7 June 2022

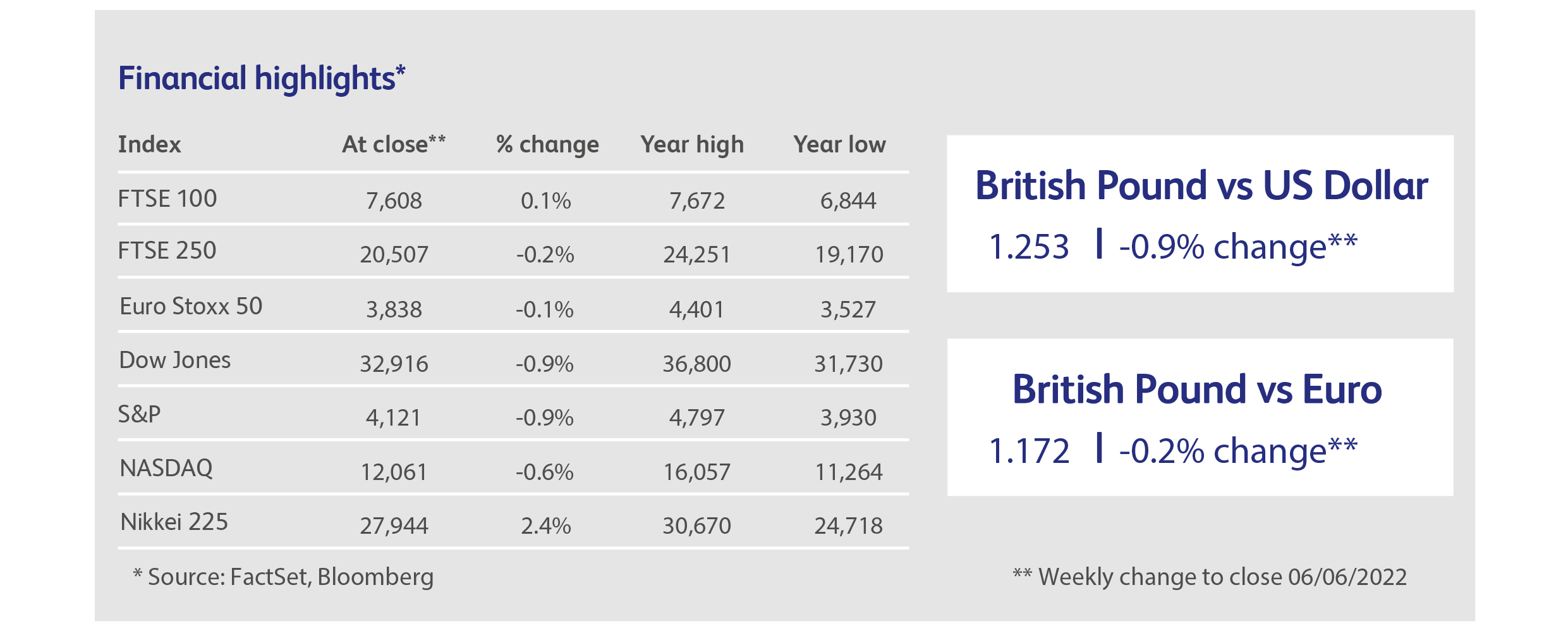

Skittish stock markets struggled to maintain the positive momentum of the previous week and, following a barrage of bad news, it’s beginning to look like the previous week may have been the aberration. The week started with an outsized jump in Eurozone inflation in May, to 8.1%, and the fact that the announcement of this data coincided with the announcement of the European Union’s embargo on Russian oil was not helpful. It also didn’t help that a bunch of American corporate chieftains ambushed markets with dire warnings about the state of the economy. Among them was the much-respected Chief Executive of JP Morgan Chase & Co, who warned of an impending economic “hurricane”. Fears of stagflation intensified, stock markets struggled for a couple of days and investors fled to the safe haven of the US Dollar.

A promising mid-week rally was then snuffed out by further corporate shenanigans: Elon Musk, founder of Tesla and part-time cult hero, declared that he had a “super-bad feeling” about the US economy and vowed to cut salaried staff by 10%. Later the same day, American employment data for May turned out to be better than expected, but was written off as being either the last hurrah for the US economy, or an excuse for the Federal Reserve to continue to raise rates aggressively. Stagflation again.

Another rally at the start of this week, encouraged by hopes that China will soon be ending its regulatory clampdown on technology companies, brought markets back full circle. While it’s promising that stock markets are trying to climb the so-called “wall of worry”, economic evidence is growing that consumers are being impacted by inflation at 8%. The profits warnings seen recently in the retail industry are spreading to other industry sectors. It will be difficult for investors to hold their nerve if expectations for corporate profits turn definitively downwards and, while investors might have been able to ignore the profits warnings by down-market Walmart or Target, they are certainly not anticipating profits warnings by up-market brands such as Tesla.

However, the improving sentiment towards China is probably justified, with the recent Covid-lockdowns seemingly coming to an end, the government taking action to ameliorate the economic slowdown, and the Biden administration talking about lifting tariffs. Given the current depressed state of Chinese asset prices, it does not take much to encourage buyers, as demonstrated when shares in Didi Global, China’s version of Uber, initially jumped by 56% after the Wall Street Journal reported that the Chinese government’s investigation into the company could end this week. As regulatory interference has been one of the main threats hanging over Chinese technology stocks over the past year, another piece of the jigsaw may be falling into place.

British investors, meanwhile, were treated to a ringside seat in the contest between Boris Johnson and the Pound Sterling, which have experienced a see-saw relationship ever since Johnson came out in favour of Brexit in 2016, prompting the pound to crash. Sterling appreciated from $1.250 to $1.257 in the two hours after the confidence vote was announced and, once Johnson had won the vote, gave it all back and more.

Business-to-business software provider Salesforce reported revenues and profits that beat market expectations, sending the stock up 15% and avoiding the roller-coaster ride that most of the US technology sector was subjected to. Management reported healthy ongoing demand and no impact from the broader economic world. The company recently diversified its revenue-base with the acquisition of corporate messaging platform Slack for $28 billion.

HP (formerly Hewlett Packard) also reported healthy demand in its business-to-business divisions, but a decline in sales to consumers. Sales of laptops to consumers and printing revenues were particularly weak, and the slowdown was focused in low-end products in Europe and China. However, the company’s commercial sales were strong enough to carry revenues beyond market estimates and ensure that the share price hit a new all-time high.

Tesla founder Elon Musk’s bid for Twitter is fast becoming a media circus. Musk is widely believed to have had a bout of “buyer’s remorse” since the merger agreement was signed, and is accused of using the issue of fake accounts to abandon or renegotiate the deal. This week Twitter took the unusual step of publicly stating that it will hold Musk to the terms of the deal. But Musk has friends in high places, and the Republican Attorney General of Texas waded into the dispute, opening an investigation into Twitter’s reporting of fake accounts on the basis that it violates the Texas Deceptive Trade Practices Act. Musk had moved all of his corporate assets to Texas in 2020, and only last month tweeted that he would be voting Republican. Texas, for its part, has already passed a law freeing social media platforms such as Twitter from having to moderate their content.

Elon Musk also waded into the debate about whether companies should return to the office, threatening everyone at Tesla that, if they don’t show up to the office for 40 hours a week, they will be assumed to have resigned. Most companies remain wary of forcing workers back to the office in case they lose workers wanting to work from home.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.