29 August 2023

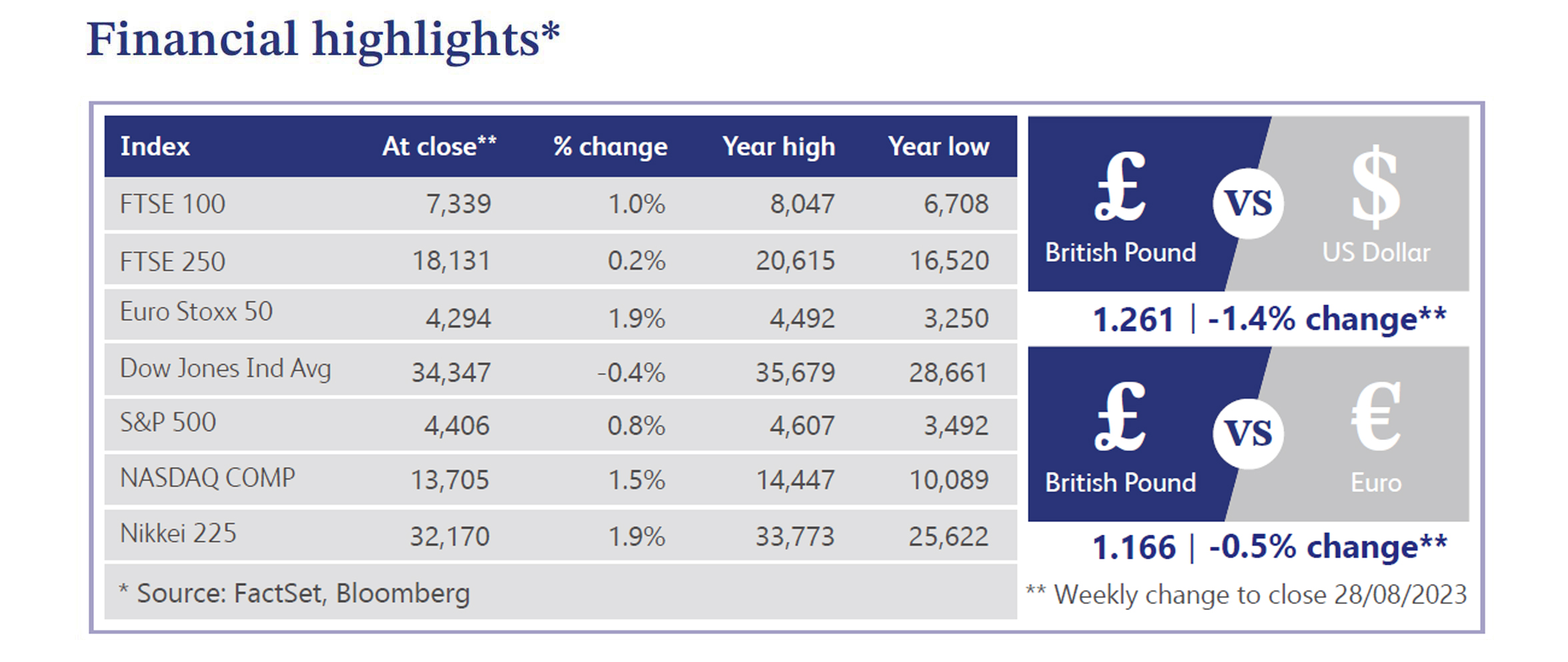

The UK market experienced a relatively quiet week last week as the FTSE 100 closed approximately 1% higher at 7,339. Inflation and interest rates continue to be the main influencing factors at present with the market continuing to forecast UK interest rates peaking at 6%. The Times reported on the most recent Office for National Statistics (“ONS”) inflation data published last week which suggested that inflation may be easing quicker than initially expected. The ONS calculations showed that core inflation fell to 6.8% in July from 6.9% in June and from a peak of 7.3% in May, compared with original data for July showing that core inflation had held steady at 6.9%. This update is a welcome development; however, services inflation is at multi-decade highs of 7.4% and wages continue to be at record levels, meaning that the updated ONS figures are unlikely to shift near term market or Bank of England (“BOE”) expectations. A Reuters poll of economists also showed that 61 of the 62 economists surveyed expect a 0.25% rate hike in September with a narrow majority thinking that this will be the end of the rate tightening cycle. Out of the 62 economists surveyed, 27 still said that rates could peak at 5.75% and two said 6%, with underlying inflation remaining too high and elevated wage growth continuing to be the most challenging aspect of BOE policy making.

The UK housing market was also in the news this week as figures from the government Insolvency Service prompted a Financial Times article that showed approximately 4,280 construction firms have gone out of business in the 12 months to June, 16.5% more than the same period in the previous year. Persistent cost pressures due to an increase in the price of raw materials and high labour costs have been a headwind, alongside a slowdown in housebuilding amid higher interest rates. The number of failures is now the highest since 2012 which is when the construction industry was still recovering from the after effects of the global financial crisis. Reuters also reported the announcement of the UK competition regulator that it is set to launch a new enquiry into the amount of land controlled by the top homebuilders. This announcement is after a six-month study in response to concerns major homebuilders were not delivering homes at an adequate pace or scale. Critics of the housebuilding sector have accused firms of sitting on land, where they limit the amount of housebuilding in order to keep prices elevated. The regulator highlighted that it cannot alone resolve the problems within the sector, but it can make recommendations to the government for legislative changes. This review comes at a time when homebuilders are already under pressure as a result of the slowdown in demand due to higher rates which has led to several firms reducing building targets and profit forecasts.

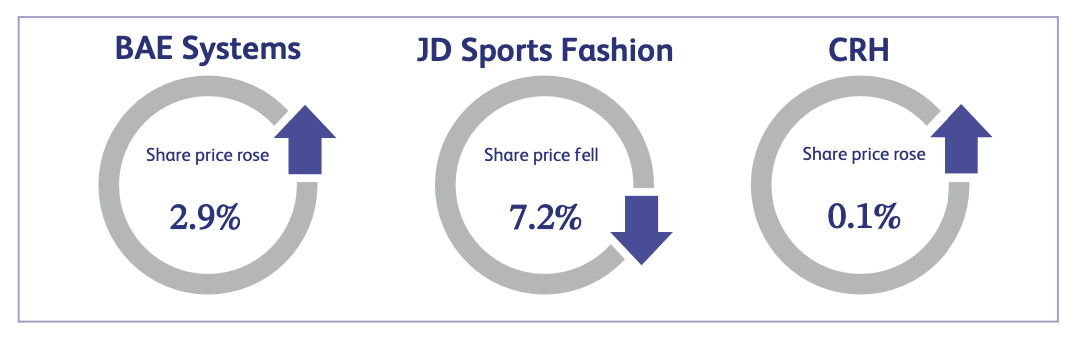

BAE Systems, the defence, aerospace and security company, announced last week that it has been awarded a contract modification exceeding $190 million for the continued production of its Bradley A4 for the British Army. The contract includes more than 70 M2A4 Infantry Fighting Vehicles and the M7A4 Fire Support Team Vehicles. The Bradley is a crucial vehicle for the Armoured Brigade Combat teams as it allows the Army to transport troops to the fight while providing cover fire to suppress enemy vehicles and troops. The shares climbed approximately 2.9% last week.

JD Sports Fashion, the UK based multichannel retailer of sports, fashion and outdoor brands, saw its share price decline approximately 7.2% last week. This was as a result of Dick’s Sporting Goods, an omnichannel sporting goods retailer based in the US, announcing its earnings for the second quarter of 2023. Dick’s revenue increased by 3.6% against the same period in the previous year, however the company’s earnings per share declined 23% as well as issuing a profits warning. This led to fears that JD’s results may lead to a similar theme for its US business and therefore investors sent the share price tumbling.

CRH, the Ireland-based company, which operates a building materials business in both North America and Europe, announced its first half results last week which saw its share price remain relatively flat, increasing approximately 0.1%. The company announced revenue of $16.14 billion, slightly beating consensus expectations of $16.09 billion. The results were largely positive and beat analyst expectations alongside demonstrating strong cash generation supporting the company’s balance sheet.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.