22 November 2022

In a relatively light week for economic data and company updates, markets broadly managed to hold onto the momentous gains of the previous week. Coming so soon after last week’s relatively benign US inflation data, the week got off to a good start with a deceleration in US producer price inflation, which should ultimately feed through into lower inflation in the prices of goods for consumers. What investors really want to know, however, is whether the more positive outlook for inflation will influence governors at the US Federal Reserve into slowing the pace of increases in interest rates. Despite an unusually large number of governors speaking at conferences and in interviews during the week, investors were left with the feeling that opinions are still divided between those who prioritise defeating inflation at any cost, and those who are becoming more cognisant of an economic slowdown.

It was encouraging that markets just about shrugged off the resurgence of Covid cases and Covid lockdowns in China, which risk derailing the recent euphoria unleashed by the prospect of a softer approach to the pandemic by the Chinese authorities. Despite recent new guidelines regarding quarantine and mass testing rules, the fact that China is now suffering some of the most serious Covid outbreaks of the last twelve months threatens to sap investor confidence. And winter is coming, of course.

In the UK, the Chancellor of the Exchequer was caught between a rock and a hard place for his Autumn statement, trying to placate both capital markets and voters. In the event, he prioritised markets. The immediate problem was how to reign in the excesses of September’s calamitous mini-Budget while, at the same time, seeing the government’s economic forecasts drastically cut the financial resources available to him. The independent Office for Budget Responsibility, which prepares forecasts for economic growth and government borrowing, had been recklessly ignored by the Chancellor’s predecessor, so it was important that Jeremy Hunt played by the rules. But this left him with a materially worse outlook, as the latest forecasts cut GDP growth significantly in 2023 and 2024, and also raised the expected cost of interest on government debt by nearly £50 billion.

The Chancellor, therefore, had little choice but to announce a dose of austerity. This he did, primarily by cutting support for energy bills for consumers and businesses, which shores up short-term credibility but goes against the global political trend for bigger subsidies. As a result, British households will see their incomes hit hard early next year, cementing the likelihood of recession. Moreover, freezing income tax thresholds when inflation is running at 10% is unlikely to encourage consumption and is certainly not a vote-winner.

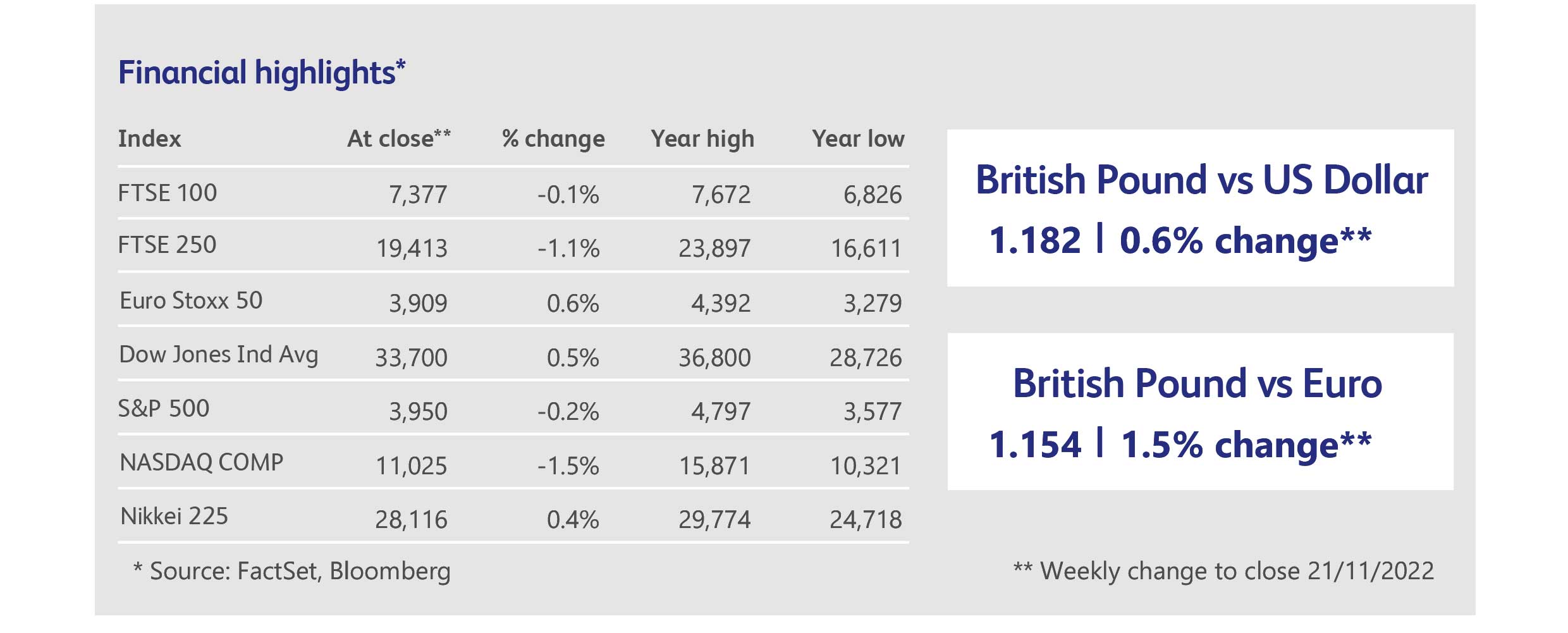

Nevertheless, markets appear to have been placated. The overall package was relatively well-received by the gilt market, with the yield on 10-year government bonds rising only trivially to 3.2%, well below its peak of 4.5% in September. The pound continued to appreciate against the US dollar, capping an impressive recovery from its September plunge.

US discount retailer Target Corp. issued its fourth profit warning for the year and forecast a decline in revenues for the current calendar quarter. Ominously, management stated that sales trends “softened meaningfully” in the latter weeks of the third calendar quarter. The slowdown was particularly apparent in the toy department, which suffered a “meaningful deceleration”, prompting the stocks of toy manufacturers Hasbro and Mattel to also sell off. Earlier in the year Target was one of the first companies, along with Walmart, to highlight weakness in US consumer spending.

Engineering giant Siemens is still riding the wave of record orders left over from the Covid lockdowns, though management expects the order backlog to normalise in the coming months. The company saw revenues rise last year in every line of business and reported profits doubling in the most recent accounting quarter from the same period last year. The shares rose 7% on the news.

Shares in computer equipment manufacturer Cisco Systems jumped by 7% after the company raised its expectations for turnover in the current quarter. Management’s belief that the need to upgrade computer networks trumps the slowdown in the economy seems to be well-founded. Despite the upbeat forecast, the company announced a cost-cutting programme: 5% of the company’s employees will be laid off or moved to other positions.

China’s leading online shopping company, Alibaba Group, reported revenues for the latest quarter that missed expectations, and suffered a $3 billion loss as it wrote down the value of several technology-related investments. Nevertheless, the stock was buoyed by management’s decision to increase its stock repurchase programme from $25 billion to $40 billion. The Chief Executive Officer highlighted the Chinese government’s new pandemic measures as likely to have a positive impact.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.