25 January 2022

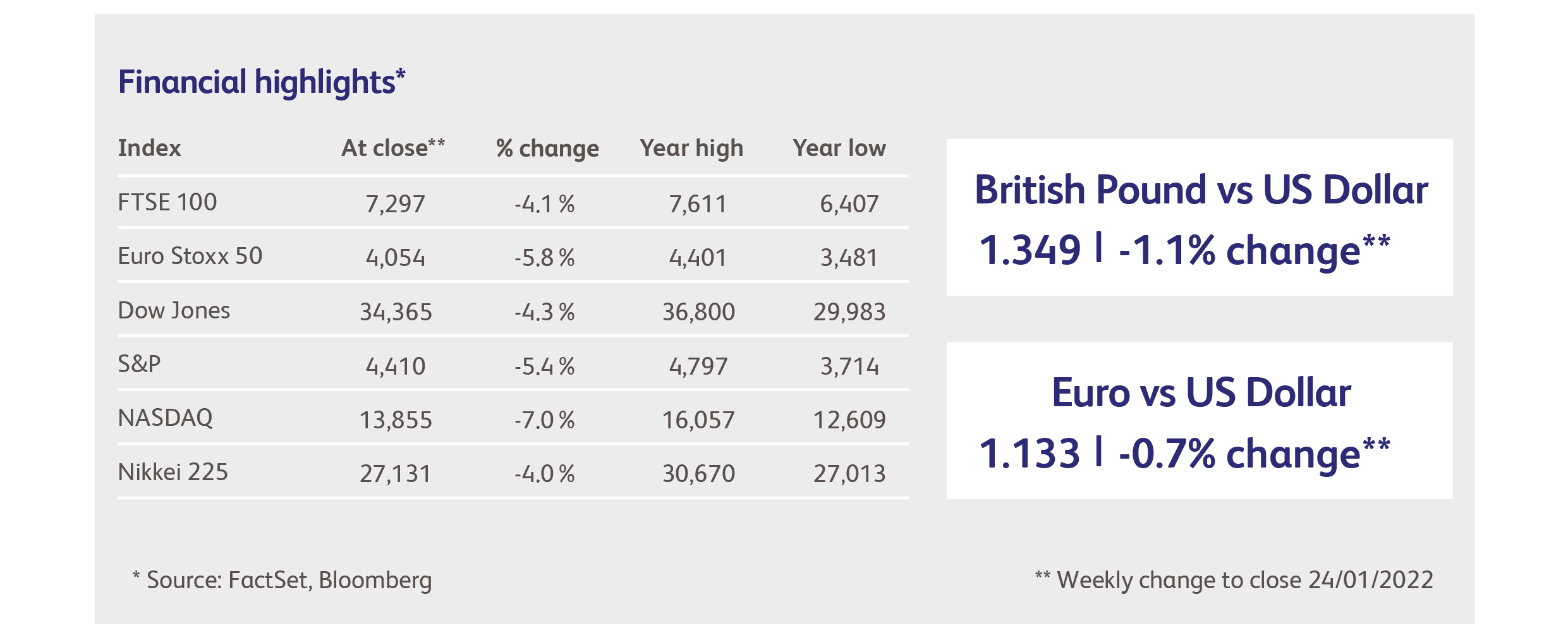

Bond market investors were, no doubt, delighted to pass the baton of extreme volatility to equity markets last week, but the theme continues to be the same: markets themselves are making the headlines, and not in a good way. The technology sector has taken a pummelling, and the Nasdaq Composite index came within a hair’s breadth of closing below its level of a year ago. All the sound and fury of the preceding twelve months now signifies nothing. The same is true of the Japanese stock market: a volatile last twelve months saw, at one point, a rally in the Nikkei 225 index of 13.5%, which has now all been given back. Even the more-stately Dow Jones Industrial Average has fallen to a level last seen in April last year.

To put things in perspective, however, it’s worth acknowledging that the Nasdaq Composite is still 40% above its pre-pandemic level, which was itself an all-time high. Similarly, both the Nikkei 225 and Dow Jones Industrial Average are still well above their pre-pandemic levels. The pandemic or, more precisely, the $30 trillion pumped into economies and markets as a consequence of the pandemic, has been very good for most investors.

Over the last week the FTSE 100 was, once again, the stand-out performer though it has not been immune from the latest wave of selling. Further down the size scale, however, the pastures have not been so green and pleasant. The smaller-company FTSE 250 has seen a precipitous decline, falling 10% since the start of the year, with over half of that coming in the last two days. Unlike most stock markets indices, the FTSE 250 now trades below its pre-pandemic level. One can’t blame Brexit for this because, although European smaller-company indices still sit above their pre-pandemic levels, the gap is down to a couple of percentage points.

Many of these performance figures would have been much worse were it not for a rally yesterday in US markets that saw gains of over 4% in the afternoon, following a 4% decline in the morning. Such huge intra-day swings are typical of a market that has become completely unhinged. But the truth is that the unhinged part was the preceding eighteen months, a period of unusually low volatility, and completely at odds with the risks caused by a once-in-a-century event in the real world. The difference, of course, was that $30 trillion, but that is now looking increasingly like a band aid and less like a vaccine.

The return of inflation, the overlooked rise of geopolitical risks (China is the bigger worry here, not the Ukraine), the massive indebtedness of governments – all these things could force investors to confront the real world for a period of time, rather than living in the cotton-wool cocoon of central bank and government generosity. If so, it would be the first time in nearly a decade and a half. Investors will have to dig deep to find strategies that don’t rely on interest rate reductions and asset purchase programmes. But the lessons of the post-credit crunch era won’t easily be unlearned, and it may be wrong to assume that era is over. In any case, if markets continue down at this rate, we will soon find out if the Federal Reserve’s priorities are still aligned with investors.

Netflix was one of the biggest casualties in the technology sector, falling over 20% and losing about $45 billion in market value in one day, after marking down its expectations for subscriber growth. The company added 18 million customers in 2021, but now forecasts that it will add only 2.5 million new subscribers this calendar quarter. Discouragingly, the company struggled to pinpoint exactly why growth has slowed, variously blaming the economy, competitors and the pandemic.

New 5G telecommunications networks started operating in the US last week, despite another round of warnings from airlines and politicians that 5G services close to airports could have catastrophic consequences. Airlines are worried that the 5G signals could interfere with aircraft equipment, and highlighted a lack of transparency in the data used to assess 5G safety.

Various cryptocurrencies and related products made the news for the intensity of their sell-offs. Bitcoin, the largest cryptocurrency by market value, breached levels that left it down 50% from its November peak. It’s been a very similar story for Ether, the second largest, also down about 50% from its peak. In aggregate, about $1 trillion has been wiped off the value of cryptocurrencies globally.

The price of lithium, used in the manufacture of batteries for electric cars and which is mainly found in China, rose to another record, sending the shares of mining company Ganfeng Lithium up 10%. The rally was prompted by news that electric vehicle registrations in China jumped by 35% between November and December. Lithium Carbonate prices are up 500% in the past year. Earlier in the week, Serbia had blocked plans to open what would have been Europe’s largest lithium mine.

The sixth plenum of China’s Central Committee for Discipline Inspection ended in a communique that pledged to “investigate and deal with corruption behind disorderly expansion of capital and platform monopolies”. This was seen as a sign that the regulatory crackdown on technology companies, which has already erased over $1 trillion of market value from Chinese stocks, will be expanded this year.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.