26 July 2022

By Scott Palmer, Chartered Financial Planner

When it comes to pensions, the $64 million question you may ask is also one of the most important – how much money will you need in your pension to keep you going once you stop working?

It’s a question sometimes ignored, and too often people fly blind into retirement without any real thought for their future. Unless you are lucky enough to hold a company scheme that will deliver a lifetime regular income linked to earnings (final salary scheme), you will have to live within the limits set by your pension pot when your employment income is turned off for good.

There are several ‘rule of thumb’ answers to the question such as:

The truth is the answer varies for each individual depending on the standard of living you are accustomed to and the lifestyle you would like in retirement. Some prefer the simple things in life, such as countryside walks, whilst others have ambitions to travel the world.

Targeting a level of income is a good starting point. Look at your outgoings. Take away costs that drop off at retirement, like mortgage repayments, pension contributions, regular savings and work-related costs. If you have children, your food bills may reduce once they fly the nest (this will save me a fortune!!). You will be left with a monthly figure that will, in theory, provide a comfortable lifestyle. You can then add anything you put off during your working life, such as that trip around the world.

The unfortunate truth is that the majority of the UK enter retirement with less than £50,000 (source: Unbiased, 23/05/2022). At present, £50,000 will buy a single life annuity income of £3,092 a year (source: Sharing Pensions, 01/07/2022) and if you add a State Pension of £9,627, you’re looking at £12,719 per year. Or £1,060 per month. Or £245 per week. Let’s be honest, living on this could be tight – very tight.

Now, let’s be generous and throw in a property downsize. The average house price in the UK at present is £283,000 (source: gov.uk). Let’s assume you release £80,000 net of expenses on downsizing. This could generate £4,947 per year if you buy another single life annuity (source: Sharing Pensions, 01/07/2022), increasing your total income to £17,666 per year. Or £1,472 a month. Or £340 per week.

This isn’t an annuity-bashing exercise. After all, they provide an income for life, and we live a lot longer than we used to. But those reading this article are hopefully smarter than the average bear. You may not have access to limitless money, but you’ve been shrewd with it. You’ve invested wisely and as retirement edges closer and the kids leave home, you’ve topped up your pension relentlessly. So, let’s assess two scenarios of what you can achieve with pension pots of £250,000 and £500,000.

The £250,000 Scenario

In this scenario, we assume a total retirement pot of £250,000. This can be from pensions, savings, ISAs, property downsize or a combination of them all. What would this buy if you retired now?

Buying an annuity would give an annual income of £15,460, or £1,288 a month (source: Sharing Pensions, 01/07/2022). Add State Pension and you get an annual income of £25,087, or £2,090 a month. This paints a better picture and allows a lifestyle many consider between “quiet and comfortable” and “care-free”. That said, it may not be ideal if you like to go abroad a couple of times a year.

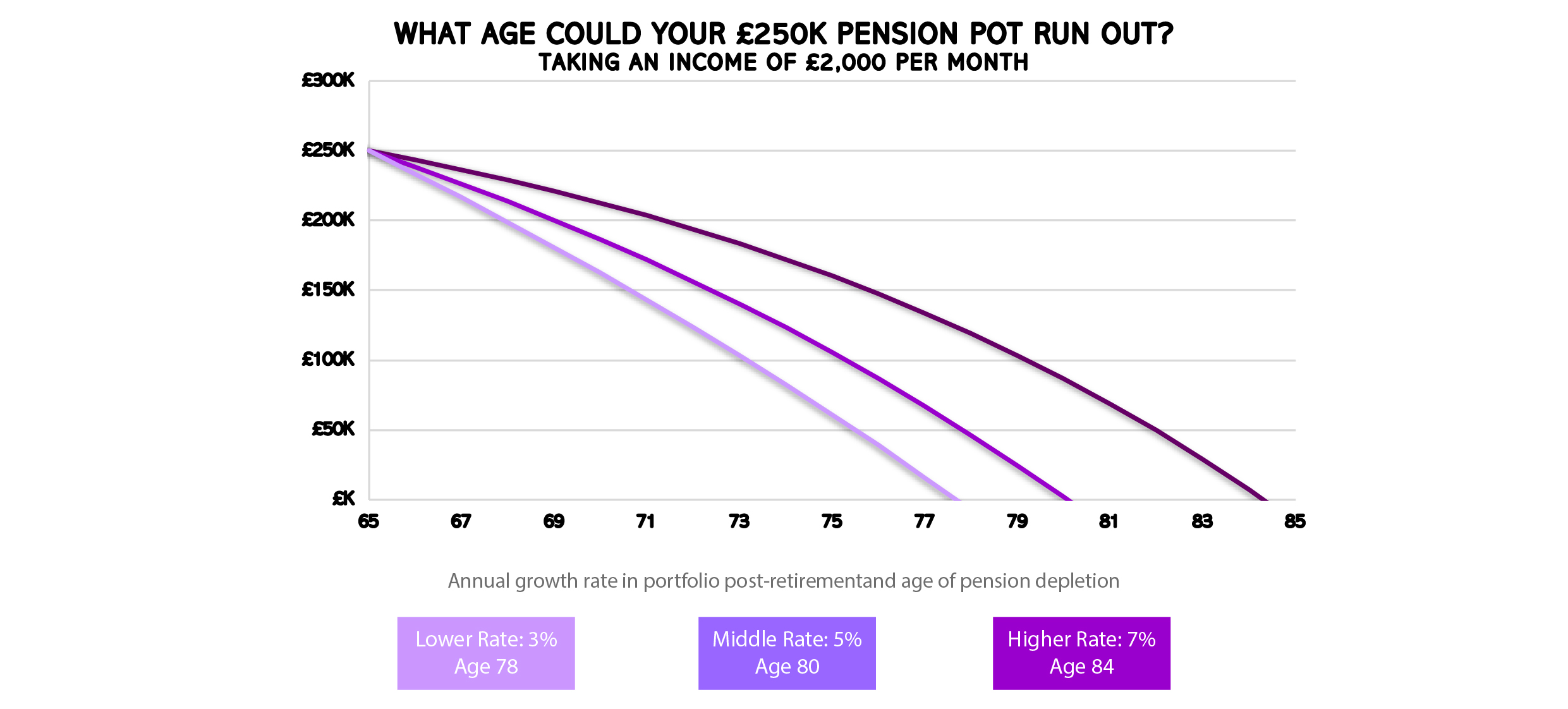

Another option is Drawdown. One perceived advantage of living longer is that it extends your investment horizon and allows more risk in retirement, with the potential to foster more growth. If we assume an income of £2,000 per month, the graph below illustrates the age at which your pot will run out. Should you achieve higher rates of growth this will allow a lifestyle at the top end of the “care-free” retirement zone. Whist life expectancy of a 65-year-old is 85 for a male and 87 for a female (source: ons.gov.uk), it should be remembered there will still be State Pension to add to the equation.

The £500,000 Scenario

If you accumulate £500,000 and take it down to the annuity shop, you’ll receive an income of £30,920 a year for life (source: Sharing Pensions, 01/07/2022). Again, adding in your State Pension, your annual income could rise to £40,547, or £3,378 per month. This would put your lifestyle in the “care-free” category.

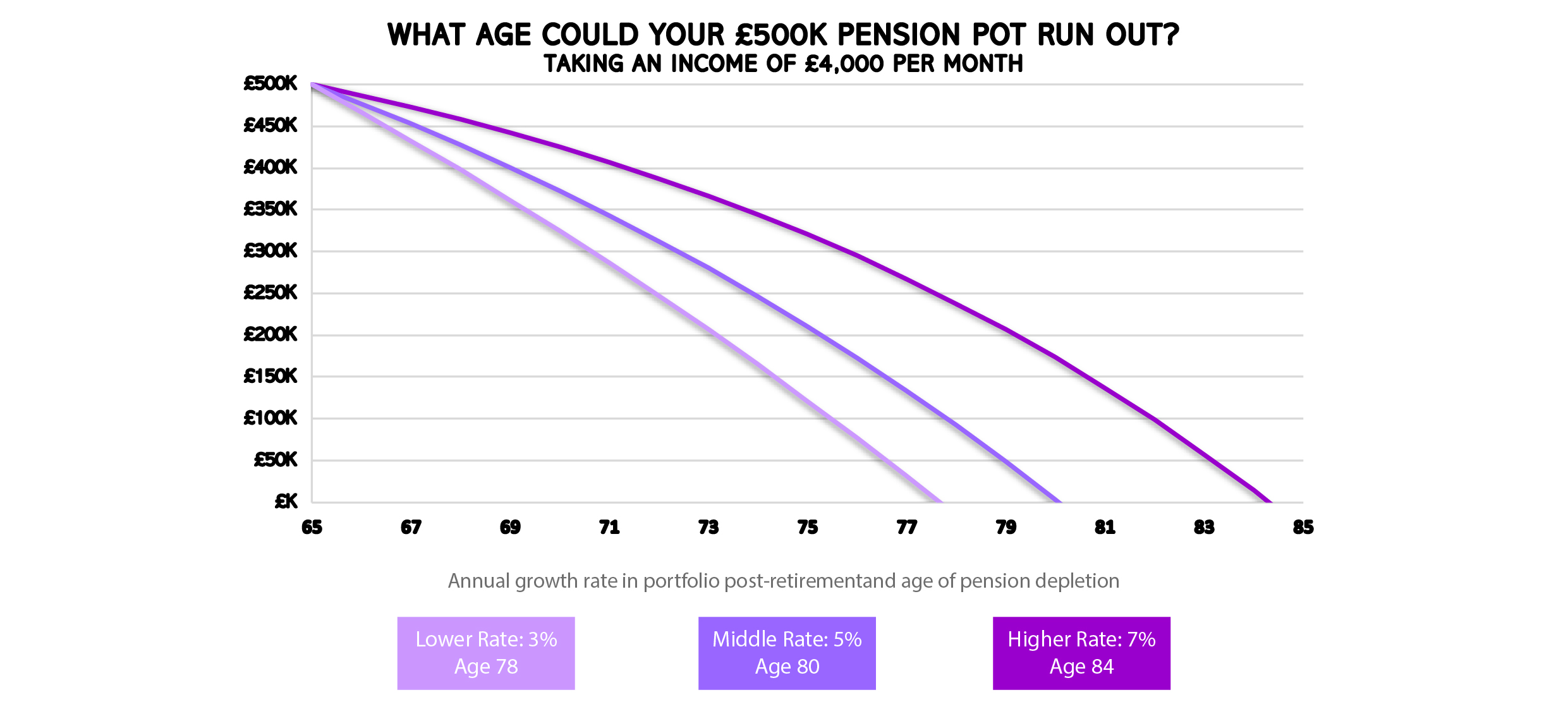

If you opted for drawdown, let’s assume you take £4,000 a month. Add in State Pension and you’ll have an annual income of £56,094. This figure puts you towards the top of the tree in terms of lifestyle – luxury all the way. Again, we can see in the graph below the age at which the pot is assumed to deplete.

So, What’s the Answer?

These scenarios are simplified and don’t consider a reduction in spending habits as we get older or stock market volatility. We have almost certainly missed certain costs, and your idea of how much luxuries such as cars and holidays will cost may be very different to ours. You will also need to take inflation into account if your retirement is some way off. Although £500,000 sounds like a lot today, it won’t have the same purchasing power in twenty years’ time.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.