19 September 2023

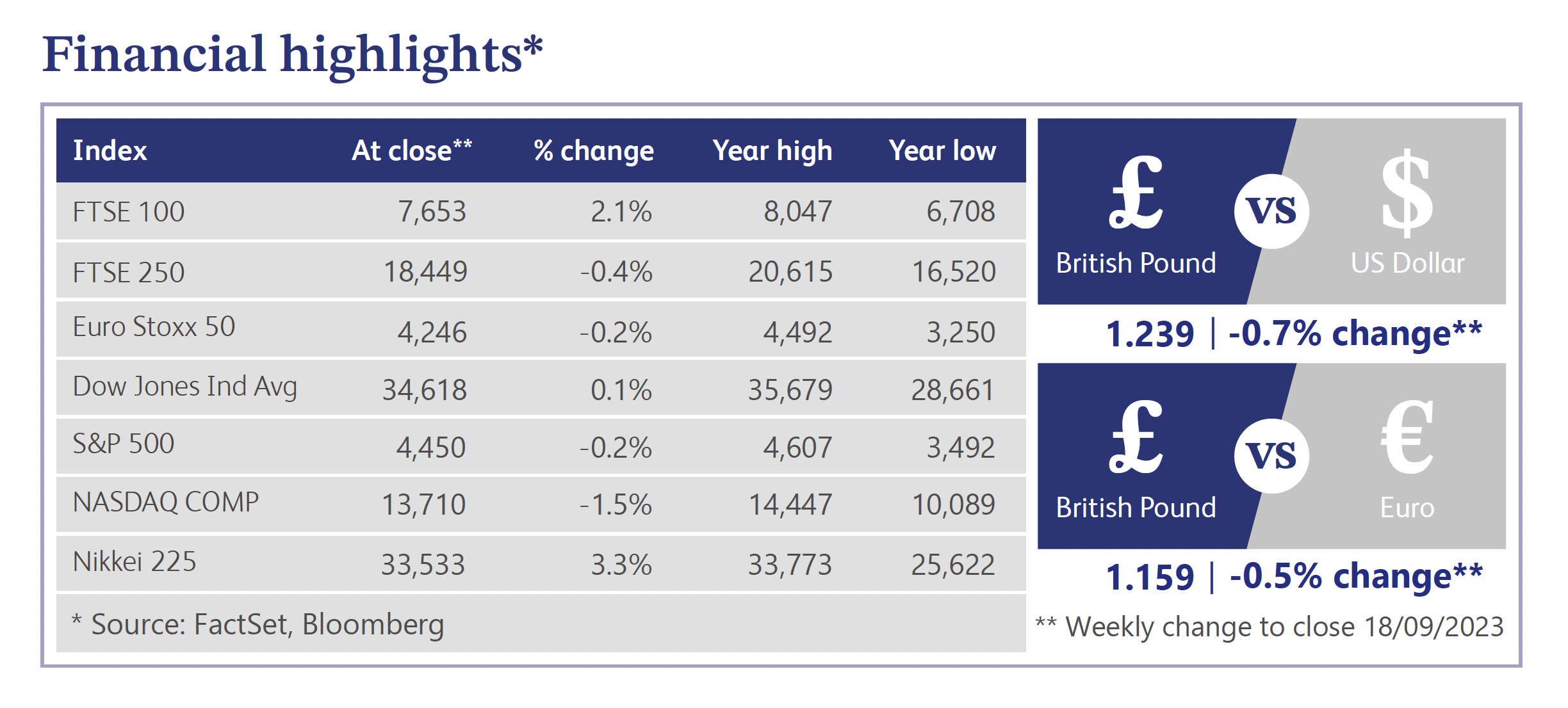

Last week saw UK equity markets in positive territory as the FTSE 100 closed the week 2.1% higher as markets continue to anticipate that the Bank of England (“BoE”) is approaching the end of its rate tightening cycle. An article published by Bloomberg discussed recent rhetoric from BoE policymakers and noticed that there is a change in tone alongside more clarity on the debate facing the Monetary Policy Committee as it nears the end of the cycle. It was noted that the change in tone may be a sign of the BoE laying the foundations for a pause in interest rate hikes. However, the BoE may find it difficult to justify a pause at this week’s upcoming meeting, due to accelerating wage growth as a result of one-off bonuses and basic pay increases stuck at high levels. This demonstrates the continued resilience within the UK labour market, although unemployment figures are showing gradual signs of increasing as a result of the slowing economy. The latest figures published last week show the UK unemployment rate was 4.3% during the period May to July 2023, compared to 4.2% in the previous quarter.

Kantar, the global market research company, published figures last week which showed that grocery inflation has fallen to its lowest level in a year. Annual grocery inflation was 12.2% in the four weeks to 3 September, down from 12.7% in the previous month. This is now the sixth consecutive drop in grocery prices after peaking above 17% in March, although the research also highlighted that 95% of consumers are still worried about the impact of rising food prices, alongside significant concerns about energy bills. Economists anticipate that the BoE will have much to consider in its rate setting meeting this week, with the expectation that August inflation will accelerate largely due to the rising cost of motor fuel. Alongside this, core inflation and services prices remain elevated, and new alcohol duties took effect in August, which will offset downward pressure on food prices. It should also be noted that a survey from Citi and YouGov showed the British public’s expectations for inflation over the medium to long term marginally increased to 3.3% from 3.2%, the first rise in public inflation expectations after five consecutive monthly declines.

In the UK housing market, the widely followed UK house price gauge by the Royal Institute of Chartered Surveyors (“RICS”) showed that house prices are experiencing the most widespread fall since 2009. The house price balance, which measures the difference between the percentage of respondents seeing rises and falls in house prices, fell to -68 in August 2023 against a consensus estimate of -56 and a prior reading of -55, marking the most negative reading since February 2009. The RICS stated that practically every region is now experiencing relatively steep falls in house prices. However, RICS Chief Economist, Simon Rubinsohn, highlighted that whilst prices continue to fall, the size of the moves are still relatively modest in the context of the substantial rises seen during the Covid-19 pandemic.

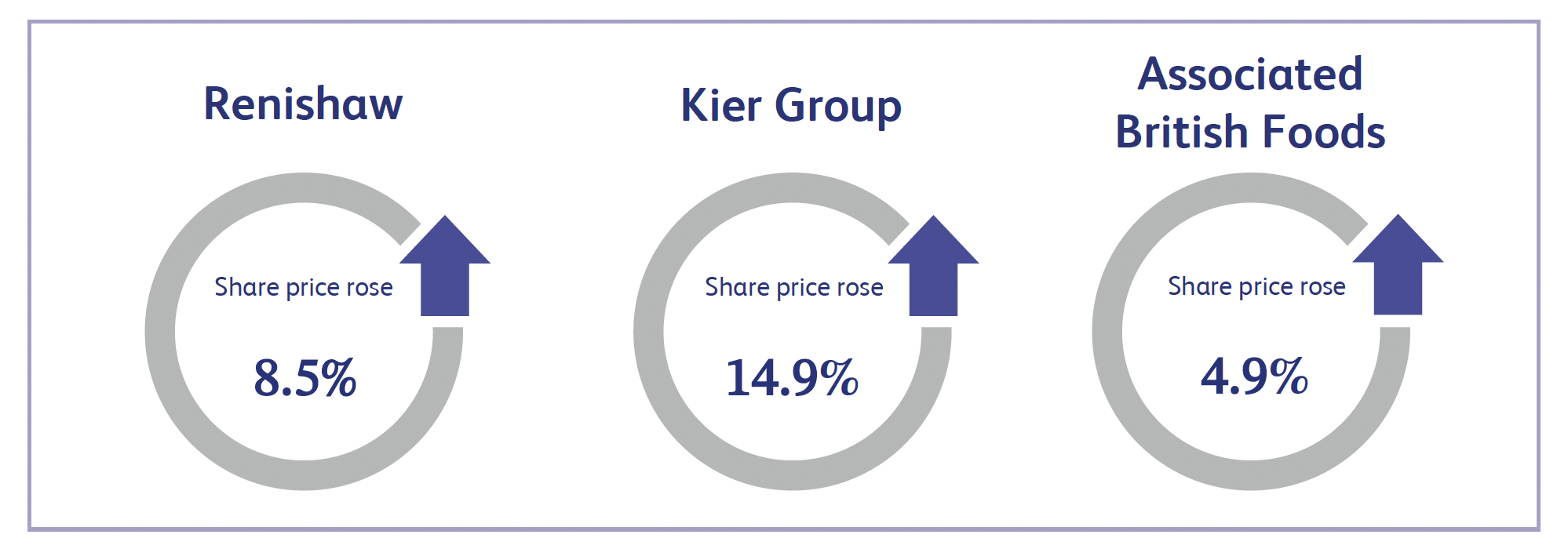

Renishaw, the UK based company engaged in the design, manufacture, and marketing of metrology and healthcare products, saw its share price increase approximately 8.5% last week after the company delayed the publication of its annual results. It is expected that the company will meet previous guidance issued which suggests that revenue will be approximately £689 million up from £671 million last year. Results are now expected to be published this week and be in line with prior guidance.

Kier Group, the infrastructure services and construction company, saw its share price surge approximately 14.9% after announcing full year results. The results showed a significant increase in pretax profit in 2023 to £52 million compared with £16 million in the prior year, alongside announcing that it will resume its dividend payout in the first half of 2024 as a result of its strong operational and financial performance over the previous year. The company now has a strong year-end net cash position alongside increased confidence in short-term prospects, which appears to have put the company in a strong position for delivering future growth.

Associated British Foods, the UK based diversified food and retail company, announced its full year trading update last week which saw its share price increase by approximately 4.9%. The company appeared to trade reasonably well as it recovered cash margin and continued to drive sales in a challenging macroeconomic environment. The trading update saw the company raise its fiscal 2023 guidance on the back of improved sales growth across its categories, with Primark expected to be one of the main contributors with revenue anticipated to be £9 billion compared to approximately £7.7 billion a year ago.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.