17 June 2025

The UK economy is showing mixed signals amid ongoing inflationary pressures and signs of slowing growth. Bank of England (“BoE”) Monetary Policy Committee member Megan Greene highlighted that inflation remains sticky, driven by persistent wage growth and weaker supply conditions that could keep prices elevated over the medium term. Despite a recent rise in the minimum wage, wage growth has eased slightly, and retail sales have slowed sharply to their weakest pace in over a year. Consumer confidence remained fragile amid ongoing cost-of-living concerns, while April’s gross domestic product (“GDP”) contracted by 0.3%, exceeding expectations for a mild decline. Employment indicators showed softer hiring activity and retail footfall fell despite seasonal factors, reflecting cautious household spending. The BoE also warned banks to prepare for tighter liquidity conditions as reserves approach lower thresholds and noted that households have increased cash hoarding amid global uncertainties.

Chancellor Rachel Reeves delivered a spending review focused on investment and growth as Labour targeted the next general election. The plan prioritised key sectors including health, defence and technology, with £86 billion earmarked for research and development. However, political U-turns on cutting winter fuel payments and increased spending pressures have constrained fiscal flexibility. The government signalled no new energy cost support for businesses despite continued global price volatility, reflecting a tighter fiscal stance. Trade tensions have weighed heavily on the economy, with UK exports to the US falling sharply by 31% due to tariffs. While a US - UK trade deal is expected to come into force soon, reducing tariffs on British goods, future tax rises appear likely amid limited fiscal space and growing public spending commitments.

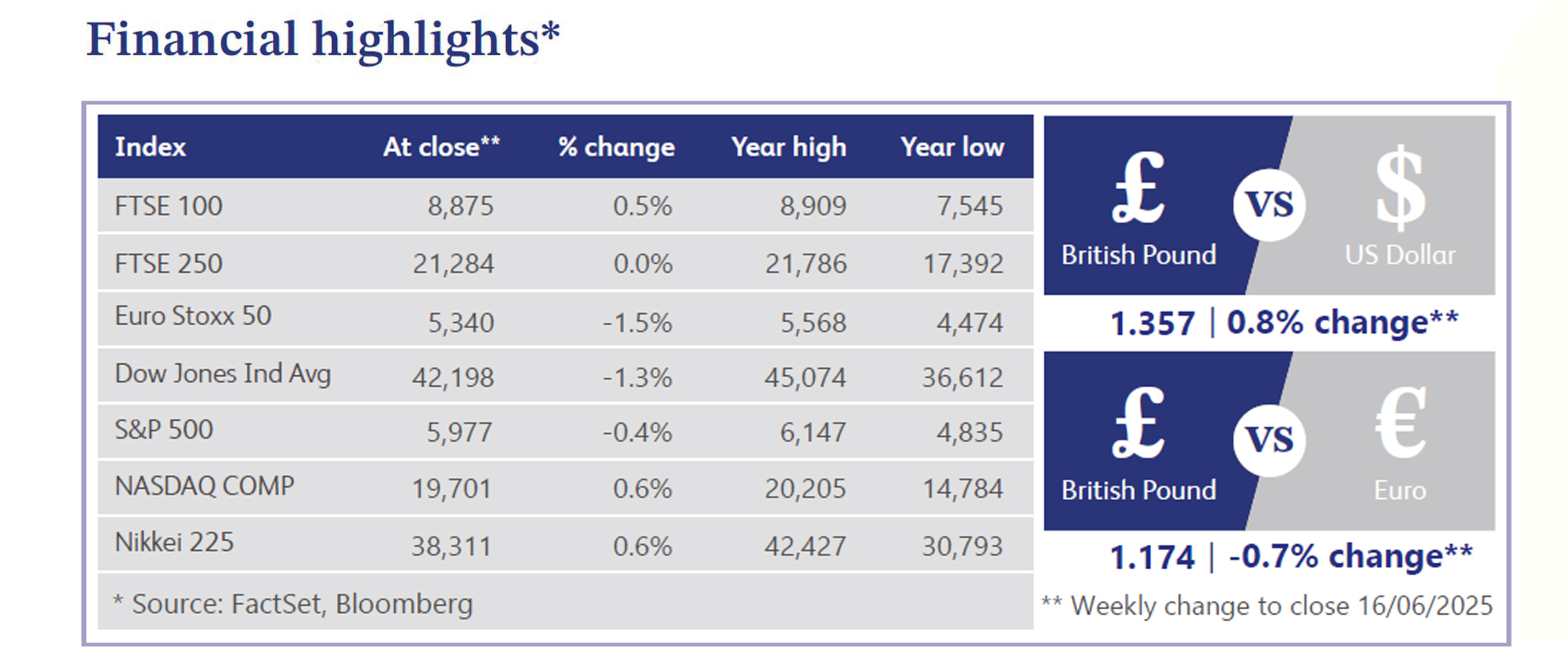

The UK continued to lead Europe in financial services investment, despite a 32% decline in new projects this year. Nvidia’s CEO praised UK artificial intelligence (“AI”) talent as world-leading, aligning with government initiatives to foster AI innovation within the City’s financial sector. The FTSE 100 reached fresh highs, buoyed by easing tariff concerns and expectations of BoE rate cuts following softer macroeconomic data. However, UK equity markets face headwinds, including increased foreign takeover activity and concerns over the decline in domestic listings. This has prompted calls for reforms such as tax incentives to attract more companies to list locally and boost investment.

Meanwhile, US equities declined amid renewed geopolitical tensions after Israeli strikes against Iran sparked risk-off sentiment. Energy and commodity sectors gained, supported by a surge in oil prices. Treasury yields fell despite heavy government bond issuance, and the US dollar weakened to its lowest level since early 2022. Trade discussions with China yielded limited progress, with a modest rare-earth export deal offset by ongoing tariff threats. Inflation data softened, supporting hopes for Federal Reserve rate cuts, though geopolitical risks continue to cloud the market outlook.

In the UK housing market, rents rose 2.8% annually - the slowest pace in four years - indicating easing demand while remaining above pre-pandemic levels. The Royal Institution of Chartered Surveyors (“RICS”) house price indicator reached a 10-month low, as more agents reported price declines following April’s stamp duty changes, highlighting a gradual softening in the housing sector.

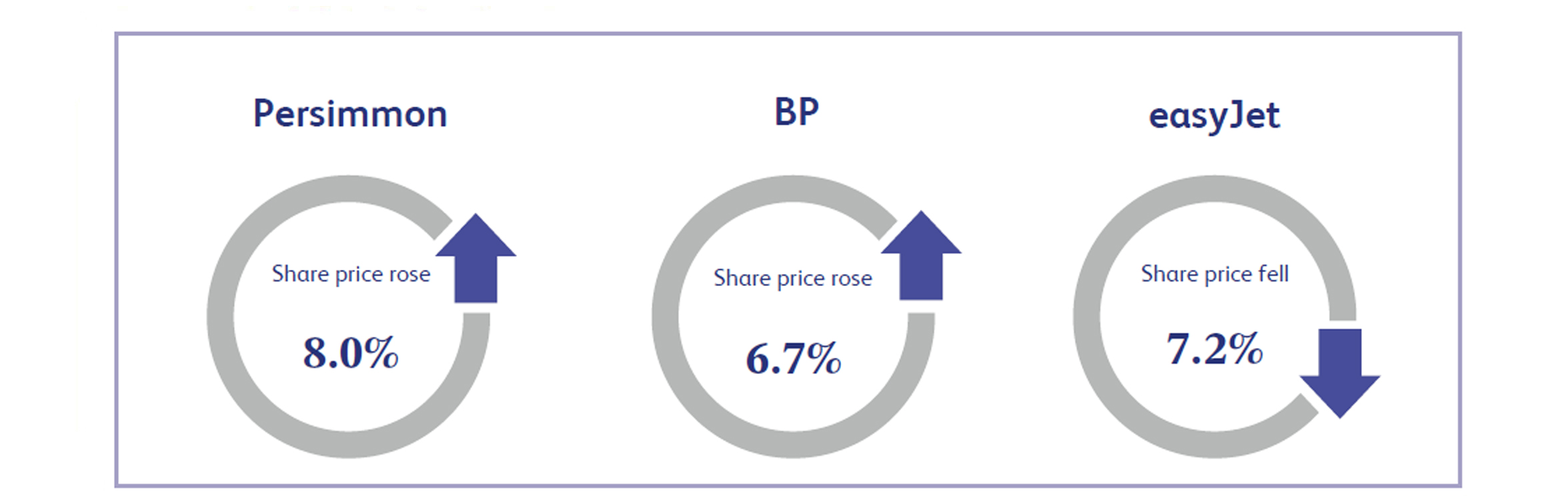

Persimmon, a UK homebuilder, rose 8% following government announcements aimed at boosting the housing sector. Chancellor Rachel Reeves’ spending review included a £10 billion investment to support new housing developments, as part of a broader £39 billion, 10-year programme to increase affordable housing supply. The British homebuilders index climbed 2.2% in response. These fiscal measures signal strong political support for the housing sector, lifting sentiment and expectations of improved construction activity. The policy boost comes amid rising mortgage availability and improving buyer confidence, giving homebuilders like Persimmon momentum into the second half of the year.

BP, the global oil and gas company, gained 6.7% last week as oil prices rose in response to renewed Middle East tensions following Israel’s strike on Iran. The geopolitical risk premium temporarily lifted crude prices, supporting shares of European energy majors, including BP and Shell. While Morningstar’s analyst cautioned that the price spike may be short-lived due to weak underlying fundamentals, the market reaction suggested ongoing investor interest in oil equities. Broader negative sentiment toward the sector could paradoxically create upward pressure as contrarian investors rotate into undervalued energy stocks amid global uncertainty.

easyJet, the European low-cost airline, fell 7.2% amid escalating geopolitical tensions in the Middle East. Israel’s strikes on Iran raised fears of a wider conflict, spiking oil prices and rattling travel sector sentiment. Higher fuel costs and the prospect of disrupted travel demand weighed on airline stocks broadly. easyJet, which operates across the region, faces dual headwinds from potential route volatility and inflationary pressure on operating costs. While energy stocks benefitted from rising crude prices, travel-related names suffered, with easyJet among the hardest hit as investors reassessed risk exposure to geopolitical flashpoints and sector-specific vulnerability.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.