating expectations. The main upward thrust came from housing and energy prices but price pressure was broad-based. The energy regulator Ofgem had raised its tariff price cap by 12.2% in October, but this was before the recent huge increases in natural gas prices. Partly as a result of this, UK inflation is destined to go higher over the next several months.

US industrial production rebounded more strongly than expected in October from its plunge the previous month. Other US economic data was similarly above expectations, with strong retail sales boosting the outlook for consumption in the fourth calendar quarter. Retail sales are currently over 20% higher than their pre-Covid level, boosted by gains in income from pandemic stimulus programmes.

Calendar

The Thanksgiving holiday in America will see a deluge of economic data brought forward to Wednesday from later in the week, including the minutes to the Federal Reserve’s latest monetary policy meeting, at which it’s likely that governors discussed an acceleration in the winding-down of the $120 billion per month asset purchase programme. Consumer income and spending data are expected to add to the picture of a strengthening economy, offsetting the disappointments of the previous quarter.

Having caught everybody out last month with a 16% rise, industrial profits in China are likely to fall back to levels associated with an economy that is slowing quite drastically – at least by Chinese standards.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.