27 September 2022

Markets were already enduring a torrid time when the British government dropped its fiscal bomb on Friday. Earlier in the week, the US Federal Reserve had raised rates by 0.75% as expected, but there was no let-up in the hawkish tone as the Fed simultaneously cut its growth forecast and lifted its own expectations for future interest rates. Once again, the Fed is signalling that it is ready to tolerate a recession in order to combat inflation. This has been the message for a while, but markets are now repricing how far the Fed will go, and how deep any recession might be.

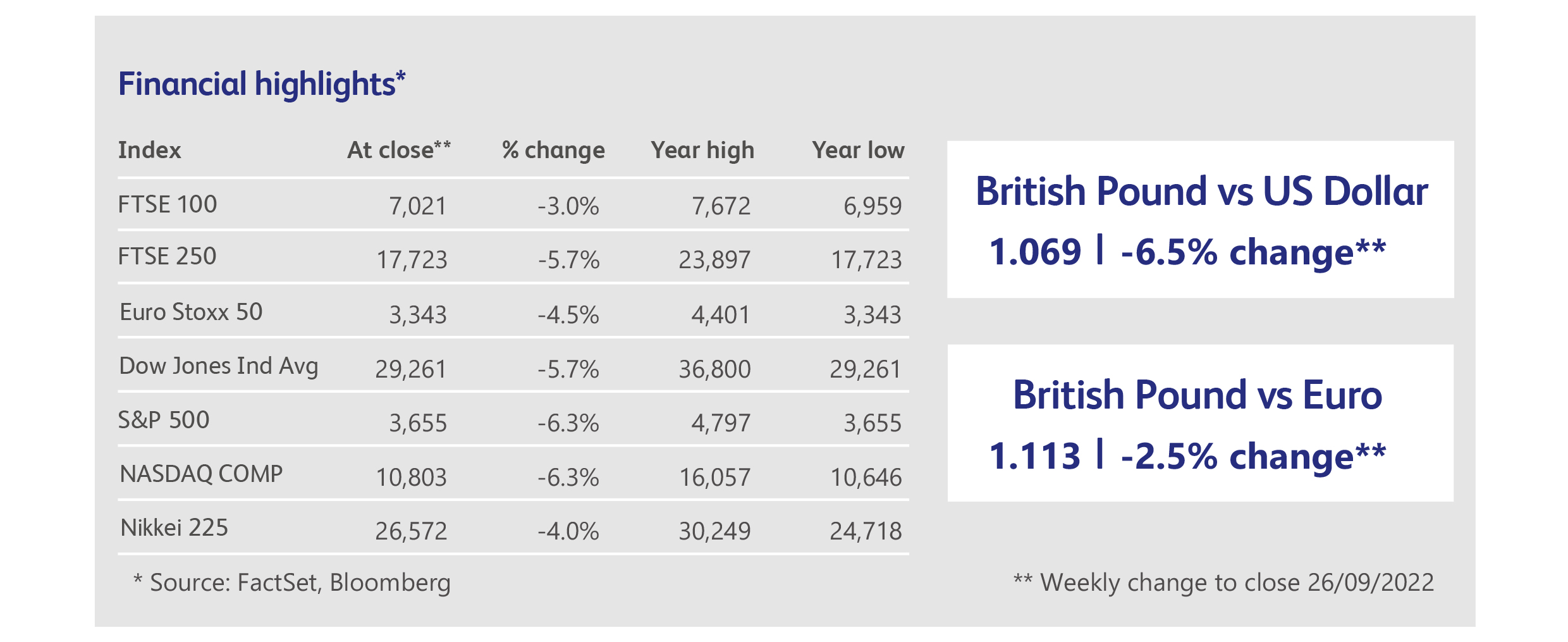

Attention then switched to the strength of the US dollar in what is now being termed a currency crisis. Having seen the yen fall 20% against the dollar since the start of the year, Japan’s central bank was forced to intervene to support its currency for the first time since 1998, producing an immediate gain of 2.3% on the yen-dollar exchange rate. Commentators were sceptical, however, whether even the vast reserves of the Bank of Japan would be enough to win this battle, and the yen subsequently fell back over the course of the week. The People’s Bank of China was simultaneously conducting its own war against speculators, which culminated in the imposition of stricter currency exchange controls. The Chinese yuan is flirting with its lowest level against the dollar since 2008, prompting fears of capital flight. The pound was already under pressure against the US dollar, having fallen to $1.12, when the Bank of England announced its decision to raise rates by another 0.5%, though some had been anticipating a 0.75% rise to keep pace with the Fed and European Central Bank.

The publication of highly-anticipated European business activity surveys on Friday morning confirmed fears of another step-down in economic activity, with both the UK and Eurozone showing signs of outright economic contraction. It was into this maelstrom that the British Chancellor announced a radical change in policy towards unfettered government spending in a seemingly desperate attempt to stimulate economic growth, prompting an immediate collapse in sterling and UK government bond markets. It didn’t help that the Chancellor shrugged off the move in markets with the phrase, “The markets will do what they will do”, perhaps forgetting that government bond yields dictate the cost of government spending and that the level of sterling contributes to inflation via the cost of imports. Sterling fell by over 3% against the dollar on the day of the news and a flash-crash in overnight trading in Asia on Monday sent it down another 4% to, momentarily, $1.04. The pound subsequently recovered from that debacle but is still trading at a record low to the dollar. UK government bond yields jumped to their highest in a decade, anticipating massive additional government expenditure, the increased cost of funding that expenditure and the possibility that the Bank of England may have to raise rates to prevent further depreciation of the pound. Stock markets are often the beneficiaries of lower taxes and higher government spending, but scepticism is currently so rife even amongst equity investors that the UK-orientated FTSE 250 stock market index ended the day at new lows for the year.

The repercussions went far wider than UK assets, however, as global investors reconsidered how likely their own governments would be to spend their way out of trouble. Bond yields all over the world surged and global stock markets tumbled, with US and European markets also reaching new lows for the year.

Ford Motor Co. had its biggest daily decline in value in eleven years, with its shares dropping by 12%, after the company reported $1 billion of extra costs due to inflation in the current calendar quarter. Moreover, shortages of parts continue to plague the company’s productivity. Perhaps optimistically, management maintained its full year forecast for profits.

Shares in the British retail chain JD Sports Fashion were also given short shrift despite its management also sticking to profit guidance for the full year. Investors were more focused on the short-term problems of softer demand, supply chain-inflation and strikes at two ports (Felixstowe and Liverpool) used by the company to receive imported products. The shares fell 17% over the week.

In a rare piece of good news from the European banking sector, Italian banking giant UniCredit announced that it will “substantially upgrade” its guidance for profits in the coming quarter. The group’s Chief Executive pointed to the unexpectedly sharp rate rises by the European Central Bank, which took interest rates into positive territory, as being a key driver. The shares rose 5% on the day. Germany’s Deutsche Bank issued a similarly positive update, stating that improved income from loans would more than offset any effects of the inflation crisis. There was no such luck for Credit Suisse, however, as the bank’s share price fell to a record low on rumours that it would be pulling out of its American activities entirely.

The energy sector was the worst performer of any industry on Friday, falling by 5-6% across the board, as investors took fright at the recent decline in the oil price and the outlook for global demand. Being denominated in US dollars, the strength of the dollar has added to the pressure on oil consumers overseas.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.