20 December 2022

The week started well enough, with the publication of American data showing that the pace of inflation had decelerated more than expected in November. US petrol prices had fallen during the month, while food and rent inflation both moderated. Investors were jubilant all over the world. This was the long-awaited evidence that inflation had peaked, and markets seemed set for an easy run-in to the end of the year. The “Santa rally” was on.

Not for the first time this year, however, central bankers sent markets into a tailspin, although this time it was a one-two punch from the US Federal Reserve and, the following day, the European Central Bank. The Fed raised interest rates by 0.5% as expected, but the tone of Chairman Powell in the press conference afterwards was particularly aggressive towards inflation and unsympathetic to markets. Powell focused on the labour market in his comments, which is still growing robustly, rather than other, weaker aspects of the American economy. Not only did the Fed raise its expectations for where interest rates will end up, but the strong degree of unanimity from the members of the governing committee surprised investors. Moreover, the committee raised its expectations for the trajectory of inflation, confounding economic forecasters who had just witnessed the rate of inflation begin to decline.

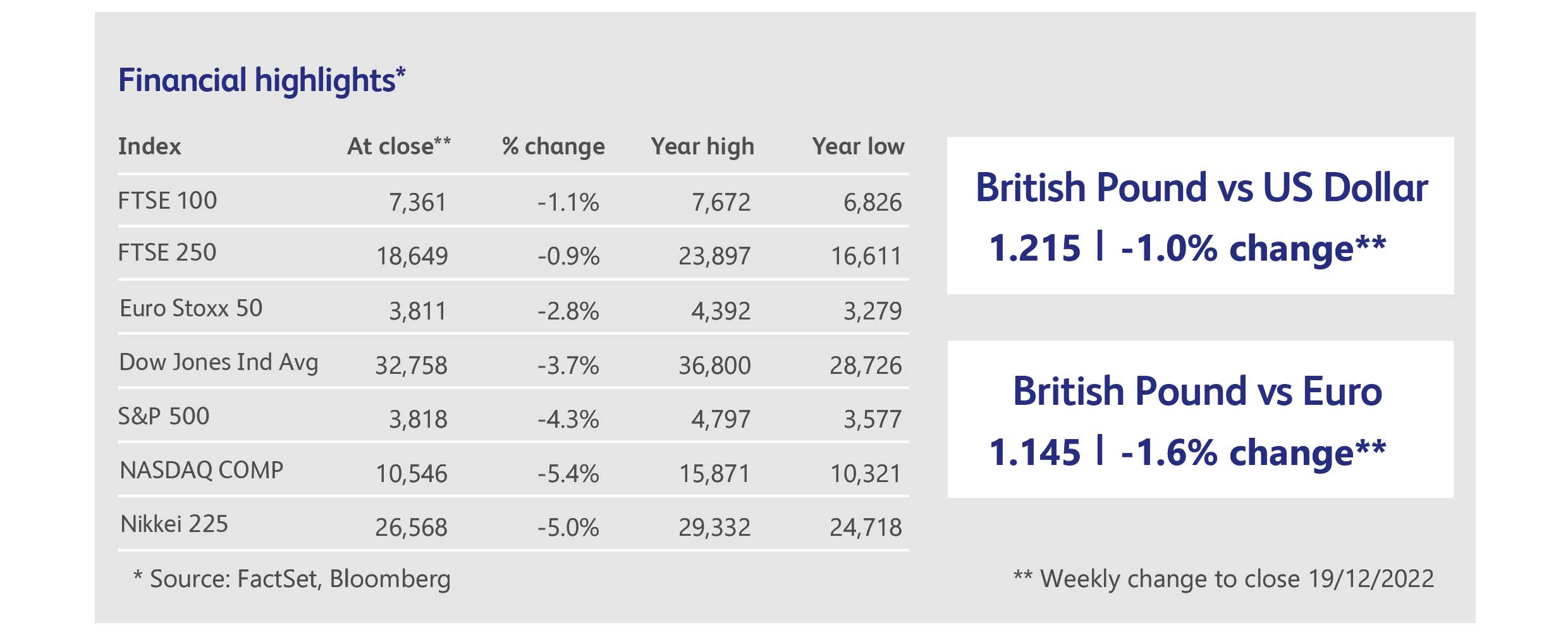

The recent rally had been built on hopes for a so-called pivot in interest rate policy towards fewer rate rises, and these hopes had seemingly been confirmed when inflation data did begin to recede in recent weeks. Predictably, therefore, stock markets did not like the Fed’s message at all. The S&P 500 Index fell by 4% over the two days following the news, but European and Asian markets march to an American beat and share indices, globally, were dragged down by a similar amount. The reaction of American bond markets, however, was much calmer. After an initial wobble, they rallied and ended the week holding onto a noteworthy gain. This is an important development for investors as it marks a clear departure from the beginning of the year when nearly all asset classes were falling together, and portfolio diversification became less effective. Now it seems that what is bad for equities could be good for bonds, putting portfolios that are diversified across both asset classes in a much better position.

Unfortunately, the same cannot be said of European bond markets, whose recent good run was ended by the European Central Bank’s own pivot towards higher rates. The ECB raised rates by 0.5% as expected, but also raised its forecasts both for the path of inflation and, also, interest rates, to significantly above the market’s current expectations. This came completely out of the blue, about as shocking as Saudi Arabia beating Argentina in the World Cup finals. For good measure, the ECB also announced the start of quantitative tightening in March, which will involve running down its stock of government bonds. Commentators and analysts were stunned and saw in the ECB’s statement, and subsequent press conference, a sea-change for a bank hitherto regarded as being highly sensitive to economic weakness, as well as to the bond markets’ sensibilities. Given that the Fed had already abandoned its support for markets, where do investors look for sympathy now?

The weekly Market Commentary will return on 10th January in a new format. Merry Christmas and Happy New Year!

Recession concerns reached the American steel industry for the first time last week, precipitated by a profit warning from Nucor Corp, the largest American steelmaker. Nucor warned that both volumes and prices in the fourth calendar quarter were below expectations. The company’s shares fell 9% on the news. Nucor’s warning prompted similar warnings from its competitors US Steel and Steel Dynamics, though both were able to report that prices had bottomed before the end of the year and were now improving.

According to the financial news service Bloomberg, a European citizen is the richest man on the planet for the first time since its measurements began. Frenchman Bernard Arnault, founder and part-owner of the luxury goods giant LVMH, surpassed Elon Musk as the world’s richest man after suffering a mere $7 billion loss of wealth in 2022 due to the strong performance of companies in the luxury goods sector.

Elon Musk’s assets, on the other hand, suffered losses of more than $100 billion during the year. Musk surprised markets during the week by selling $3.6 billion of shares in Tesla, enough to cover about one year’s interest on debt associated with his acquisition of Twitter. That brings his sales of Tesla shares to about $23 billion since the Twitter deal was announced. Tesla shares hit new lows for the year and have now fallen by more than half in 2022.

A breakthrough in nuclear fusion, announced by an American nuclear laboratory during the week, could spark interest in companies with investments in fusion-related technology. Several fusion start-ups raised money privately during the pandemic stock market boom but have yet to come to market. Lithium, however, is a key fuel used in the fusion process and listed Lithium producers could eventually benefit if the technology can be commercialised. Some listed engineering companies, such as Babcock International, are also involved in the construction of fusion-related technology.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.