7 February 2023

Newsflow over the past week was dominated by central banks as they continued to tighten monetary policy in their ongoing fight against inflation. Perhaps most importantly for global markets, the US Federal Reserve ("Fed") increased its funds rate by 0.25% to a target range of 4.5 - 4.75%, marking the 8th increase (albeit the smallest rate of increase) since March 2022. The Bank of England and the European Central Bank both read from the same script and followed suit, each raising their benchmark lending rates by 0.5% (to 4.0% and 2.5% respectively).

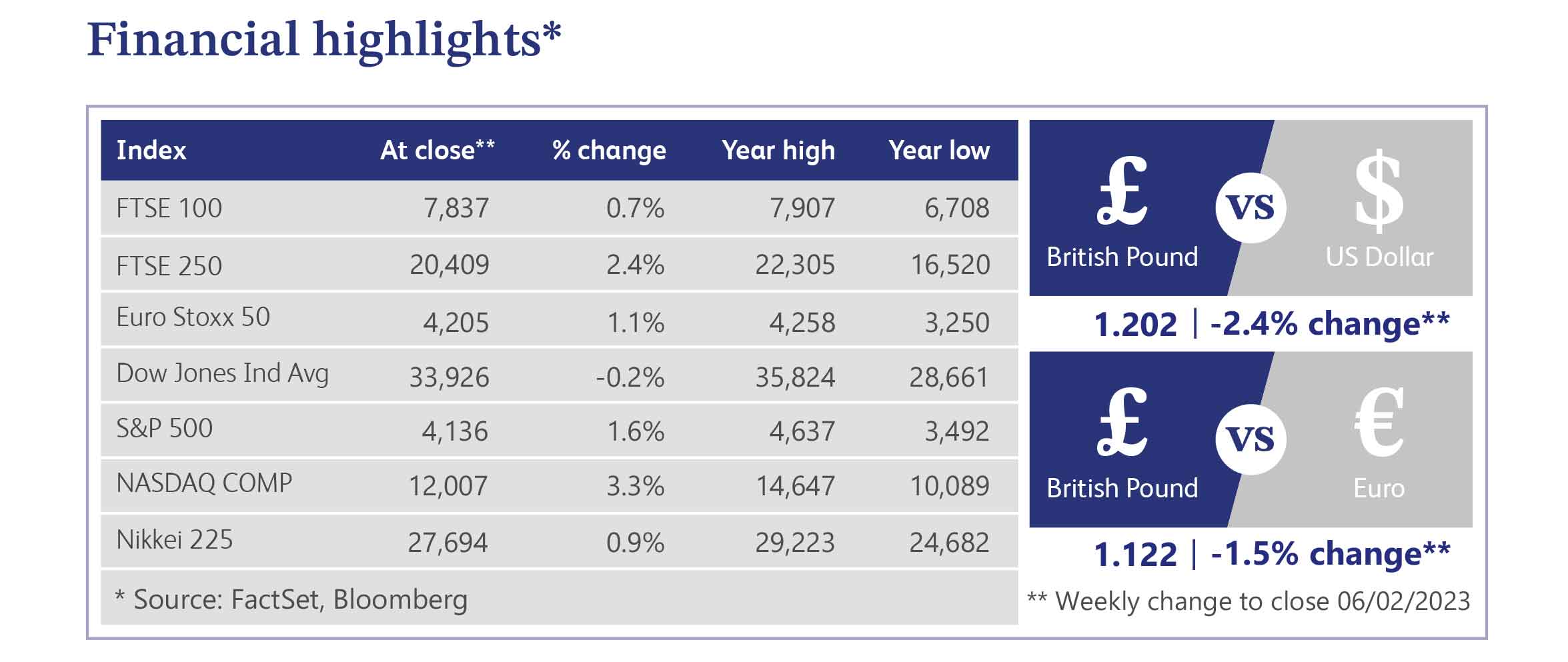

In the US at least, markets arguably place more significance on the post-meeting statement than the decision itself and as ever they hung on every syllable, desperately looking for a clue on the Fed's view of the likely path for inflation. Markets whipsawed with the bellwether S&P 500 Index falling as much as 1% at one point as it heard the messages that inflation "has eased somewhat but remains elevated" and there is a need for "ongoing (rate) increases". The index later rallied sharply to close around 1% higher following the post-statement press conference in which Fed Chair Powell uttered the five magic words "the disinflationary process has started".

Chairman Powell may have gone on to caveat that it would be "very premature" to declare victory over inflation, but the markets may not have been listening by this point as the word "disinflationary" was still ringing loudly in its ears. If markets chose to turn a blind eye to Chairman Powell's caveats, they could not ignore Friday's non-farm payrolls report, which confirmed that the US added 517,000 jobs in January - a staggering number compared to the 185,000 that had been expected by a consensus of Wall Street economists. The unemployment rate also fell to a 50-year low of 3.4% and to top it all off average earnings also increased. Friday's employment data poured cold water on the market's optimism over disinflation and swung the pendulum back toward the need for more rate hikes in order to try to loosen the tight labour market.

As for equity markets, a casual bystander could be forgiven for looking at a 6.3% increase in the price of the S&P 500 during the month of January and thinking that all is rosy in the garden. The reality is that weakening economic data is pointing to imminent recession on both sides of the pond. Whilst the Bank of England this week appeared to soften its projections, it still expects to see five full quarters of recession in the UK. Consensus earnings expectations for the S&P 500 as a whole for calendar year 2023 are now some 2.5% lower than they were just over a month ago on New Year's Eve, with nine of the market's eleven sectors seeing earnings expectations for the year being reined in. A combination of falling earnings expectations and increasing prices means the S&P 500's prospective price to earnings ratio has expanded to 18.4x from 16.7x at the turn of the calendar year. Equity markets are either turning a blind eye to what is staring them in the face, or they are looking ahead to what they hope are happier times in 2024 and beyond.

Apple - the largest US-listed company by market capitalisation at around $2.4tn - saw its shares fall 3% in post-market trading as the company missed consensus earnings expectations for its first quarter. Citing supply chain disruption in China and warning of a "challenging environment", the maker of the iPhone and iPad reported earnings per share of $1.88 versus expectations for $1.94 (and compared to $2.10 for the same quarter last year). Despite the miss in terms of quarterly earnings (driven primarily by lower sales of hardware) the company reported a 6.6% increase in its Apple Services division to $20.8bn from $19.5bn a year earlier. Apple now boasts over 935m paid subscriptions across more than 2bn active devices.

Despite reporting a record-breaking holiday season in the US, Amazon saw its shares fall 5% in after hours trading as its Q4 results revealed a year-on-year decline in revenues of 2% for its online stores. Even the highly profitable Amazon Web Services division failed to lift the spirits of investors as it grew year-on-year revenues by a relatively modest (by its own high standards) 20% versus year-on-year growth of 27.5% just one quarter earlier. In order to try to arrest the slide, the company has promised to keep pushing to "streamline" costs, notably announcing that it will make 18,000 redundancies as well as ordering a temporary freeze on hiring and a pause in warehouse expansion.

BT Group cited "extraordinary energy costs and other inflationary headwinds" as it reported a year-on-year fall in revenues of 1% to £15.6bn for the 9 months to 31 Dec 2022. At a time of rising interest rates, the company is facing a growing debt pile, which rose by £1.2bn from £18bn (net) at 31 March to £19.2bn (net) at 31 December. Despite seeing some benefit from higher gilt yields, the pension deficit is also still proving to be a drain on the company's cashflows. Add to this the regular capital investment needed to run the business on a day-to-day basis and not to mention the impact of strike action last year, which the company appears to have resolved for now. All in all, it is fair to say that BT has faced and continues to face challenges on many fronts.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.