9 May 2023

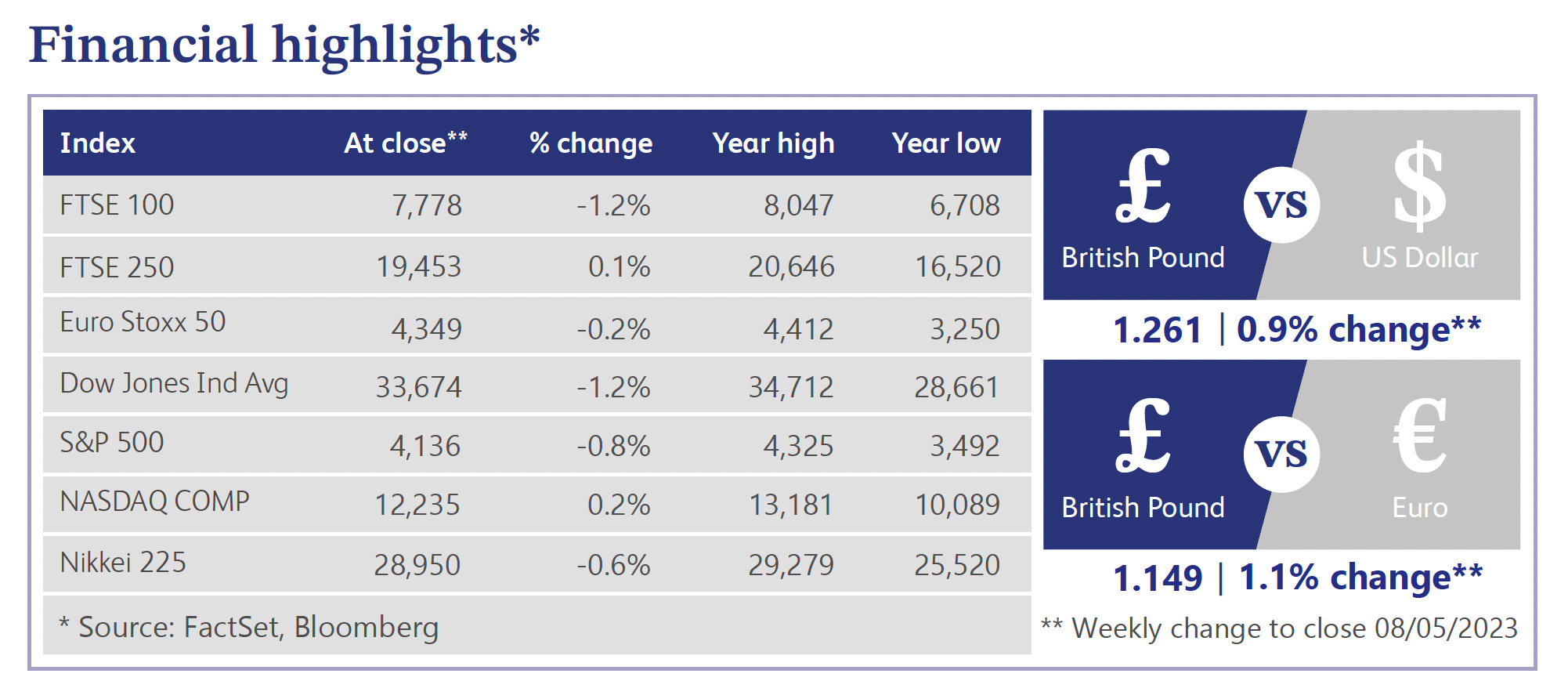

Interest rates remained a focus last week as the US and Europe raised rates by 0.25% each to 5.25% and 3.25% respectively. The S&P 500 closed down approximately 0.8% last week as comments from Federal Reserve Chair Jerome Powell suggested a pivot to cutting rates might not occur as quickly as markets had hoped. Language used in the meeting signalled to keep options open in terms of future interest rate decisions as a focus remains on incoming data and economic developments. There were also renewed concerns regarding the need to raise the US debt ceiling which impacted market sentiment. US Treasury Secretary Janet Yellen notified congressional leaders in a letter that the agency might not be able to meet its debt obligations potentially as early as June 1. Regional banking fears continued as multiple banking stocks plummeted such as PacWest Bancorp which saw a decline of approximately 43% for the week.

In Europe the decision by the European Central Bank (“ECB”) to raise interest rates by 0.25% led to a decline in European government bond yields, notably the yield on benchmark 10-year German government debt fell near one-month lows. This is a slowdown from the three increases of 0.5% we have experienced this year due to turmoil within the banking industry increasing the concerns of reducing the amount of credit to the economy. The ECB President Christine Lagarde expressed that reducing inflation to the 2% target remains the key focus and that interest rates would rise to sufficiently restrictive levels. Inflation in the eurozone accelerated in April to 7.0% year over year from 6.9% in March, leading to expectations that further rate rises by the ECB are necessary.

The UK interest rate decision will be announced on Thursday this week where markets expect the Bank of England (“BoE”) to raise rates by 0.25% to 4.50%. Last week saw signals of a stabilising housing market as mortgage approvals for home purchases in March rose for a second consecutive month. In February lenders approved 44,126 mortgages compared to a sharp uplift to 52,011 in March, which is also the largest number of approvals since October but still below their average of around 70,000 before last September’s mini-budget.

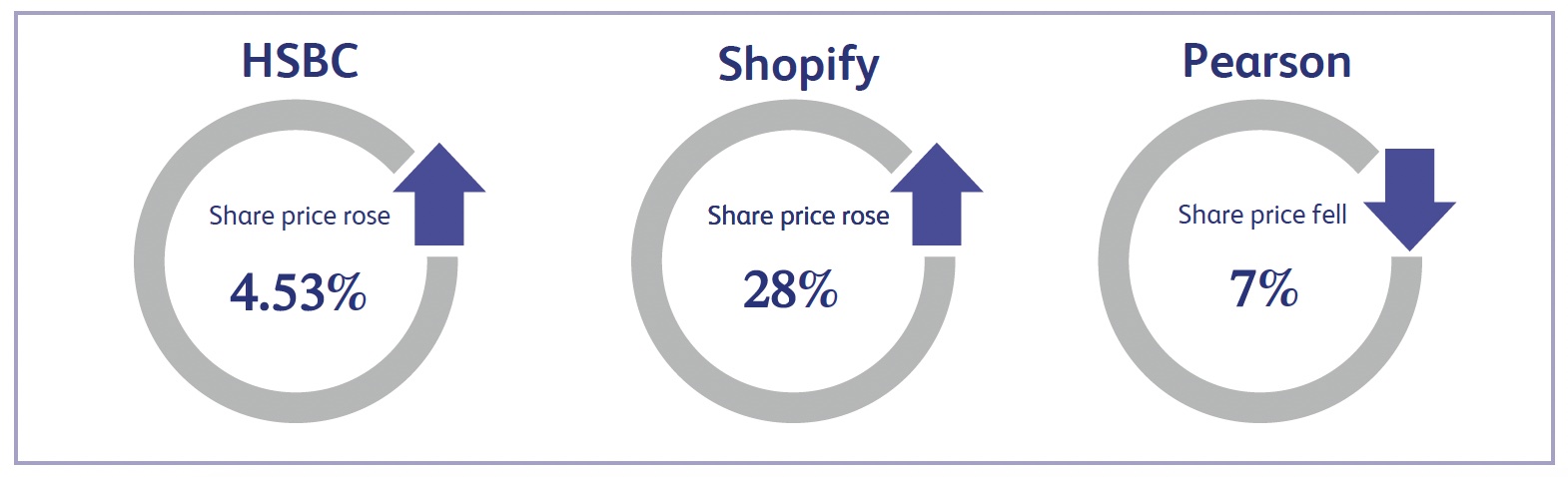

HSBC reported strong first quarter results this week and announced record profits as the bank benefited from the new era of higher interest rates and the rapid reopening of China. HSBC reported profit before tax of $12.9 billion, up $9 billion compared to the first quarter of 2022, an increase of approximately 230%. HSBC also saw revenue increase by 64% to $20.2 billion which was largely driven by higher net interest income in all of HSBC’s global businesses due to interest rate rises. The strong results enabled HSBC to announce its first quarterly dividend since 2019 of $0.10 per share, as well as a share buy-back of up to $2 billion. Management announced that HSBC expects to be able to have substantial future distribution capacity for dividends and share buy-backs. Markets responded positively to this announcement, sending the share price up by approximately 4.53% last week.

Shopify shares surged approximately 28% last week after earnings beat analyst expectations for the first quarter, alongside the announcement that Shopify will sell its logistics unit to Flexport and cut its workforce by 20% amid artificial intelligence (“AI”) advancements. During the first quarter Shopify revenue increased to $1.51 billion compared to $1.2 billion a year ago, beating expectations of $1.44 billion. Shopify launched a new AI shopping assistant on its Shop app, powered by OpenAI’s ChatGPT, which is expected to improve the simplicity of its products and services. Shopify’s management team explained that the new capabilities of AI are unprecedented and will help simplify their technology.

Pearson experienced a volatile week as the company’s shares closed the week down approximately 7% after a US competitor admitted that the rise of AI is impacting its business. US based Chegg reduced its full year guidance as management detailed that recently AI has been having an impact on Chegg’s new customer growth rate. This led to analysts significantly downgrading forecasts which sent the share price of Chegg plummeting. This announcement spread fears across the educational sector and led to a significant drop in value of Pearson on similar concerns. Pearson’s management team announced that Chegg is a fundamentally different company with a different business model and that Pearson is a highly diversified company with 80% profits coming from businesses outside higher education.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.