1 November 2022

Stock markets ran the gauntlet this week of some weak financial performance from the technology industry, as well as disappointing economic data, but without sustaining much damage. In fact, the resilience of markets to bad news raises the possibility that the recent bottom could mark the end of the current bear market.

This hope is dependent on central banks softening the tone of their comments on interest rate rises, examples of which were in evidence twice during the week. The Bank of Canada increased rates by 0.5% rather than the 0.75% that markets had expected, and noted that past rate rises were beginning to affect household spending and housing markets. More importantly, the European Central Bank met expectations with a 0.75% rate rise but hinted that a slowdown in the pace of tightening is imminent with the comment that “substantial progress” has already been made towards tighter monetary policy.

Last week was one of the busiest of the year for companies reporting results and was marked by some notable successes in the world of bricks and mortar, offset by significant disappointments in the technology sector. Companies such as Unilever, Coca-Cola and McDonald’s saw strong revenue growth and were able to exploit their dominant brands by pushing through price increases. Shares in Visa and Mastercard jumped after reporting solid results, suggesting only a mild slowdown in the volume of credit-card transactions. Oil companies produced record profits which, predictably, prompted threats of windfall taxes from politicians.

The technology sector was beset by problems as online transactions and advertising expenditure shrank again in the third calendar quarter, and growth in even the most cutting-edge online technologies began to slow. Amazon reported a slowdown in online expenditure and shocked markets by projecting revenues for the current quarter that would represent the slowest growth-rate in the company’s history during the important holiday season. Crucially for investor sentiment, however, Apple (the world’s most valuable company) pleased investors when it reported revenues and profits that beat expectations. Apple shares rose 7%, despite management warning that the rate of revenue growth is likely to fall in the current quarter.

As the week came to an end, stock markets were able to shrug off weak economic data from China, where business activity is floundering due to a combination of Covid-lockdowns, the crisis in the property sector, and falling exports to the developed world. Even more remarkable was the lack of market reaction to dreadful inflation data in continental Europe, where another acceleration in energy prices was compounded by rapid increases in food-price inflation and in the cost of services. It seems likely that inflation in Europe has yet to peak. With problems mounting in the supply of agricultural commodities, mainly due to the war in Ukraine, food-price inflation could become a real issue for investors hoping that central banks can “pivot” towards less aggressive rises in interest rates.

Coca-Cola showed its pricing power when it reported revenue growth of 16% in the third calendar quarter from the same period a year ago, excluding the impact of acquisitions and currency movements. This easily beat analysts’ expectations and prompted the company to raise its revenue forecast for the full year. Coca-Cola shares are now up for the year to date.

Microsoft shares fell 7% after the company reported that sales of Windows software had fallen by 15% in the previous quarter, and forecast that revenue growth at its cloud-computing services business will slow from its current rapid rate. Nevertheless, the company was able to produce revenue growth of 11% versus the same period last year.

Revenue and profits at Alphabet, the parent of Google, both disappointed market expectations, prompting a 10% decline in its share price. Despite the search engine having been hitherto relatively immune to economic conditions, it finally succumbed to the slowdown in digital advertising that had already affected competitors.

Shares in Meta Platforms, formerly known as Facebook, plunged by 30% after the company announced a decline in revenues and raised its estimate of the cost of investments in virtual reality technology. So far this year the company’s value has lost over $600 billion dollars.

Shares in industrial bellwether Caterpillar had one of their best days in years after the company reported strong shipments of bulldozers, as well as price-rises that will more than offset inflation in the company’s own cost-base. Profits for the third quarter easily surpassed expectations.

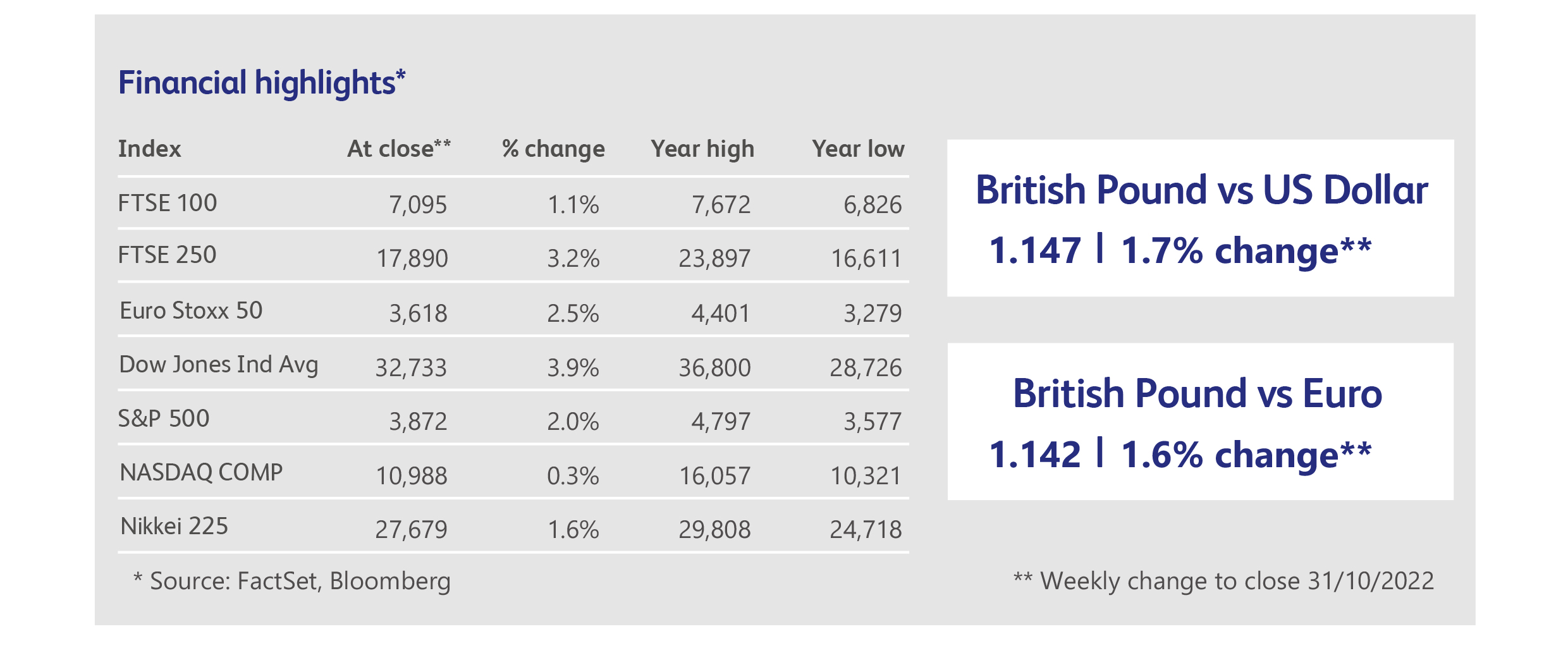

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.