11 January 2022

Volatility was the name of the game over the festive season, with both stock and bond markets on roller coaster journeys. In truth, some drama is probably to be expected given the size of the upward moves in asset prices since the pandemic started. Stock markets in particular had been unexpectedly calm given a quadrupling of the rate of inflation, a crisis in the Chinese property market, and continued waves of the pandemic undermining the high hopes for vaccination programmes.

But change is in the air, and perhaps a hint of denial with it. Nothing captures the zeitgeist quite as well as the mass U-turn on ultra-dovish monetary policy by the world’s central bankers. Bond markets don’t know which way to turn: they had managed a decent rally during the fourth quarter, suggesting that investors either doubt the persistence of inflation or doubt the ability of the economy to withstand rapid rises in interest rates. But this rally has already completely unwound since the start of the year, sending government bond yields to post-pandemic highs, and suggesting that investors now think central bankers are behind the curve when it comes to inflation.

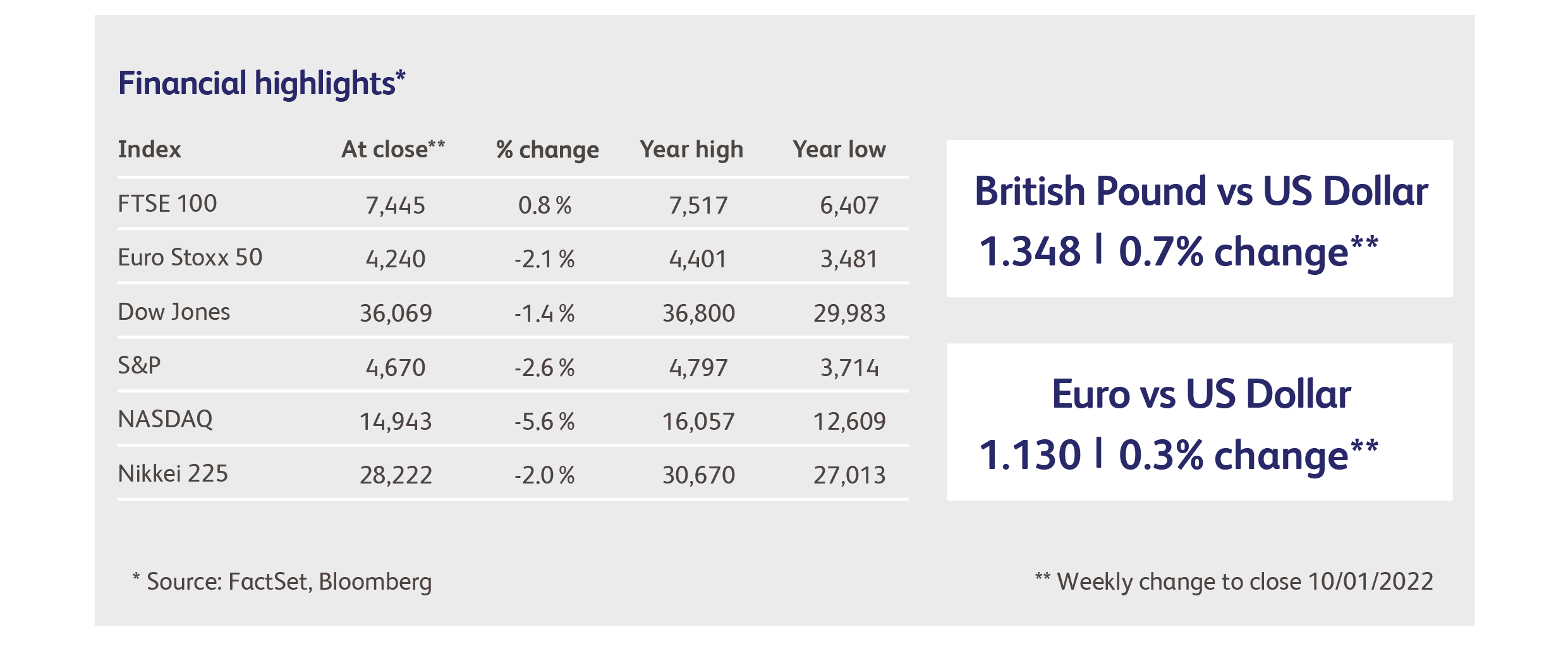

Moving to equities, it’s not often one can say that the FTSE 100 has outperformed the US technology sector, but the FTSE 100’s unique bias towards energy, mining and banking stocks means it has benefitted from the surge in inflation. As a result, the FTSE 100 sits close to its post-pandemic highs, whereas the technology-heavy Nasdaq 100 index is down 6% from its recent highs. The other major indices sit somewhere on a line between these two, in terms of recent performance. It’s tempting to say that the long-running pre-eminence of growth stocks over value stocks has finally come to an end, but there have been many false dawns of this kind over the past decade.

The major indices have weathered the inflationary storm well compared with the corrections in more speculative asset classes, such as cryptocurrencies, meme-stocks, Special Purpose Acquisition Vehicles, IPOs, micro-caps and early-stage biotechnology companies. It has recently become popular for analysts to build ad hoc equity indices exclusively comprising profitless, ultra-high valuation technology companies, and these show a sell-off which is nearly as bad as the collapse following the internet boom. In a similar vein, the performance of the big, American stock market indices is increasingly dominated by a few, highly-valued companies, which hides the poor performance experienced by most of the remainder of the index components.

Despite the furore over inflation, however, it’s worth noting that the actions planned by central bankers to date are quite tentative. Assuming they follow through on their guidance, interest rates would still be at levels that, by historic standards, stimulate inflation rather than reining it in. The last time that US inflation was at 6.8%, for example, US base rates were at 9%! Moreover, some of the forces that have led to high inflation are still in place. China continues with its zero-tolerance approach to Covid, which means further lock-downs in factories and more bouts of input price-inflation. The prices of commodities and other raw materials are roaring again. Omicron-induced absenteeism, amongst employees will further constrain manufacturing pipe-lines. Above all, the excess of demand over supply for labour, which is by far the biggest cost input for most firms, looks set to continue.

Volkswagen and Toyota pledged their commitment to the age of the electric vehicle by declaring, within five days of each other, plans to invest a combined $170 billion over the coming years. Volkswagen will expand manufacturing of electric vehicles from five to eight plants, and plans to have 27 electric vehicles under production by the end of the year. Toyota is emphasising diversity of business models and plans a slower roll-out of electric vehicles. It currently aims to have 30 electric vehicles in production by the end of the decade.

Will the traditional giants of the car industry dislodge Tesla from the top spot in electric vehicles? Tesla announced sales of 309,000 in the fourth calendar quarter, making a total of 936,000 vehicles for the year, compared to Volkswagen’s expected total of about 400,000 electric vehicles. Tesla announced a scaling up of production in the face of wait-times of more than six months for some of its models. The news helped fuel a rally of 33% that took Tesla’s market value to over $1 trillion, and also overshadowed news of recalls of 475,000 defective vehicles in the US, and another 200,000 in China.

Ford Motor Company surged to its own mini-record, with its stock price reaching a 20-year high after announcing an increase in production capacity for its electric pick-up truck. Ford’s stock rose 12% in a single day but, at just under $100 billion, its market value is dwarfed by Tesla’s $1 trillion.

Shares in Ford’s competitor in the electric truck market, Rivian Automotive, have now fallen by a half from their peak following the company’s IPO in November. The latest hit was due to the retirement of the firm’s chief operating officer and, only a week previously, Amazon.com had announced it would buy electric delivery vans from a competitor, despite having a sizeable investment in Rivian. Rivian sold only 920 electric vehicles in the last year but, at $73 billion, its market value has only recently dipped below Ford’s. The $12 billion raised by Rivian in its IPO made it the largest IPO worldwide in 2021, and the largest for an American firm since Facebook in 2012.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.