4 April 2023

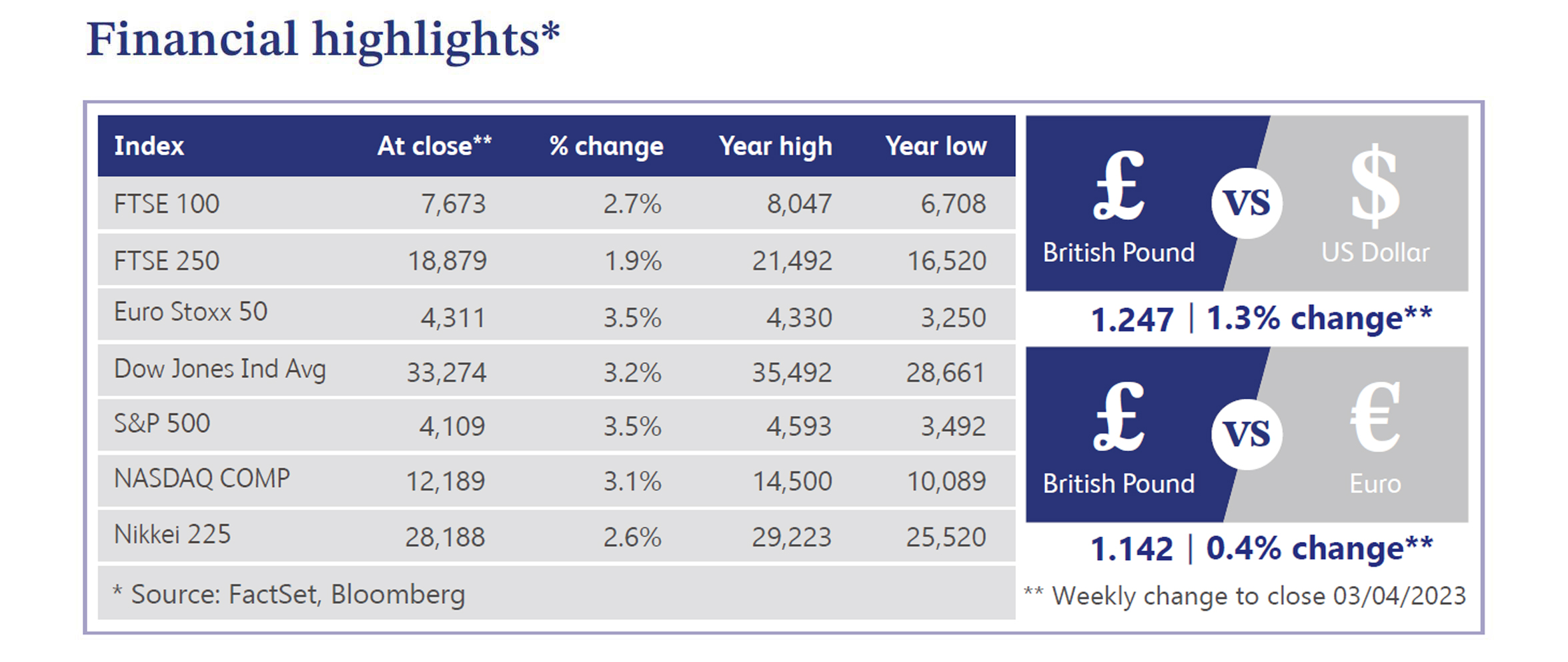

Last week, revised official data revealed that the UK avoided a recession last year, helped by the energy bill subsidies provided by the government to ease pressures on households from the cost of living crisis. Notably, UK GDP grew by 0.1% in the 4th quarter demonstrating the UK economy is still seeing some growth. However, there are signs the housing market remains weak as Nationwide said house prices fell in March at the fastest annual rate since the 2007-2008 financial crisis. Alongside this, Bank of England data demonstrated that there was a big drop in net mortgage lending in February. This was largely due to rising interest rates as a result of persistent high inflation, which is still weighing heavily on affordability for house buyers.

The Bank of England Governor, Andrew Bailey said in a speech last week that the central bank is still focused on taming inflation, despite the increasing pressures in the banking sector. The governor insisted that the UK banking sector remains in good health despite the “heightened tension” from the failures of SVB and Credit Suisse, which has led to global banking stocks declining. He added that UK lenders were resilient and will continue to be able to support the economy.

In other news, artificial intelligence (or “AI”) and ChatGPT have been making headlines again as Bloomberg released a paper detailing the development of BloombergGPT. Bloomberg is a leading financial data software company which delivers business and market news, data, analysis and video around the globe. This paper outlines the way that AI is likely to transform the finance industry and automate many tasks such as sentiment analysis, named entity recognition, news classification and Q&As. This could be a huge development in the financial industry and may be one of the catalysts in how financial roles are likely to change.

It is becoming more apparent that AI is going to transform the way the world operates and will impact many roles in a variety of ways. Markets are constantly learning more about how AI will be applied and it is one of the most talked about topics at present. This has led to numerous people, notably Elon Musk and Steve Wozniak among others, signing an open letter to immediately pause AI experiments for at least six months due to concerns around risks to society and humanity. This demonstrates the potential that AI might have and demonstrates that it is at the forefront of minds for firms and business leaders around the world.

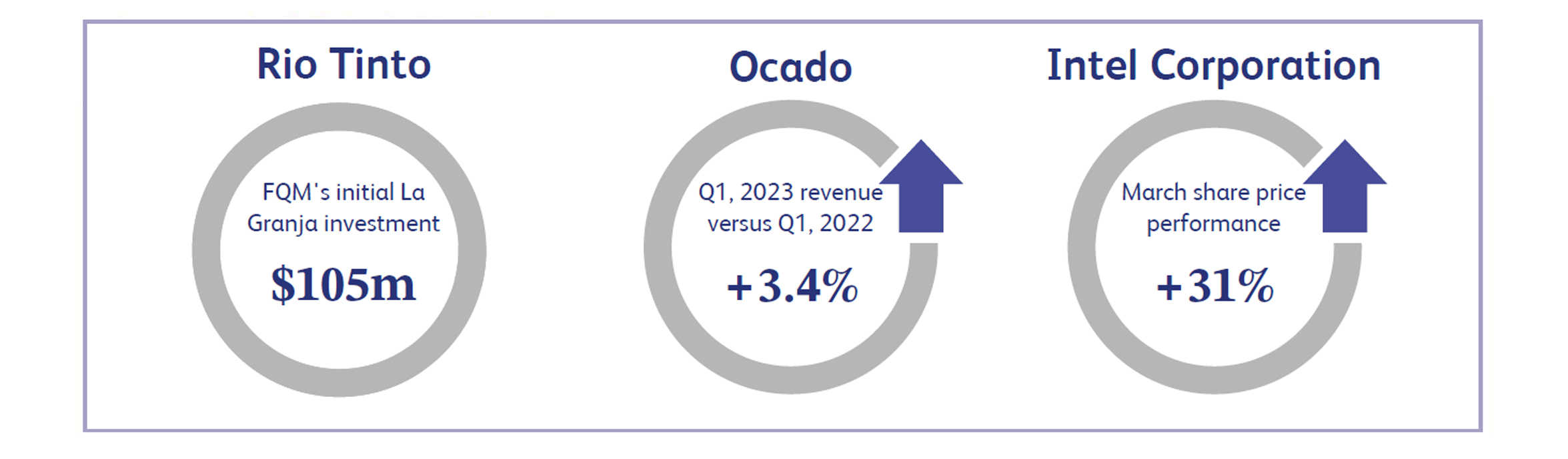

Rio Tinto announced that it has entered into a joint venture agreement with First Quantum Minerals for the La Granja copper project in Peru, one of the largest underdeveloped copper deposits in the world. First Quantum Minerals will acquire a 55% stake in the project for $105 million and commit to invest a further $546 million to sole fund capital and operational costs to take the project through a feasibility study and toward development. Rio Tinto acquired the La Granja project from the Government of Peru in 2006 but has detailed how complex the project is. The company believes this joint venture agreement will bring the necessary capabilities to unlock the full potential of La Granja.

Ocado shares surged after the company announced it expected its joint venture with M&S will return to profitability in 2023 alongside comprehensively winning the patent infringement suit brought by AutoStore at the UK High Court. AutoStore initially asserted six patents against Ocado, where two were invalidated by the European Patent Office before the judgement, AutoStore withdrew two patents before the start of the hearing, and the remaining two were invalidated by the judgement. The online grocer, which posted a pre-tax loss of £501 million in 2022, revealed that in the first quarter of 2023 it gained revenue of £584 million, up 3.4 per cent compared to the same period the previous year.

Intel Corporation shares rose last week to end March 31% higher; the company's best monthly share performance since 2001. At the company’s investor presentation on Wednesday last week, Intel executives announced that the company’s chips will be ready sooner than expected; news which was well received by the market. Some analysts are still not convinced that this will have a material impact on the outlook for Intel, but this news has built confidence that Intel is increasing its market competitiveness with Advanced Micro Devices, Inc., which has remained a very strong competitor in recent years.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.