21 June 2022

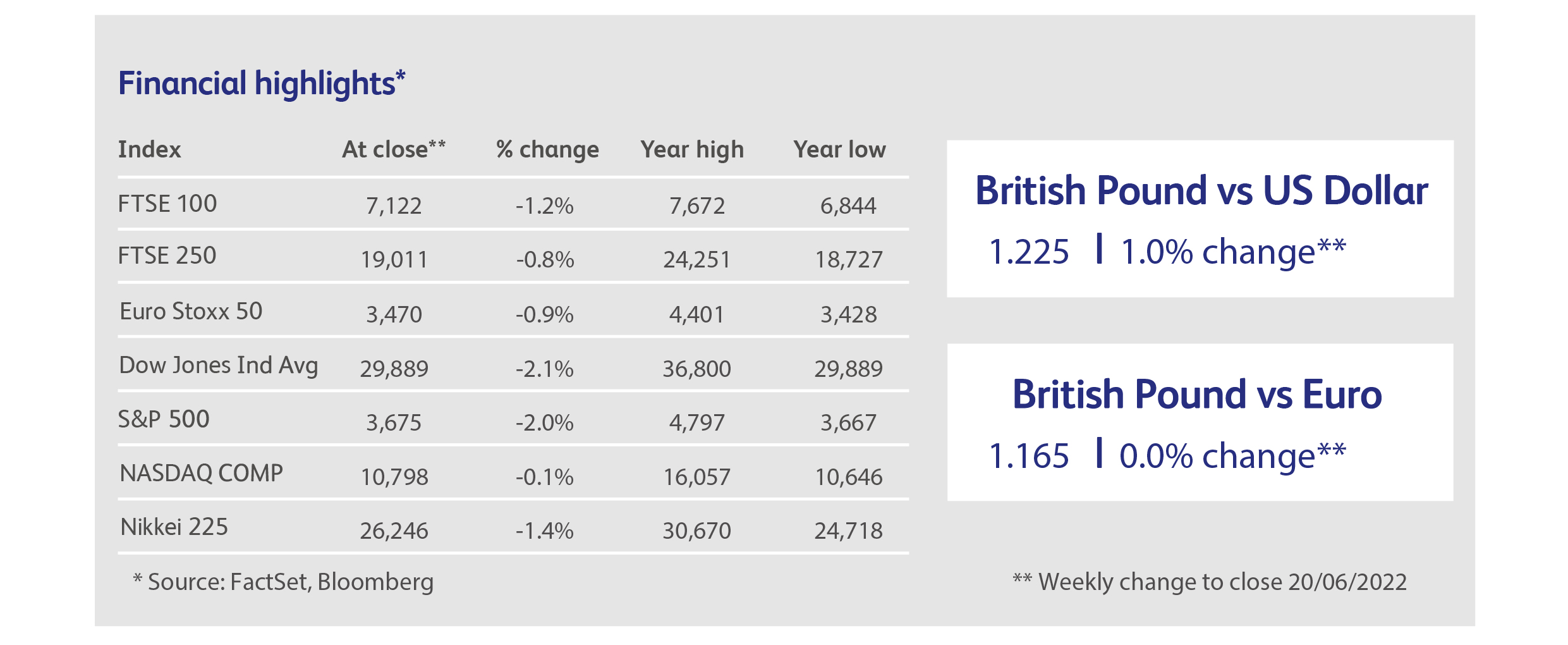

The bad news is that stock markets slipped again last week. The good news is that things could have been much worse, with a fairly modest move down despite the US Federal Reserve raising rates by 0.75%, its biggest hike in 30 years. The Fed is following through on tough talk over the past few weeks, and Chairman Powell made it clear, repeatedly, that the Fed won’t stop hiking until it sees a clear run of lower monthly inflation data. The 0.75% move had been widely leaked in what appeared to be a choreographed media strategy. Nevertheless, it did the job, and the US government bond market actually had a good week, hinting that perhaps the US central bank has regained some of its lost credibility.

The same was not true of British government bonds, which plunged after the Bank of England’s mere 0.25% rate rise, implying that it won’t be enough to stifle inflation. The sell-off may have been influenced by the bank’s own forecast for inflation, which now shows it peaking at slightly above 11% this year, following the next increase in the energy price cap in October. The outlook for the UK economy has dimmed in recent weeks, with Brexit risks and industrial unrest adding to the pain already inflicted by rampant inflation and higher taxes. The recent decline in the pound will also be inflationary due to the UK’s propensity to import goods. This combination of extreme political and economic chaos has historically been associated with sterling crises; indeed, one may already be playing out in slow motion.

The European Central Bank tried to calm bond markets by formulating a plan to combat the recent “fragmentation” in bond yields issued by different countries within the EU. The move followed a rise in Italy’s 10-year bond yield to above 4% for the first time since 2014. The announcement of an emergency meeting to discuss the plan, the run-up to the meeting, and the plan itself were accompanied by a blow-by-blow series of press releases, suggesting that it was as much about public relations as anything else.

The Swiss National Bank used shock tactics when it unexpectedly raised rates by 0.5%. The bank had previously been regarded as somewhat dovish in the face of rising inflation, and had been notable in recent years for its desire to avoid a strong currency. But all that went out the window as the Swiss franc enjoyed its biggest rally in years, strengthening by 3% against the US dollar in a single day.

The Japanese central bank simply bullied bond markets into submission, spending the equivalent of £66 billion in one week buying Japanese government bonds. With inflation at a mere 2.5%, Japan faces a very different situation to the rest of the world and the Bank of Japan is actually still seeking to encourage more inflation. This is despite a decline in the Japanese yen to a 24-year low against the US dollar as investors seek the higher yields on offer in US bonds. The Japanese central bank is effectively trying to stare markets down but, given the tsunami of rate rises around the world at the moment, one can’t help but think of King Canute ordering the tide not to come in.

Halfords Group was the latest retailer to issue a profits warning, as the company highlighted a squeeze on revenues with reduced demand for more discretionary, upmarket items, as well as significant inflation in its cost-base. Halford’s share price fell more than 20%, its worst day since the start of the pandemic.

It seems that no company is immune from adverse sentiment after shares in US supermarket chain Kroger declined, despite reporting revenues that beat expectations and raising both its revenue and profits forecasts for the current year. The fly in the ointment was a gross profit margin of 21.6%, slightly below analysts’ expectations of 22%. Kroger shares had risen by 12% in the year-to-date prior to the announcement, but fell by 7% on the news.

European Natural Gas prices jumped by 50% when a large, Texas-based production facility reported that it will be out of action four times longer than previously thought. The disruption to American production is particularly acute due to Europe’s increased dependence on imports as it seeks to avoid Russian supplies. At the same time, Gazprom reduced its exports to Europe by more than half. Gazprom stated that its supply was halted due to technical issues.

Financial news service Reuters reported that Teslas have been banned from the Chinese district of Beidaihe ahead of a visit by President Xi in August. Teslas were recently banned from Sichuan for the same reason, suggesting the Chinese authorities fear their potential for surveillance and the transmission of data.

Apple workers in a shop near Baltimore voted to become unionised by a two-to-one margin. This is likely to stimulate other Apple workers to organise into unions. A similar vote in a Starbucks coffee-shop last year prompted 300 others to file for union elections.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.