12 September 2023

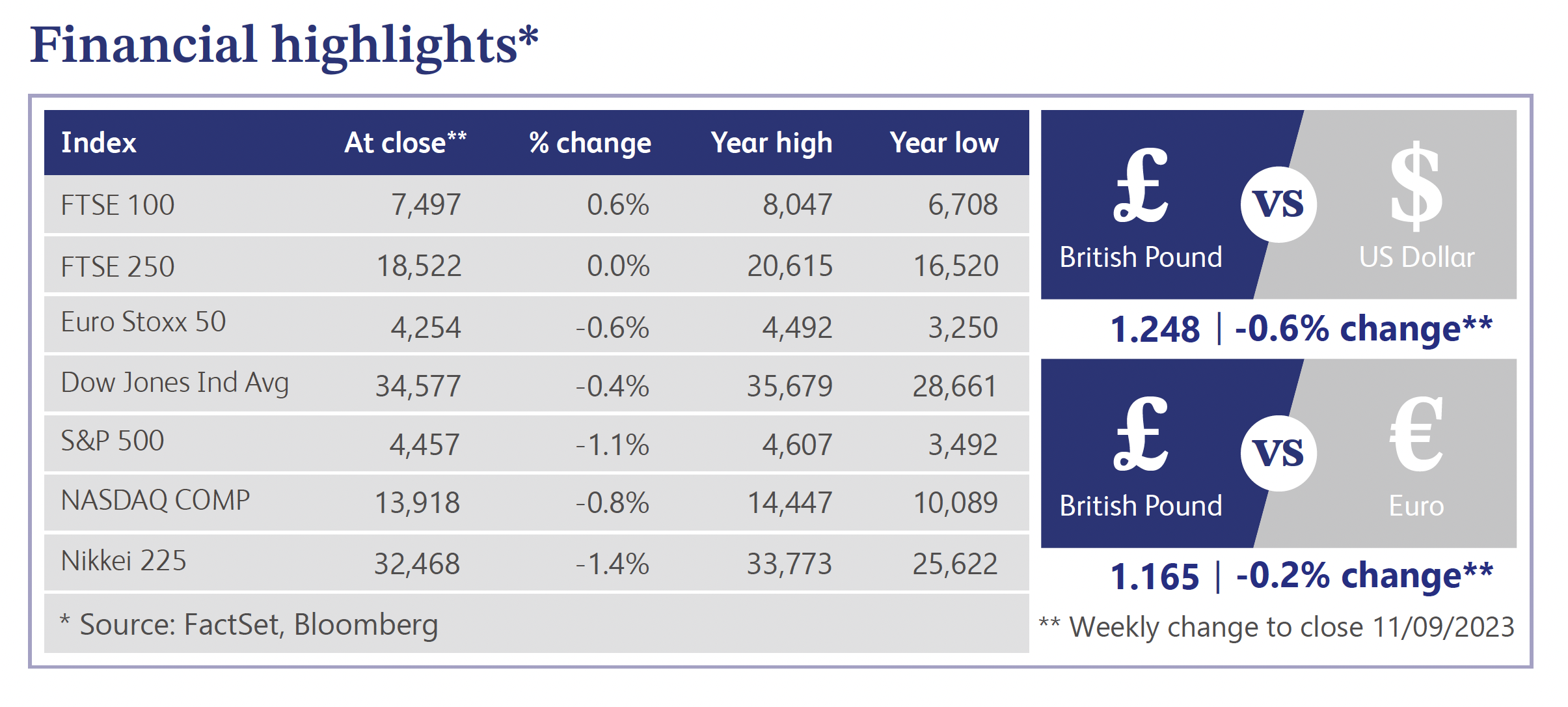

The British Chamber of Commerce ("BCC") published updated economic outlook figures last week which highlighted an expectation that the UK economy will avoid a technical recession. However, growth is set to remain weak. Figures state that the UK is expected to have a growth rate of 0.4% for the whole of 2023, dropping to 0.3% in 2024 and rising to 0.7% in 2025. The BCC also revised inflation figures upwards for 2024 to 3% against a previous forecast of 1.5%. This shows that the BCC expects inflation to remain higher for longer, largely as a result of a resilient labour market. The report suggests that although the UK economy will avoid a recession, it will likely feel like one for a lot of households and businesses due to the low growth levels within the economy.

Markets are currently pricing in a peak interest rate of 5.75% which has reinforced expectations that the Bank of England (“BoE”) is close to the end of its tightening cycle. Monetary tightening has a delayed impact on markets and therefore figures have only recently started showing signs that the aggressive tightening by the BoE is starting to have an impact. For example, Wilko, the family-owned UK retailer, recently announced it has collapsed into administration as a result of the difficult economic environment. The Centre for Economics and Business Research also published research last week stating that Britain is likely to witness 7,000 business insolvencies per quarter in 2024 as high interest rates will continue to put financial pressures on companies. This is based on the expectation that the BoE will be required to keep rates higher for longer in order to bring inflation nearer to its 2% target. The Chancellor of the Exchequer, Jeremy Hunt, also stated that UK inflation is on track to halve to approximately 5% by the end of 2023 but will remain high over the medium term, emphasising the expectation that the BoE will need to keep rates higher for longer.

In terms of the financial markets, UK investors accelerated their sell-off in equities and also sold bonds in August, according to data published by Calastone, the largest global funds network. August experienced approximately £1 billion of outflows in equities which was the highest level since September 2022 and the seventh worst month on Calastone’s nine years of records. Equity funds focused on the UK experienced the hardest hit, with redemptions of £811 million, the highest since February. The report also stated that August was the 27th consecutive month in which investors have withdrawn capital from UK-centric equity funds. Fixed income funds also experienced outflows for the first time since June 2022 as investors instead favoured money market funds which experienced near record inflows.

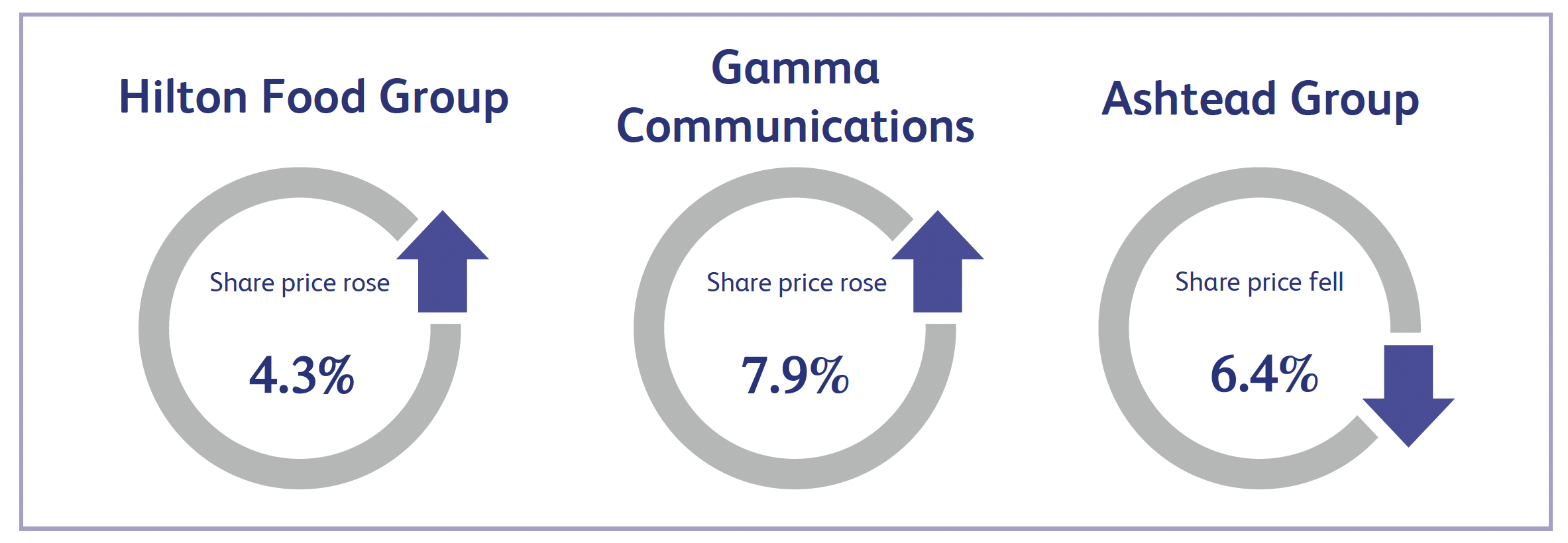

Hilton Food Group, the UK based specialist international food packing business, saw its share price increase by approximately 4.3% last week after announcing its first half results. The company announced revenue of approximately £2.1 billion which was 5% higher than the previous year, alongside adjusted earnings before interest, taxes, depreciation, and amortisation (“EBITDA”) increasing to £67.5 million from £66.6 million a year ago. These figures largely met analyst expectations, but it was also noted that the company has delivered a robust operational performance in a challenging market which led to more positive sentiment.

Gamma Communications, who provide business-to-business ("B2B") communications in the UK and mainland Europe, saw a surge in its share price of approximately 7.9% last week after announcing its first half results. The company reported a revenue increase of 9% to £256.2 million from £234.7 million a year ago, as well as adjusted profit before tax increasing 12% to £48.3 million and adjusted EBITDA increasing 9% to £56.5 million. The results demonstrated healthy performance for the first half of the year and suggests that growth is expected to continue into the second half of the year with adjusted EBITDA and adjusted earnings per share now anticipated to be in the top range of market expectations.

Last week, Ashtead Group, a UK based international equipment rental company, announced its first quarter results which beat expectations as revenue was reported at $2.7 billion against a consensus estimate of $2.58 billion alongside EBITDA of $1.23 billion against a consensus estimate of $1.19 billion. Despite results surpassing expectations, the company’s share price declined by approximately 6.4%. The company is cyclical by nature which brings its own risk, especially in an environment of weakening demand, and the negative share price response is a sign of wider market weakness.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.