31 May 2022

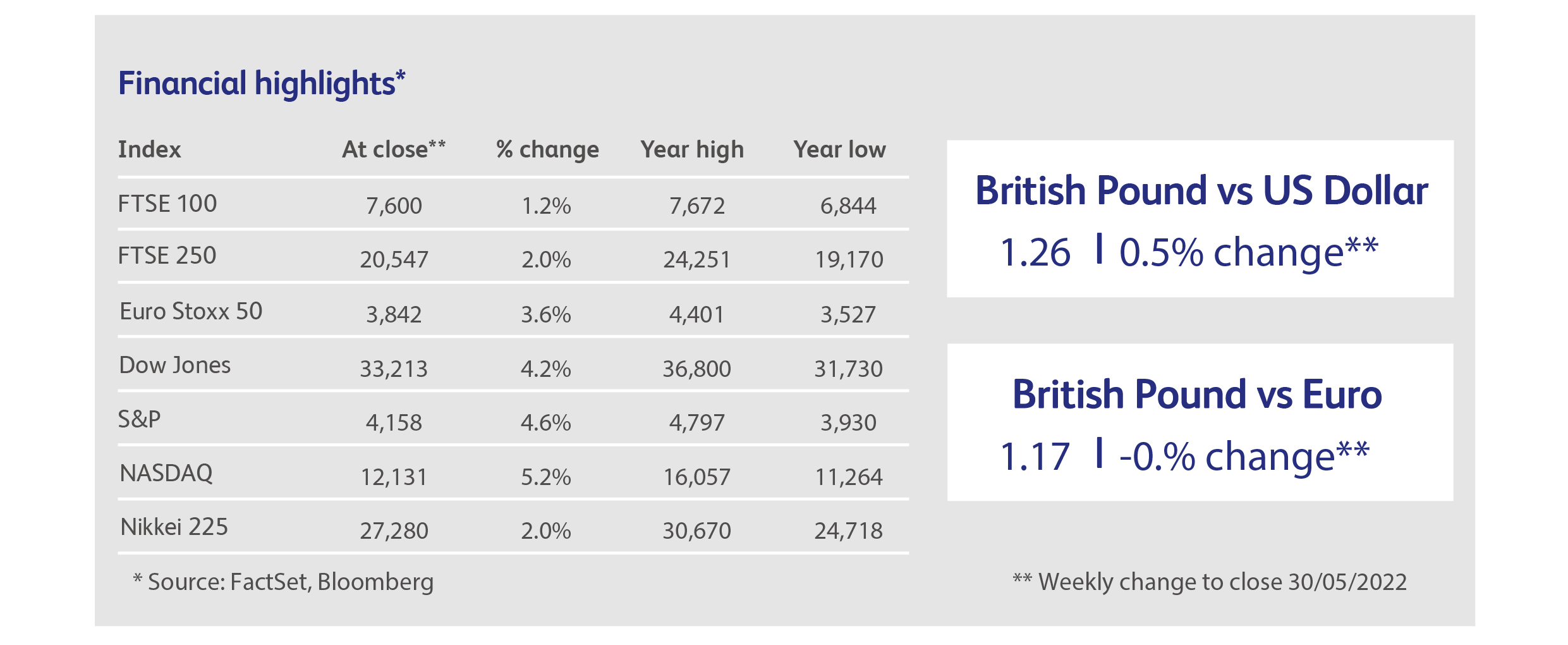

Having been rocked by a profit warning from retailing giant Walmart in the previous week, stockmarkets shrugged off the fear of recession and managed an impressive rally. America led the way, with the major indices there bouncing nearly 10% off their recent lows. European markets had already been outperforming but, nevertheless, enjoyed the additional tailwind. Indeed, it was a week in which just about everything was up. Even bond markets staged a recovery: corporate bonds across the globe had their first positive month in nearly a year, and government bonds had their best month since the start of the year.

Pinpointing an exact cause of the optimism is difficult: the minutes to the last meeting of the US Federal Reserve appeared to be slightly less hawkish than feared, and the news on China’s latest wave of Covid turned a little more positive. Some American retailers were able to report good results though the overall picture remained mixed. A weaker US dollar may have helped sentiment, as so many of the world’s bills are denominated in dollars.

Whether this is a meaningful rally depends on whether your glass is half-full or half-empty. Optimists are encouraged that such a potent rally took place without much really good news, because it suggests that investors are happy that current valuations have priced in all the bad news. On the other hand, if nothing has really changed since last week, and with the pernicious impact of inflation likely to persist for the foreseeable future, a lot of bad news still lies ahead. The key question is whether company profits can hold up: markets face their next big test in July, when companies start reporting earnings for the second calendar quarter.

Investors everywhere would really like to see the end of China’s zero-tolerance approach to dealing with Covid, which would rejuvenate supply chains in the western world, alleviating a key source of inflation, and also address a number of China’s economic problems. This prospect might have emerged last week with a public disagreement between the Premier, Li Keqiang and the President, Xi Jinping. Premier Li held an emergency meeting with thousands of party apparatchiks, including attendees from local governments as well as managers of the big state-owned firms and banks, to urge them to stimulate growth. He declared that the economic situation is in some ways now worse than when the epidemic hit in 2020. The Premier’s China State Council, which he chairs, had already rolled out $20 billion in new tax rebates earlier in the week. Shanghai’s municipal government immediately responded with a series of measures including more support for businesses and consumers, as well as a relaxation of lockdowns for manufacturers and, a day later, for consumers.

Such comments imply frustration with the current zero-Covid policy, which is as about as close to real criticism of government policy as China will ever get. Rumours have been circulating of a rift between Li and President Xi, who is the main proponent of the zero-Covid policy. Unfortunately for those hoping Li is now in the ascendancy, however, President Xi controls both the army and the media, and various Chinese media outlets responded by launching a new documentary series about following in the footsteps of Xi Jinping. Riveting stuff.

Until last week’s rally across the technology sector, Apple had made the news for a rare, 20% slide in its stock price which had knocked $700 billion off the company’s market value. But the flow of news on Apple did not turn positive last week: first there were rumours that the company had cut its production plans for 2022, and then management announced that it is raising salaries for its US workers by at least 10% and, in some cases, much more. This follows a prior round of pay-rises announced only three months ago. The company is thought to have been responding to the threat of unionisation at several locations in the US, including New York.

The profits warnings in the retail sector that so discomfited investors in the previous week were followed by a mixed bunch of earnings announcements, which contained some good performances. Shares of ultra-discount retailer Dollar Tree jumped by 30% after the company’s strategy of raising prices from $1 to $1.25 proved to be an inspired move. The company’s revenues and profits both comfortably beat expectations. The Gap, on the other hand, missed expectations and was forced to issue a profit warning due to higher costs and the impact of lockdowns in China.

Airline stocks jumped after positive trading updates by American discount airlines Southwest and JetBlue, which both raised revenue forecasts for the second calendar quarter. Airlines are enjoying a mini-boom: leisure travel is back on the menu and planes are crowded again, just as the industry has had to shrink the number of scheduled flights due to lack of pilots. US domestic airfares jumped by 19% in April from the previous month, the biggest monthly increase since flight prices began being tracked in 1963.

Twitter and Tesla both received a boost last week after Tesla founder Elon Musk strengthened the financing behind his bid to acquire Twitter. His decision to increase the cash component and decrease lending backed by Tesla shares removes an overhang from Tesla stock, which promptly rallied by 20%.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.