16 August 2022

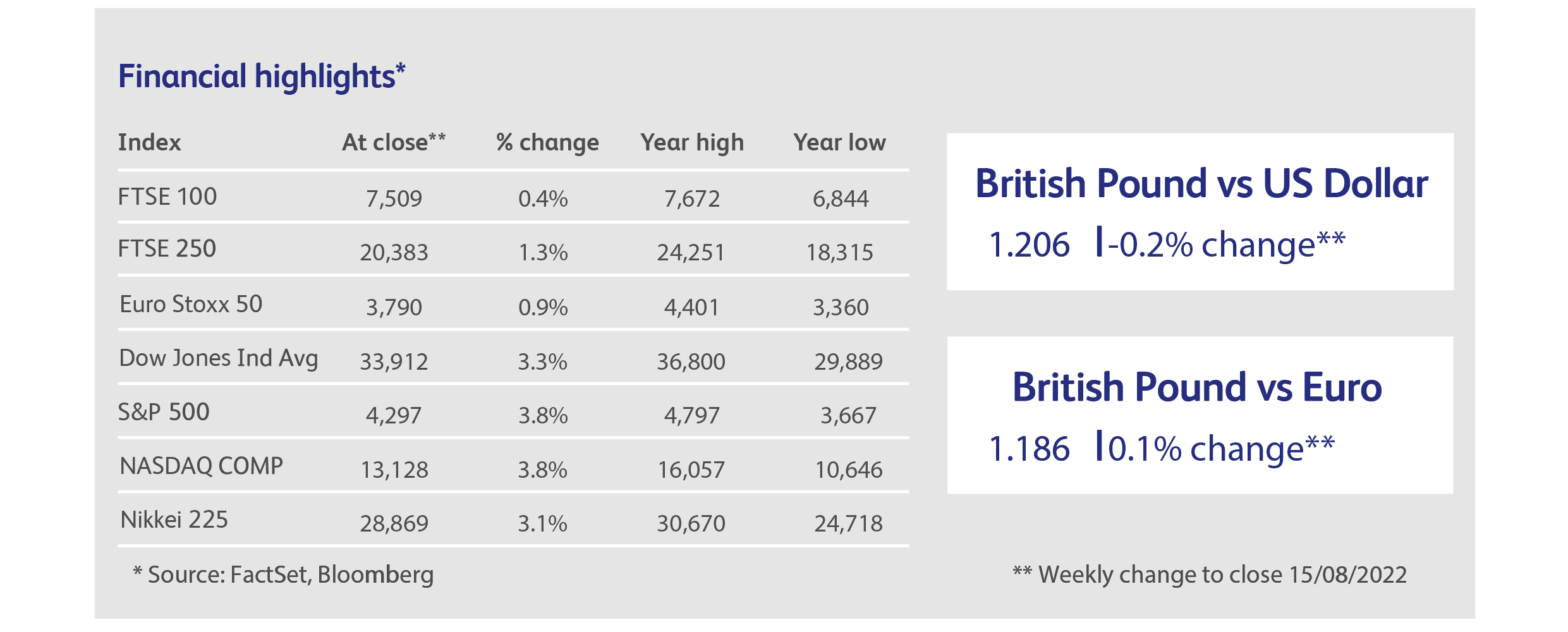

Stock markets managed another week of gains, extending the rally in American indices to two months. This has encouraged a hint of euphoria to develop, which has been reflected in the rise of cryptocurrencies, meme stocks and, of course, the technology sector favourites. Judged by the strength and breadth of the rally, and the fact that a lot of bad news has been absorbed on the way up, some analysts are calling this the end of the bear market. Their optimism was somewhat confirmed last week when investors witnessed a rare decline in US inflation data for the month of July. This was seized on as evidence that inflation has now peaked, enabling the rally in asset prices to continue. In another positive development, a survey of US consumer confidence showed a surprisingly strong uptick and bounced off its readings of the previous few months, which had been the lowest in the survey’s 70-year history. Bad news was shrugged off, such as the startlingly poor business activity surveys for the Mid-West and East Coast, as US stocks produced an especially strong week. The S&P 500 index has now recouped more than half its declines since the year began.

European stock markets also managed to rally, but their rise was more muted, lacking much in the way of good news. Admittedly, industrial production figures for the Eurozone were better than expected and will somewhat offset the slowdown in consumer spending. Nevertheless, most forecasters still expect the Eurozone to flirt with recession in the near future. Moreover, the news that the river Rhine had become impassable for shipping due to drought ought to have depressed sentiment, as it will slow industrial production and add to inflationary pressures. The river is a key artery for the transportation of fuel supplies such as diesel and coal, but it also plays a crucial role in the chemical and steel industries. The German energy regulator reiterated its calls for a 20% cut to natural gas usage in preparation for the winter, and the German government imposed an additional tax on households to support the energy industry.

UK investors were in a similar quandary to European investors, after surprisingly good GDP data suggested that the UK has avoided recession. Nevertheless, a winter recession can’t be ruled out with inflation likely to rise from its current 9% to about 13% after the energy regulator raises prices in October. Moreover, the UK’s perennial trade deficit jumped alarmingly as higher energy prices boosted the value of imports while Brexit continues to impede the post-pandemic recovery in exports. Neither of the candidates competing for leadership of the government is likely to change this trajectory in the near-term, and the pound will most likely struggle to gain any traction amongst international investors.

Both Chinese assets and the Chinese economy have dipped recently, with government pronouncements in favour of supporting the economy falling well-short of investors’ expectations and geopolitical risk flashing red. Investors remained calm, however, despite a slew of economic data suggesting that the Chinese economy is faring worse than expected, even after such expectations had already been beaten down. Chinese factory production decelerated sharply, the Chinese consumer appears to be unwilling to spend despite government support for big-ticket purchases, and the property development sector is still in free-fall. A surprise cut in interest rates by the People’s Bank of China illustrated the seriousness of the situation.

Saudi Aramco re-established its credentials as the world’s biggest company by reporting record-breaking profits of $48.4 billion for the second calendar quarter. Revenues grew by 80% to $150 billion. Unlike western-world oil companies, Aramco plans to invest in expanding its production capacity, rather than returning more money to shareholders.

Pharmaceutical companies associated with the anti-ulcer drug Zantac took a beating last week, with analysts highlighting the risks associated with impending lawsuits in the US. Some estimate that the sector will suffer losses as high as $45 billion. Zantac itself was withdrawn from the US market in 2019 after the US Food and Drug Administration found evidence of potentially cancer-causing chemicals. Sanofi had its worst two-day run ever, dropping by 20% at one point before recovering half of that decline. GSK had one of its worst days of the last two decades.

Walt Disney Co. shares capped a strong recent run with results that sent the stock up 8% in a day. The company added over 14 million subscribers to its Disney+ streaming service, nearly 5 million more than expected by analysts. The company also announced that it would raise the price of the Disney+ service by 38%. Theme park revenue also soared, and the traditional TV broadcasting business benefited from higher advertising revenues and fees from cable distributors.

While Disney’s theme parks enjoyed a rebound, Disney’s rival in the theme park business, Six Flags Entertainment, saw a reduction in attendance. Attempting to explain the decline, the CEO commented that decades of deep discounting of entry prices meant that the company’s 27 parks in the US, Mexico and Canada had become “cheap day-care centres for teenagers”. The company is now hiking prices to encourage a more premium guest experience. Six Flags’ shares fell 20% on the news, before rallying by 18% to end the week.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.