23 May 2023

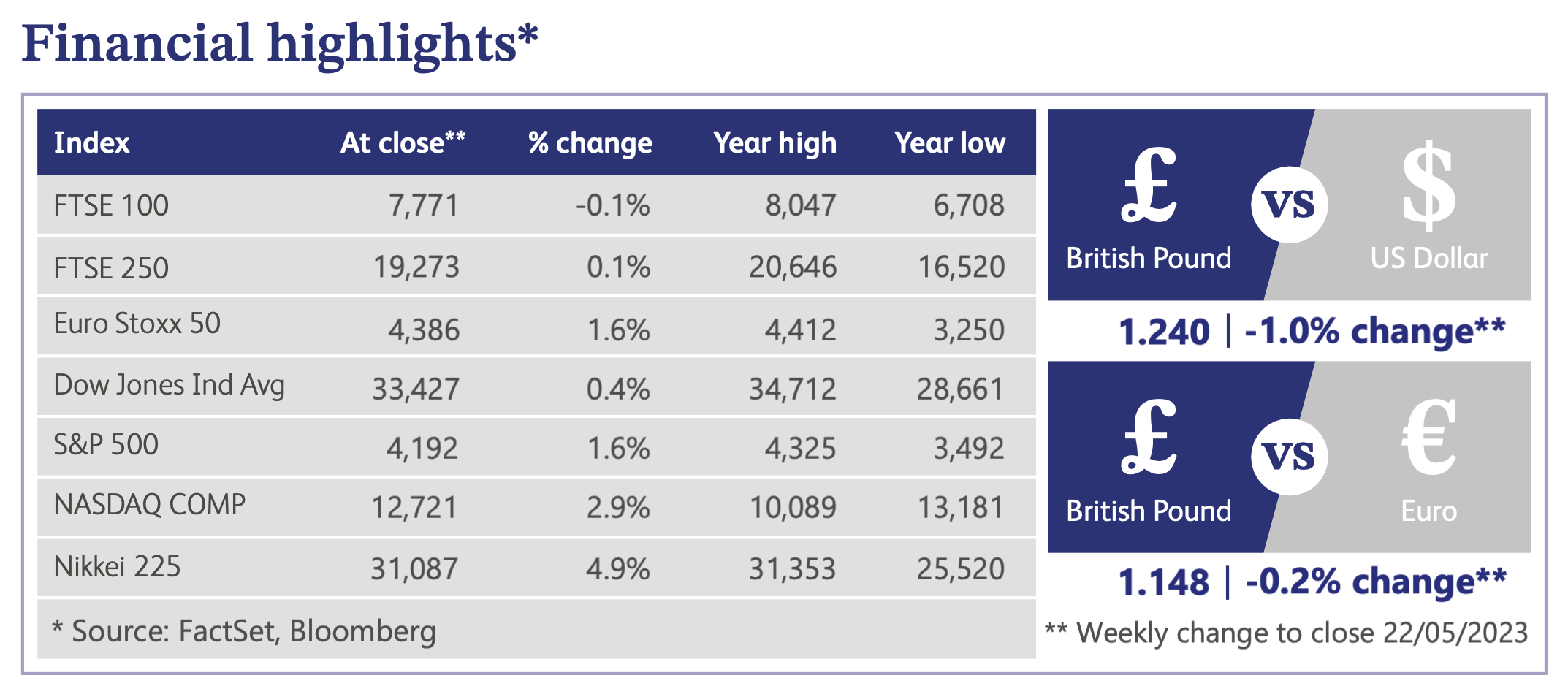

The UK markets ended flat last week as the FTSE 100 closed approximately -0.1% lower at 7,771. In terms of economic data, the Office of National Statistics (“ONS”) reported figures that showed signs of easing within the labour market. The April claimant count jumped 46,700 versus consensus of a 15,000 drop, with the prior figure of a 26,500 increase which was revised down from 28,200. The ONS also highlighted an estimate for payrolled employees which showed a fall of 136,000 which is likely to be revised when more data is received next month. This would be the first drop in total payrolled employees since February 2021. As a result, the UK unemployment rate increased slightly to 3.9% in the three months through March, from 3.8% in the three months through February. As the demand for the labour market appears to be easing, it should be noted that wage growth is still holding up. Average earnings excluding bonuses accelerated to 6.7% which was slightly below the consensus of 6.8%, but higher versus the prior figure of 6.6%. Wages growth including bonuses remained steady at 5.8% which was in line with forecasts.

UK labour market figures also showed a record number of people not working due to long-term sickness, which now stands at more than 2.5 million people. However, the number of vacancies fell for the tenth quarter as companies continue to hold back on hiring due to economic uncertainty. Despite this, there was a fall in the rate of inactivity of 0.4% which was due to more students entering the workforce, but the overall level remains elevated and the number of people aged 16-64 not part of the workforce is still higher than pre-Covid levels.

It was also said that the UK’s era of huge property price increases may be coming to an end as population growth slows and working from home becomes increasingly popular. This is supported by the fact borrowing costs are expected to stay higher for longer which will make explosive house price growth less likely. The Bank of England says interest rate rises are still working through the economy as we have seen higher rates quoted on new mortgages, but the effective rate on the whole stock of mortgages is still adjusting towards a higher reference rate.

In the US, the focus remains on ongoing debt ceiling negotiations as Treasury Secretary Janet Yellen reiterated that the US will likely default on its debt as early as 1st June if no deal is reached. Republicans have been demanding spending cuts of more than $4 trillion in order to raise the debt ceiling but Democrats refused this and are instead offering to keep spending flat. It still appears that both sides will be able to broker a deal, but it remains unclear how quickly they will be able to reach a compromise.

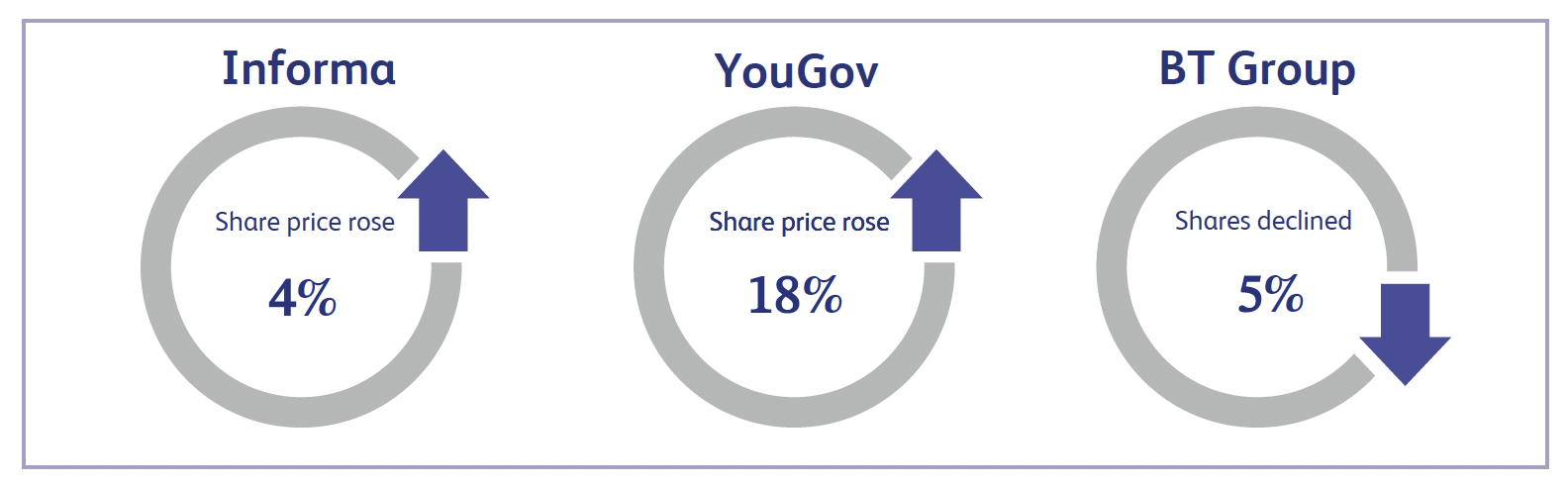

Informa shares increased approximately 4% last week as it was announced the company had reached an agreement to acquire Winsight for $380 million and that its acquisition of Tarsus completed ahead of schedule. The acquisition of Winsight is expected to accelerate Informa’s growth by offering expansion within the business-to-business foodservice market. Informa’s acquisition is also expected to deliver strong financial returns with earnings accretion from the outset and a post-tax return ahead of Informa’s long-term weighted average cost of capital in the first full year of ownership. The deal has been fully funded by in-year cash flow growth and Informa’s balance sheet, with the expectation to further grow revenues, margins, earnings and cash flow.

YouGov shares surged approximately 18% last week as management presented its third long-term strategic growth plan. The new strategic plan intends to combine all of YouGov’s capabilities in a unified way, providing a differentiated offering in order to win over competition. YouGov intends to do this by building a new platform that has the potential to increase the company’s margins over time as clients do more self-service, alongside opening the door to a new go-to-market strategy to cater for lower-touch clients. The market responded positively to YouGov’s third strategic growth plan and saw Numis upgrade the company to a ‘Buy.’

BT Group announced its full year 2023 results last week as the company announced it will stop disclosing key performance indicators in the first and third quarter for simplification purposes. BT also announced it expects a reduction of up to 42% in the number of internal and external workers by 2030 as it looks to focus on digitisation and integrating artificial intelligence. Overall the announcement was viewed relatively negatively by the market as shares declined approximately 5% for the week.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.