21 February 2023

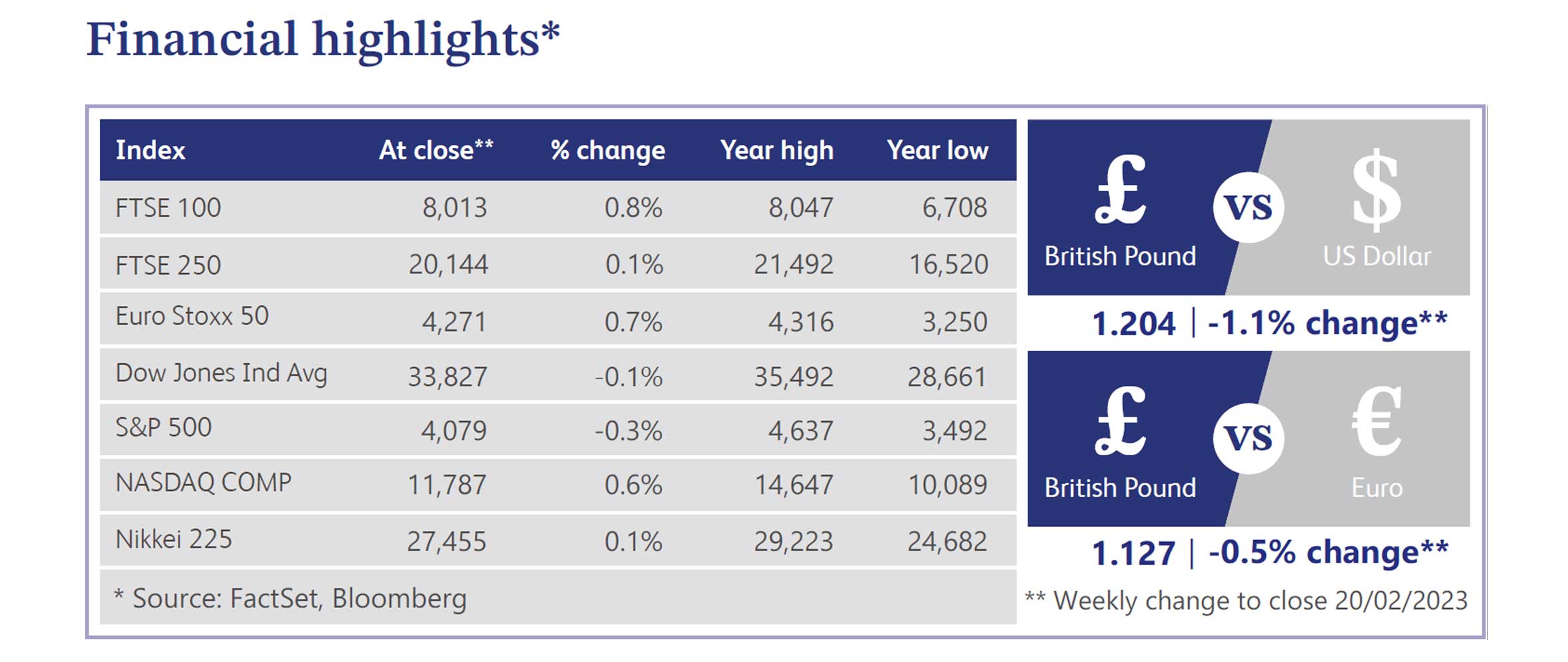

The UK’s FTSE 100 index broke through the 8,000 barrier for the first time last week, carrying on its momentum since the start of 2023. However, we should not lose sight of the fact that the FTSE 100 does not really represent the overall UK economy, as it is, of course, heavily weighted towards BP, Shell, mining stock and banks. All of which are benefiting from the reopening of China and likely resource demand that will come from that. To put it in perspective, the FTSE 100 stood at 6,335 on 30 January 2001 and its capital return over this period has been 26%. It is very welcoming to see the FTSE 100 at this level, however it is by no means a reflection of either the UK or global economy.

The UK’s Consumer Price Index ("CPI") fell for a third consecutive month in January to 10.1% due mainly to easing services and fuel costs. Core inflation eased to a much lower-than-forecast rate of 5.8%. The slowdown in inflation boosted hopes that the Bank of England might opt for a smaller interest rate hike in March or no rise at all. However, the jobs market remained tight in the three-month period between October and December 2022, with the unemployment rate remaining just off an all-time low at 3.7%. Pay rises, excluding bonuses, rose by 6.7% during the same period. This represents the fastest rate seen for more than twenty years.

Meanwhile, retail sales rose by 0.5% in January; the consensus estimate had anticipated a decline. Online sales, driven by holiday discounts, and falling average fuel prices boosted the monthly number. The annual measure, however, dropped 5.1%, declining for a tenth consecutive month.

In the US, the Labor Department reported that consumer prices rose 0.5% in January, as expected, versus a revised 0.1% increase in December. A “sticky” increase in shelter prices accounted for nearly half of the gain and compensated for another large drop in used car prices. On a year-over-year basis, the inflation rate came in at 6.4%, higher than expected but the slowest pace since October 2021. Annual core inflation was 5.6%, also slightly above expectations but its slowest pace since December 2021.

Bonds generated negative returns for the week as economic data seemed to confirm recent cautious comments from US Federal Reserve (“Fed”) officials that there was more work to do to tame inflation. As of the close of trading Friday, futures markets as tracked by CME Group began to price in an 18.1% probability that the Fed would hike rates by a half point (0.50%) at its March policy meeting, almost double the chance priced in the week before. The Fed slowed its rate increase increment to a quarter point (0.25%) at its meeting early in the month. The rhetoric from both sides of the Atlantic regarding inflation remains hawkish, however the reality might be softening.

British Gas owner Centrica's share price surged as it reported that its annual profits had more than tripled to a record £3.3 billion, driven by soaring wholesale gas prices in the wake of Russia’s invasion of Ukraine.

Barclays’ annual profits fell 14%, with provisions for debt impairments increasing as the economy worsened. The bank posted a pre-tax profit of £7 billion in 2022, down from £8.2 billion a year earlier and missing estimates of £7.2 billion.

Homeware retailer Dunelm Group backed its 2023 profit guidance and reported a drop in interim profits, as expected, pointing in part to inflationary pressures. In the 26 weeks to the end of December 2022, pre-tax profit fell 16.6% to £117.4 million.

Hargreaves Lansdown posted strong growth on both its top and bottom lines for the six-month period to 31 December 2022, despite the impact of "challenging" external conditions and “low investor confidence” impacting asset values and stockbroking volumes.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.