8 February 2022

The action switched back from equity to bond markets last week, as a one-two punch of central bank meetings reinforced the hawkish change in monetary policies. This was then followed by a positive shock in key US employment data that sent bond yields spiralling upwards. First up was the Bank of England, which raised rates - as expected - but also tried to send a relatively dovish message, reinforced by the Governor’s plea to markets to “not get carried away”. This messaging strategy didn’t work, mainly because the composition of views and votes on the bank’s Monetary Policy Committee shifted massively towards faster and bigger rate rises. In fact, four of the committee’s nine members had voted for a half-percentage point rate-rise, arguing that it was justified by the acceleration in wages at the turn of the year, and by the recent rise in the public’s inflation expectations. The committee also agreed unanimously to reduce the bank’s holdings of bonds, signifying the change from quantitative easing to quantitative tightening.

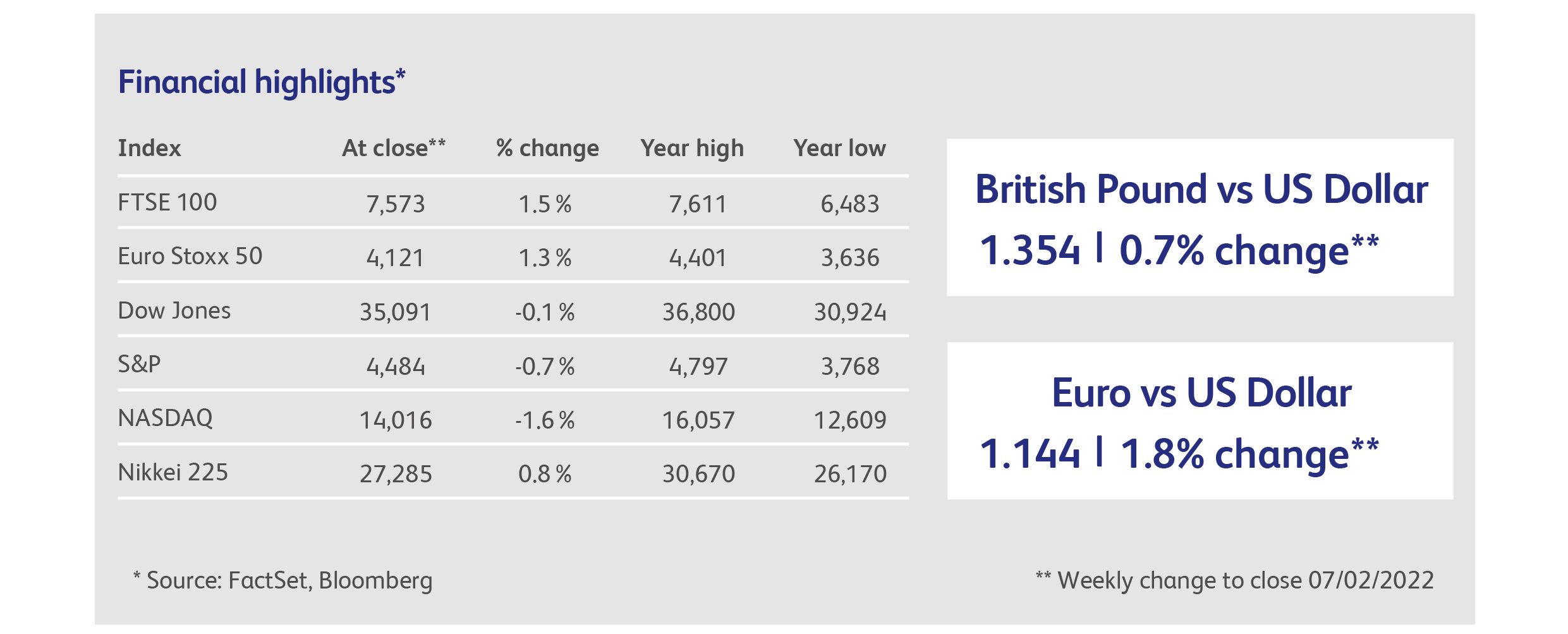

Short-term rate expectations soared on the news, to the extent that markets are now pricing a central bank rate of 1.5% to 1.75% by the end of the year. Bonds sold off at every maturity, but the biggest moves were at shorter-maturities. The FTSE 100 stock market index, however, positively relishes the battle against inflation, rising on the week as other stock markets fell, supported by its uniquely large exposure to oil companies, miners and banks.

Next up, the European Central Bank (ECB) took the opportunity to signal a clear hawkish shift, executing its own policy pivot towards containing the risk of inflation. Notably, this was accomplished without any actual change in rates or asset purchases, and without any material change to the bank’s forecasts for economic growth or inflation. President Lagarde merely noted that “things have changed”, and highlighted that the bank now sees “upside risks” to inflation.

Short-term money market yields spiked, and are now pricing in an ECB interest rate of zero by the end of 2022. This would be the first time in eight years that it has not been negative. The amount of European debt yielding negative returns fell by a third on the day of the meeting. And investors were reminded that the ECB’s monetary policy must also address the risk of default, after the gap between Italian and German bond yields jumped to 1.6%, its highest in eighteen months. Further out on the periphery, Greek bond yields jumped by half a percentage point, and are now back to the levels seen in the initial shock of the pandemic. Against this backdrop, a rally by European stock markets off their lows of the year was snuffed out, with the Euro Stoxx 50 index suffering a 4% peak-to-trough decline.

Finally, US employment data did not disappoint for a change. Quite the opposite, in fact, as employment growth in January smashed through every expectation. For good measure, there was also a dramatic upward revision to the job numbers from previous months that had disappointed so much. Those economists who had been wrong-footed pointed to statistical changes and discrepancies that have been exacerbated by the pandemic, but there was no denying the underlying trend has strengthened. Moreover, the jobs data was accompanied by wage data that showed wage-inflation of 5.7% from the previous year, exciting fears of more rate rises in the US, and completing the hattrick of bond market declines when US bonds sold off.

Spotify Technology shares collapsed after the company downgraded its expectations for new customers for the current calendar quarter. Management argued that the decline was due to its abnormally strong growth in the previous quarter, and argued that the first quarter is no longer so significant for the company’s subscriber growth. Investors were unimpressed, however, sending the shares down 17%. Spotify’s share price decline since its peak in February last year now exceeds 50%.

Paypal shares also cratered after payment volumes rose a mere 23% in the fourth quarter, the smallest increase in two years. Management pointed to a decline in online commerce towards the end of the year, particularly among lower-income consumers. The company is also under pressure as its former parent Ebay accelerated its move away from the payment platform. The shares fell 25%, and are now down 35% year-to-date.

Not to be outdone, Meta Platforms, formerly Facebook, suffered the biggest ever one-day decline in an American company’s valuation, losing $250 billion after announcing disappointing results for the fourth quarter. User numbers for the company’s main Facebook platform were flat compared with the previous quarter, mainly as a result of competition from rival platform TikTok. Management also downgraded revenue expectations for the current period. The shares fell 25% on the news, but at least the company can now argue against the Federal Trade Commission, in its anti-monopoly lawsuit, that it is encountering real competition.

Amazon was nearly able to plug the hole created by Meta Platforms, adding $200 billion in market value in a single day after its results beat expectations. Investors forgave the decline in its online shopping revenues last year, and cheered the company’s plan to raise the price for its Amazon Prime service, as well as the strong growth in its cloud computing division. Analysts highlighted Amazon’s successful diversification from its online shopping roots. Amazon shares rose by 14% on the news, and are now down only 5% on the year.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.