28 June 2022

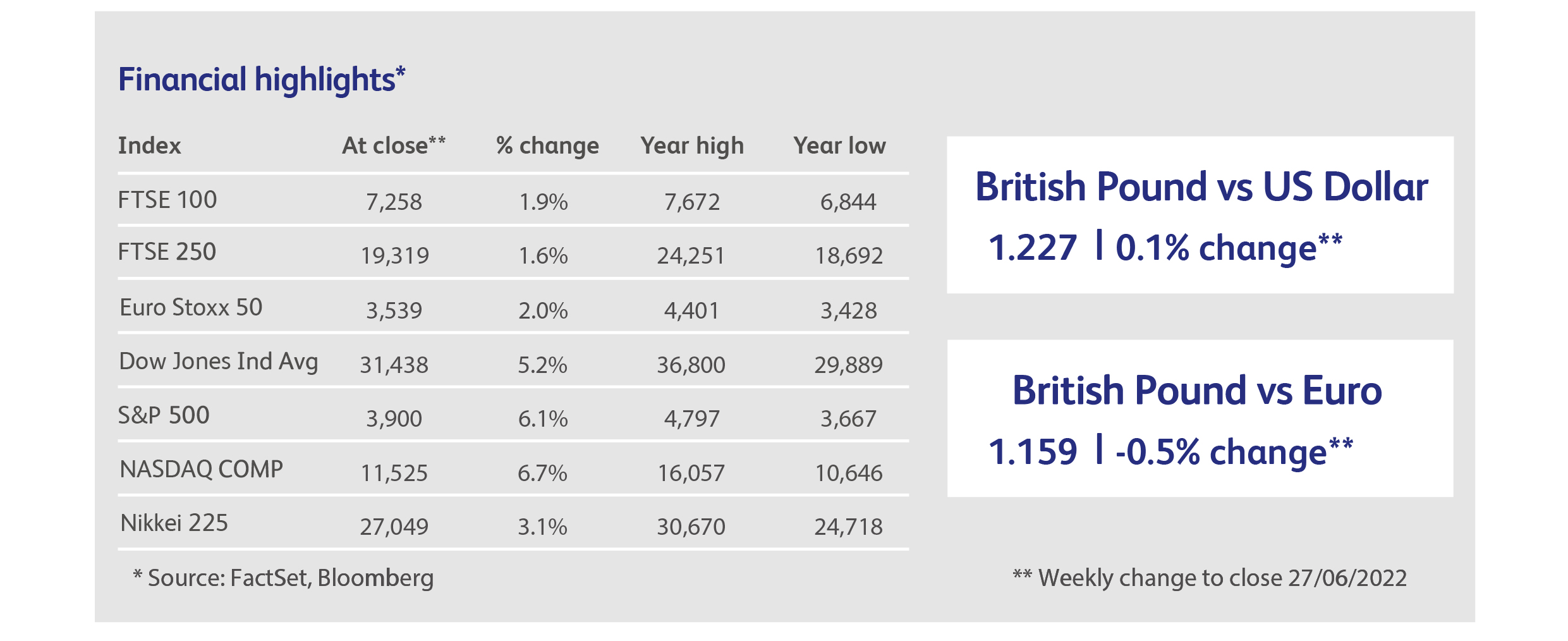

The previous week’s rally in US government bond markets, that may have heralded a change in sentiment towards the Federal Reserve in its fight against inflation, was repeated around the world. British government bonds followed their US brethren upwards after the release of UK inflation data that showed a surprising decline in so-called core inflation, which excludes more volatile components such as food and fuel. Eurozone sovereign bonds then had their own rally after the release of business activity surveys for the Eurozone that indicated a sharp slowdown in growth and, therefore, in inflationary pressures.

Unfortunately, every silver lining comes with a cloud, and the news that is so comforting to bond investors ought to have been disturbing to equity investors. The big rate rises in the US will have a negative impact on economic growth down the line, and disastrous business activity surveys in Europe imply that company profits will struggle. So far, during this current bear market, expectations for company profits have held up relatively well, but the company analysts that make these forecasts are notorious for being congenitally over-optimistic. Stock markets are vulnerable to another correction as profit-forecasts are rebased to a slower-growth, higher-inflation world.

It was notable, therefore, that stock markets managed to rally even while the chairman of the US Federal Reserve was giving his biannual testimony to the American government, reiterating his commitment to fighting inflation, and despite his acknowledgement that it will be very difficult to engineer a “soft landing” to the economy. Investors seem to want a vigorous approach to fighting inflation, perhaps fearing large rate rises now less than uncontrolled inflation, which brings the threat of even more vigorous rate rises further down the line. In any case the relief was palpable, with US equity markets bouncing by a solid 5-7%.

The positive sentiment was assisted by news from China, where government officials, including no less an authority than President Xi Jinping himself, were queuing up to re-commit to meeting the government’s economic targets for the year, despite the huge negative impact of recent Covid-lockdowns. Given that these targets now look outlandishly large, this will require a huge stimulus to the Chinese economy. Chinese equities continued their impressive rally, and are now up nearly 30% from their lows in March.

Finally, the rally was cemented when an important survey in the US showed that consumer expectations for inflation were not as bad as feared. Chairman Powell had referenced this data himself when explaining the Fed’s last rate rise, so there was general relief when the data was revised downwards. Survey respondents now expect inflation to rise by 3.1% over the next five-to-ten years, rather than the 3.3% that had caught the Fed’s attention. Nobody seemed to care that this survey comprises a mere 600 respondents, or that the reduction was due to a statistical revision rather than a change in actual inflation expectations.

The entire US banking sector rallied by the most in a year and a half after the entire industry passed regulatory stress tests with flying colours. This paves the way for an estimated $80 billion in dividends and share buybacks this year. Their European peer Deutsche Bank suffered the reverse, falling by 15% in a day after its senior management took a self-imposed EUR75,000 pay-cut as a penalty for their use of WhatsApp for business purposes. Deutsche is among several banks under investigation for the use of private messaging services.

Shares in Zalando, Europe’s largest online retailer, had their worst start to a day in three years, falling 17% after management slashed profit forecasts. Analysts suggested that trading had deteriorated sharply in June. Zalando shares are down 75% over the last year. This profit warning follows those by UK online retailers Asos and Boohoo Group, which reported seeing signs of consumer distress.

Investors who have enjoyed success with Tesla might want to consider Chinese makers of electric vehicles. These have been among the best performers recently in the overseas listings of Chinese companies, with shares in Nio, Li Auto and XPeng up between 43% and 62% in the last month. The companies have benefited from a number of stimulus measures recently announced by the Chinese government, as well as the re-opening of Chinese cities after lockdowns.

The woes in the cryptocurrency universe continued, with a theft of $100 million from a so-called cryptocurrency bridge, which aims to make tokens from different platforms convertible. Separately, lenders, hedge funds and exchanges operating in the cryptocurrency world all had liquidity issues. And, finally, in a scene straight out of a Coen Brothers film, thieves were arrested in America who planned to raid the home of a notorious crypto-hacker, who was himself alleged to have stolen $24 million in a previous crypto robbery.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.