30 May 2023

Last week saw UK inflation figures surprise on the upside with the April headline number easing to 8.7% from the prior 10.1%. This was well above the 8.2% consensus and the Bank of England’s (“BoE”) own estimate of 8.4%. Inflation figures have positively exceeded forecasts for three consecutive months as monetary policy continues to work its way through the economy. Notably the core rate of inflation accelerated to 6.8%, which is the highest level since March 1992. This came in higher than both consensus estimates of 6.2% and the previous reading in March - also at 6.2%. The breakdown showed the deceleration in the headline was due to a 1.4% fall in electricity and gas prices as last April's rise dropped out of annual inflation. However, food and non-alcoholic beverage prices continued to rise at a very rapid 19.1%, only marginally down on the 19.2% record in March.

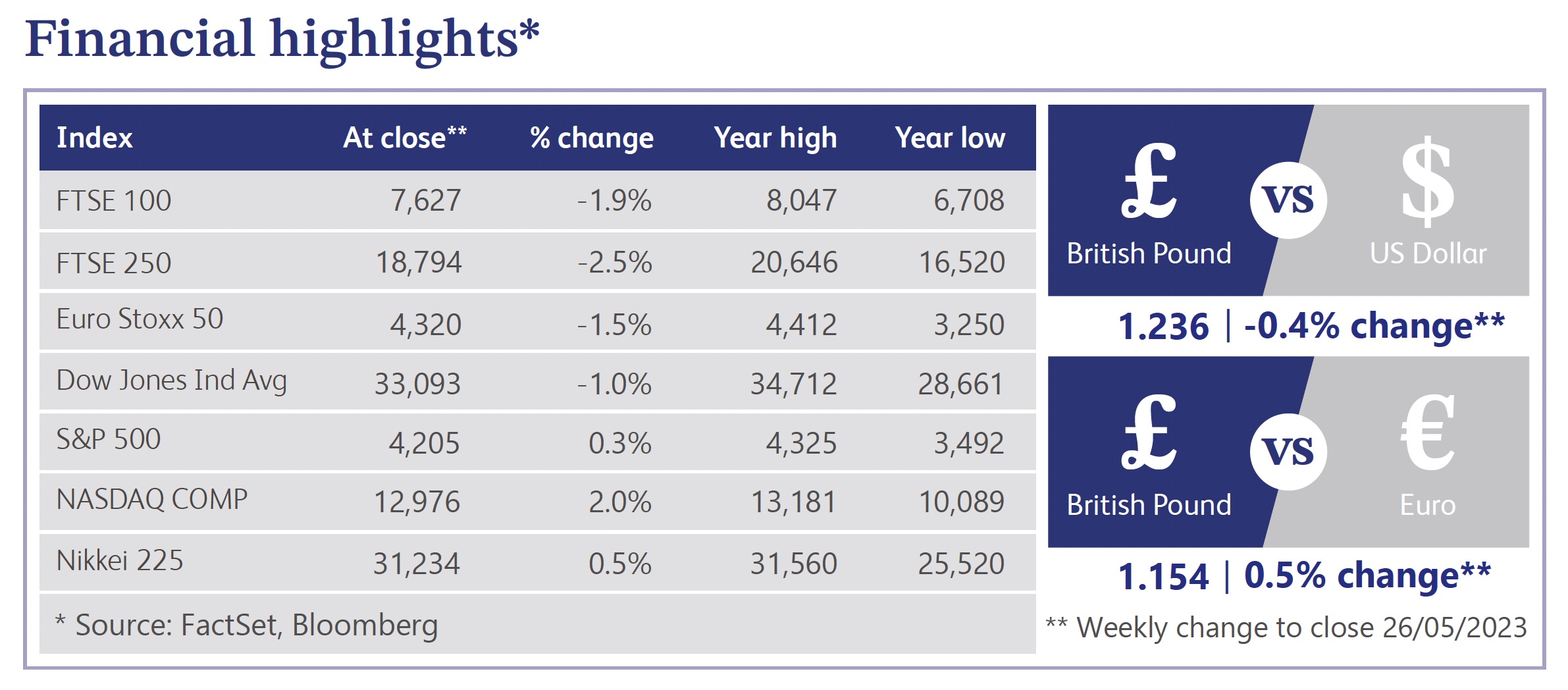

The lingering persistent high inflation caused increased volatility in the UK rates market due to a steepening in rate hike bets. Overnight interest rate swaps were pricing in a terminal rate close to 5.5%. The market has now fully priced in a 0.25% rate hike in June and anticipates a further two 0.25% rate increases in the summer, alongside the possibility of one or two further rate rises thereafter. The BoE has been criticised for underestimating the extent of inflationary pressure, but there are still some signs of optimism. Producer prices are coming down, with April input prices up 3.9% versus 7.3% in the previous month, while output prices rose 5.4% versus March’s 8.5% reading. There are also tentative signs that food prices may have peaked. For instance, the widely followed Kantar food price data showed that like-for-like grocery price inflation fell for the second consecutive month in May to 17.2%, though still at elevated levels. There are also some signs that tightness within the labour market may be easing with job vacancies declining and wage growth largely stable.

In the US, President Biden and House Speaker McCarthy reached an in-principle agreement to extend the debt ceiling until 2025 and cap discretionary spending for two years. The financial elements of the deal show non-defence discretionary spending will be roughly flat next year and rise by 1% in 2025. Spending on defence and veterans will rise by approximately 3%, in line with Biden’s budget request. Roughly $29 billion in unspent Covid aid funding will be rescinded and $20 billion cut from Internal Revenue Service (“IRS”) funding for enhanced tax enforcement. Lawmakers have been given one week to pass the debt ceiling legislation as Treasury Secretary Yellen set a new default deadline of 5th June. White House and Republican leaders are now racing to build Congressional support for the legislation. However, Biden and McCarthy are confident there are enough votes to pass the bill. McCarthy said he expects a full House vote on Wednesday after giving Republicans 72-hours to review the deal. Assuming passage, the bill heads to the senate where 60 votes are required to end debate and advance the bill to a vote.

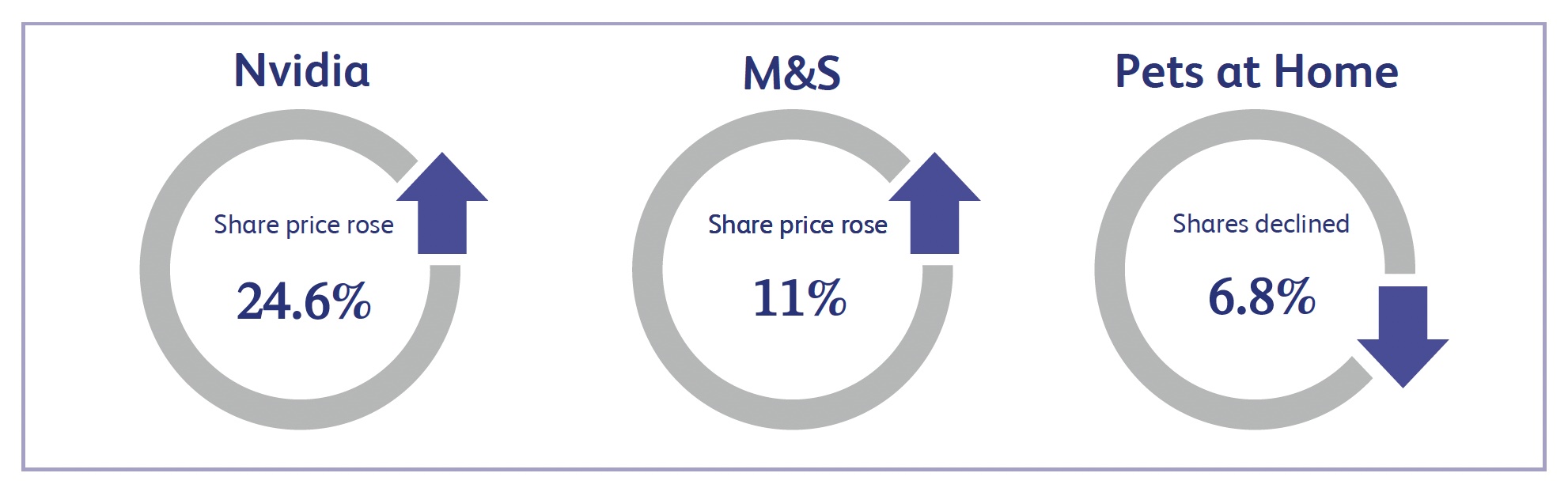

Nvidia, the American multinational technology company, announced first quarter results last week which beat expectations and sent the share price soaring approximately 24.6% last week. Nvidia issued guidance for substantial sequential revenue growth in the second quarter as demand for content-creating artificial intelligence bolsters its data centre platform. The company said that revenue has been largely flat at $11 billion, plus or minus 2%, for the July quarter. The consensus among analysts was for revenue of $7.13 billion before the outlook was given, and later raised to $11.09 billion. In the first quarter, revenue declined 13% year over year to $7.19 billion, but surpassed expectations for $6.52 billion. Generative artificial intelligence drove significant upside for Nvidia’s products, and has created significant opportunities for broad-based global growth which provides an exciting outlook for the company.

Marks and Spencer (“M&S”), a major British multinational retailer, announced full-year earnings on Wednesday last week which saw its share price soar approximately 11.1% for the week. M&S announced that profit for the 2023 fiscal year increased to £363.4 million compared to £306.6 million a year ago. Revenue also grew to £11.93 billion compared to £10.89 billion last year. The company is expecting modest growth in revenue throughout 2024 and also plans to restore its dividend during the fiscal year.

Pets at Home, a British pet supplies retailer, announced its full year preliminary results last week. The company announced that profit for the year decreased to £100.7 million compared to £124.5 million a year ago. Revenue did however increase to £1.4 billion compared with £1.32 billion a year ago. The company also announced it expects revenue to grow 7% in line with its medium target. The share price declined approximately 6.8% last week.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.