16 May 2023

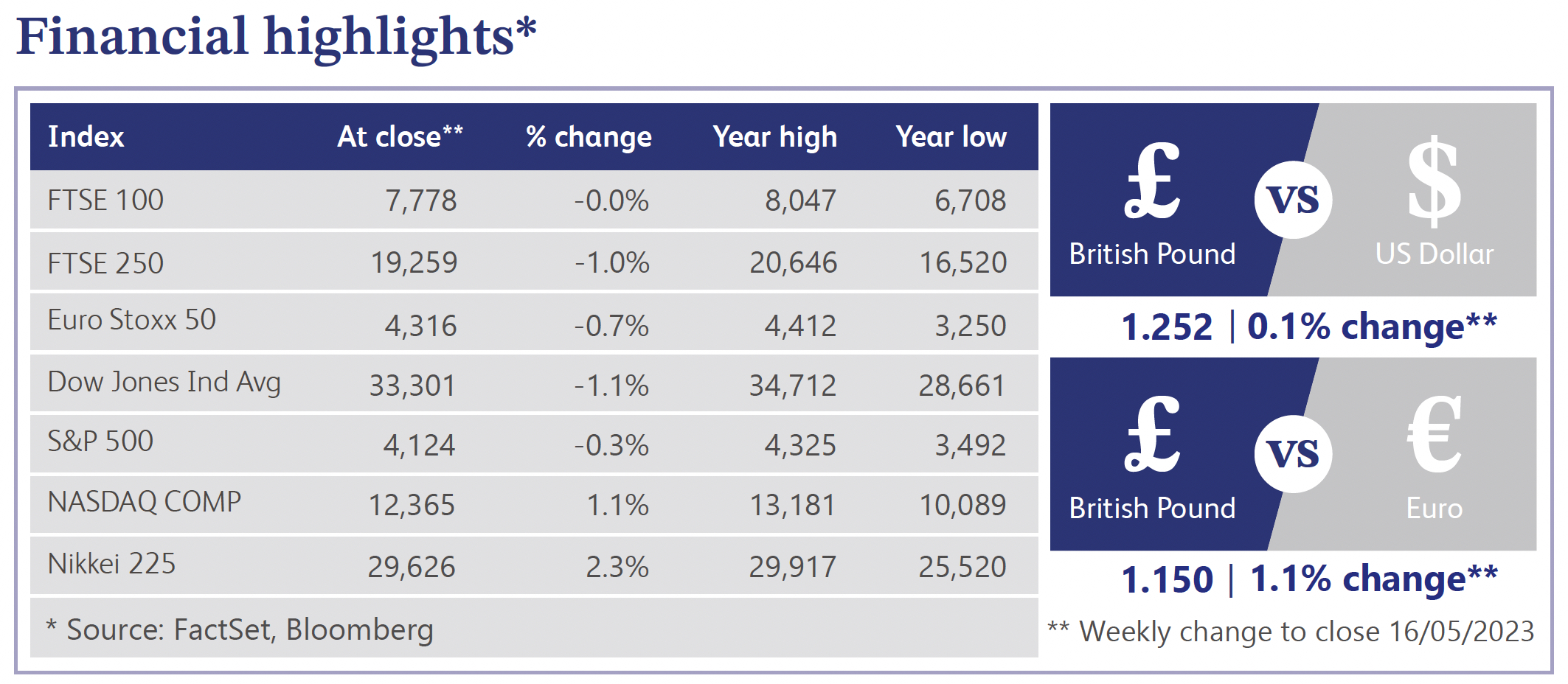

The Bank of England ("BoE") raised interest rates as expected last week by 0.25% to 4.50% as policymakers voted 7-2 to increase borrowing costs to the highest levels since 2008. This marked the twelfth consecutive hike by the BoE as sticky inflation has proven difficult to shift, forcing its hand to further raise rates. Banks are now pricing in a rise to 4.75% this year but many economists believe that it will peak at 4.50%. The persistence and strength of food price increases led the central bank to admit to underestimating the persistent high inflation and has resulted in it raising its inflation forecast. The updated projections see inflation slowing to 5.1% by the year-end compared to previous forecasts of 3.9% in February. The BoE also revised forecasts for economic growth with an expectation of zero growth in the second quarter compared to a 0.7% contraction.

News in the US was largely dominated by ongoing negotiations regarding the debt ceiling crisis. The US breached its debt ceiling in January 2023 and the Treasury Department has been using extraordinary measures to provide the government with more cash while it figures out what to do. The cap currently stands at roughly $31.4 trillion and the breach of this level has spread fears of a potential default by the US. Usually Congress raises the limit but it appears terms cannot be agreed at present this time around. The views of Republicans and Democrats differ quite significantly when it comes to debt. Republicans have a sceptical view towards debt and see rising national debt as evidence of an out-of-control government. Whereas Democrats view national government power as a force for good and see raising the debt limit when needed as necessary housekeeping to maintain the operation of the government.

If the debt ceiling is not raised then the outcome is not entirely clear as these are unprecedented circumstances. However, if it led to the US defaulting, it would likely lead to major economic damage. The last time the US was seen at a serious risk of default was in 2011. Talks went down to the wire before a compromise deal was reached which included $900 billion in spending cuts over 10 years. There appears to be several different options available in order to raise the debt ceiling, but it looks likely that negotiations may go down to the wire again. Therefore the probability of a default appears to be low at present as negotiations continue in order to achieve a suitable compromise.

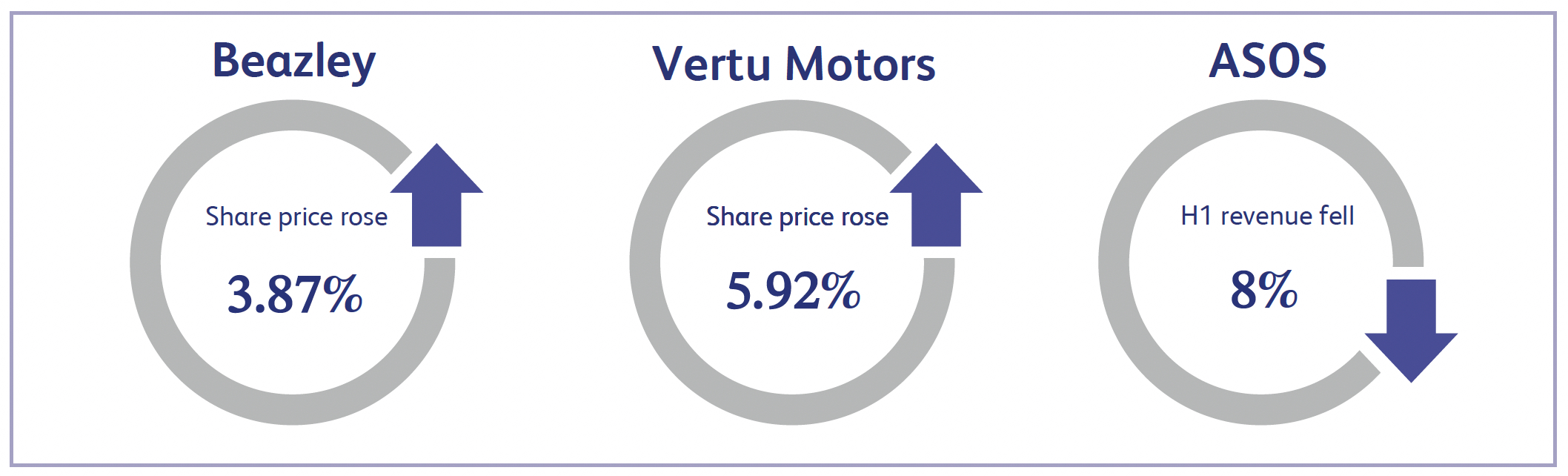

Beazley is a UK-based global specialist risk insurance and reinsurance company. Last week the company issued a trading statement announcing its net income at $104 million for the quarter ended 31 March 2023, marking a recovery from a loss of $92 million in the prior-year period. Management also remained confident in its growth guidance of mid teens gross premium written and mid 20s net premium written for 2023 full year. The positive trading statement resulted in Beazley’s share price rising approximately 3.87% for the week.

Vertu Motors is a UK automotive retailer with a network of 189 sales and after sales outlets. Last week the company announced its final results for the year ended 28 February 2023 which saw its share price close the week up approximately 5.92%. This year was an important one for Vertu as it undertook its largest ever acquisition which allowed it to generate over £4 billion of revenue for the first time. The results demonstrated lower profit before tax of £39.2 million compared to last year and good free cash flow levels of £54.3 million, which will allow the company to reduce its net debt levels. The company also maintained a positive growth outlook as it continues to fully integrate its strategic acquisitions.

ASOS is a British online fashion and cosmetic retailer which was founded in 2000. The company last week issued interim results which sent the share price plummeting as it closed down approximately 27.53% for the week. ASOS announced that revenue for the first half of the year was down 8% to £1.84 billion, missing expectations of £1.94 billion. The company also reported a deeper than expected adjusted loss before tax of £87.4 million alongside reduced free cash flow expectations. ASOS also stated that in a plausible downside scenario the group may need to raise further cash. The announced results largely missed analyst expectations, which resulted in the significant decline in the share price.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.