17 January 2023

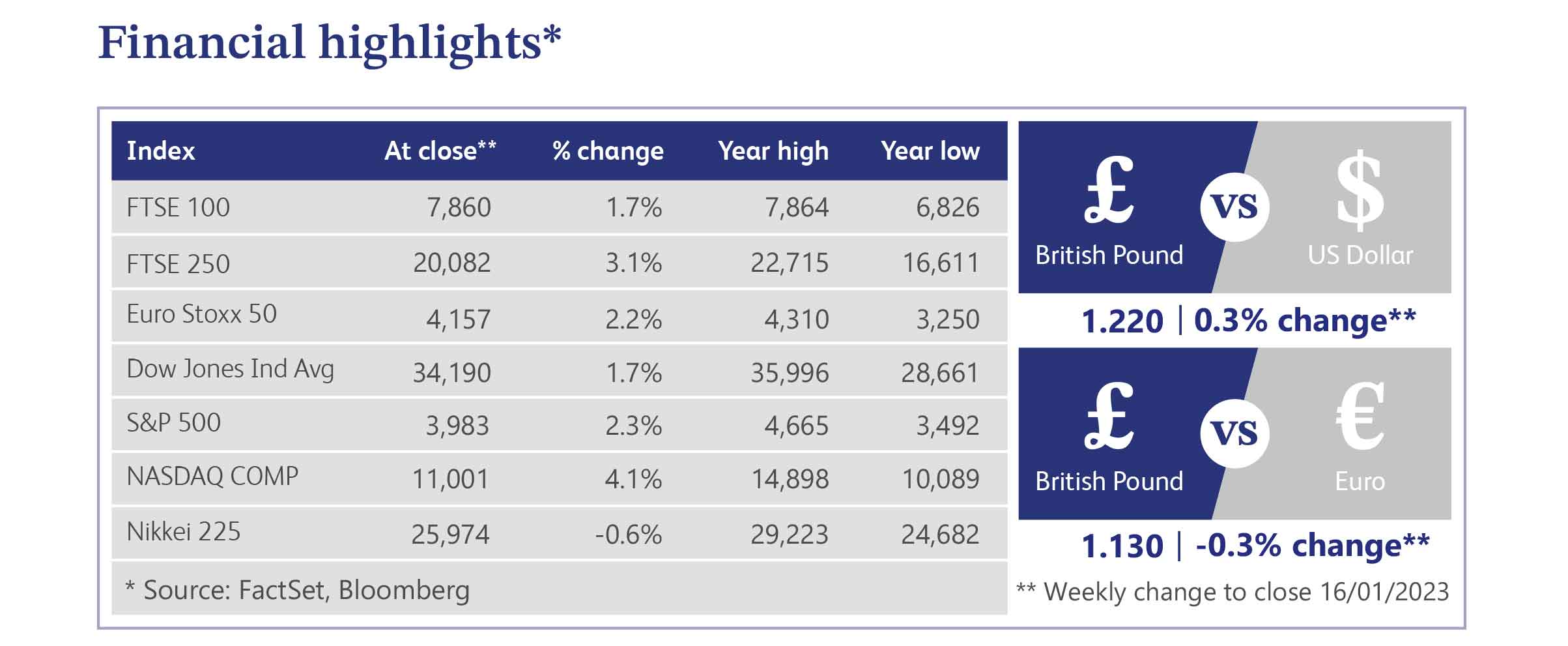

Equity markets broadly experienced another positive week with the FTSE 100 rising 1.7% over the period, to reach a near all-time high. Investors eagerly awaited the results from the latest US inflation figures which revealed a fall to 6.5% from 7.1% the previous month, in line with expectations. This was the sixth consecutive fall in CPI inflation driven largely by declining oil prices. This helped strengthen the trend that falling prices would persist and reduced the pressure on central banks to tighten monetary policy through interest rate hikes. The announcement helped drive bond yields lower which had a positive impact on prices.

The US central bank chair Jerome Powell commented in a speech earlier in the week that unpopular decisions would still be necessary in order to further lower inflation and restore price stability. The Federal Reserve raised interest rates by 0.50% to their highest level since 2007 in their last meeting, but Powell gave no details away on what may be expected in the upcoming meeting.

The tight labour market remains one of the most closely monitored medium-term influences on inflation, where record low unemployment and elevated wage growth have been problematic in a sense. This was buoyed by US weekly jobless claims, which were well short of expectations. Many expect this to soften in the coming period as global economic growth deteriorates.

Shifting the focus to the domestic economy, UK economic growth fell 0.3% over the three months to November marking the fourth consecutive month of declines. A November boost in the hospitality sector from the men’s FIFA World Cup was not enough to offset broader economic weakness, with high inflation and tightening monetary conditions having an adverse impact.

The World Bank announced in their latest report estimations that the global economy would grow by 1.7% in 2023, the third weakest year in three decades. This was significantly lower than their previous expectations of 2.9% as their previous worst-case scenario turned into their base case. They outlined that multiple economies could easily suffer recession following a tightening of financial conditions with the fall in growth led mainly by developed economies. China was one of the few economies to experience an upgrade in growth, with the economy expected to expand by 4.3%, from previous expectations of 2.7%.

Card Factory experienced a strong week with the share price rising over 10% after the company upgraded its profit guidance for the year. It noted that trading had been stronger than expected with sales rising to £433m as at 31st December, up from £337m the previous year. This was regardless of strike action with customers continuing to visit stores for greeting cards and gifts. The company also pointed to the ongoing reversal of lockdown measures being supportive for sales. Going forward, Card Factory is mindful of cost pressures and the challenging economic climate, however, it is optimistic that its value-for-money proposition will prosper. It also noted that energy costs were hedged until September 2024 to help dampen rising expenses.

Direct Line made the headlines after the share price suffered 23.5% on Wednesday after the company declared that a final dividend for 2022 would be unlikely. This was following an increase in claims paid out as a result of the severe cold temperatures and rises in motor inflation. This led to total claims for weather-related instances reaching around £140m in 2022 which was considerably higher than the £73m expected. The drastic share price move was predominately a reaction from those relying on the company for its consistent dividend income stream. Investors were also cautious over the prospect of future fundraising needed to help strengthen the company’s balance sheet.

Online fashion retailer ASOS surged by 21% on Thursday following a relatively stable update despite falling sales over the festive period. The results were not as bad as many expected with some anticipating a profit warning. The company noted that the Royal Mail strikes had caused notable disruption to the business, but investors focused on the prospects of the new chief executive being able to shift the company’s focus to improved profitability and cash generation. Despite the rapid daily price move, the shares are still down over 70% over the previous 12 months.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.