17 October 2023

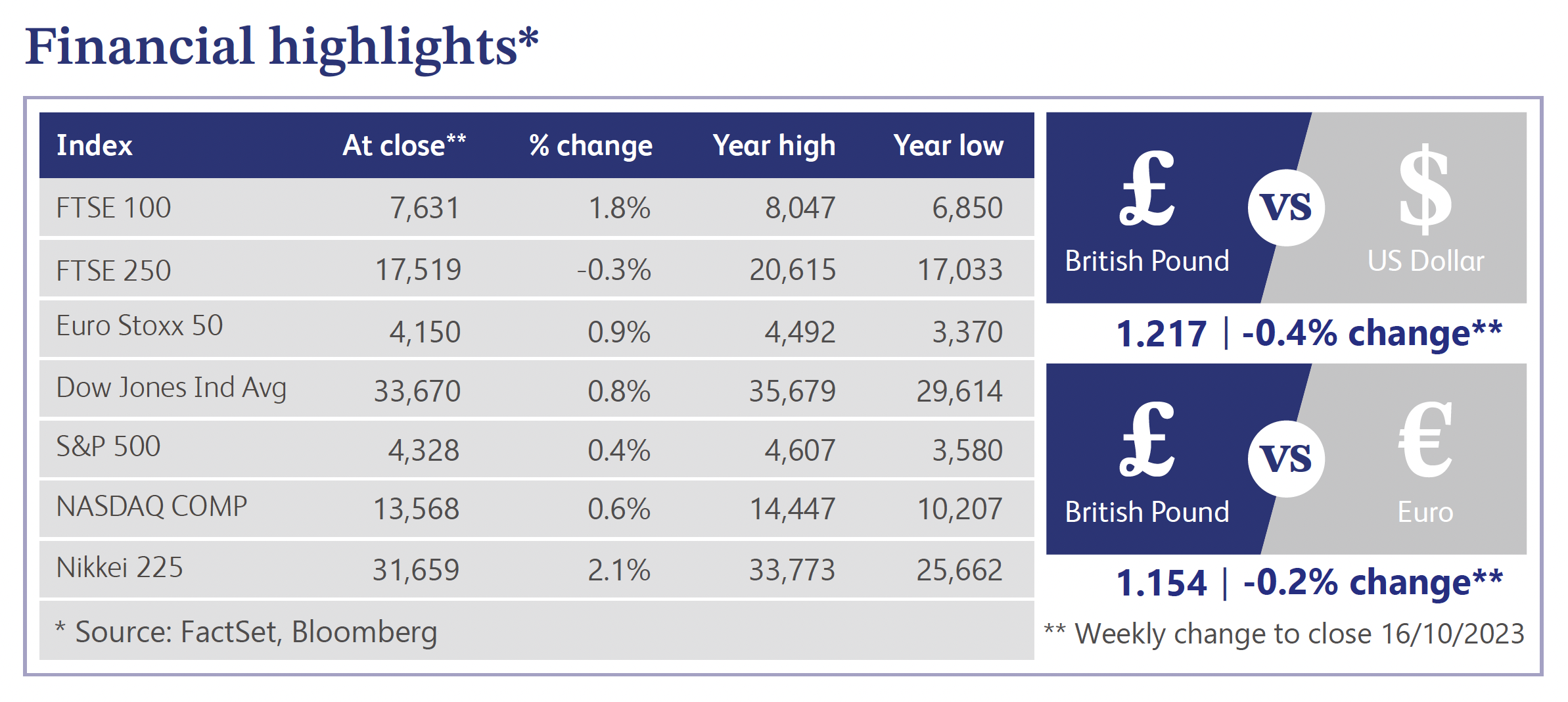

The International Monetary Fund ("IMF") released its World Economic Outlook last week, which provided a comprehensive perspective on the global economy. While the outlook has shown some balancing since earlier this year, downside risks persist. The report highlighted the limited room for policy errors and delved into the consequences of tightening policies on both inflation and economic activity. The IMF's updated gross domestic product growth forecasts for 2023 and 2024 include a weaker growth outlook for the UK compared to its G7 peers in 2024. It is also noteworthy that core inflation is expected to decline gradually, with many economies not returning to target inflation until 2025. This suggests that monetary policy must remain consistent to effectively tackle inflation, while fiscal consolidation is essential to address rising debt.

The latest survey from the Recruitment and Employment Confederation pointed to a slowdown as firms cut back on hiring for the first time since February 2021, primarily driven by economic uncertainty and escalating costs. While labour market conditions were viewed as somewhat precarious, there is optimism about the potential for a turnaround in hiring, particularly as inflation eases. The British Retail Consortium (“BRC”) also reported a marked slowdown in retail sales in September, attributed to a combination of warmer weather and increased fuel prices. BRC's like-for-like sales confirmed the influence of inflation on consumer spending.

The latest Bank of England (“BoE”) Credit Conditions Survey provided insights into the impact of higher interest rates on both the banking sector and the broader economy. Rising default rates and increased losses on secured loans raised concerns. While the availability of secured credit is expected to decrease further, there is a growing demand for unsecured lending. Separately, Barclays reported a surge in credit and debit card spending in September, primarily due to higher fuel costs.

Regulatory scrutiny in the UK reached a critical juncture as pension funds raced to sell unlisted assets, raising questions about the true valuations of these investments. The illiquidity of these assets, particularly within the defined benefit pension fund industry, has garnered attention. Simultaneously, the Financial Conduct Authority is preparing to review the practices surrounding private asset valuations, including their potential impact on the banking sector.

The latest Royal Institute of Chartered Surveyors UK House Price Balance suggested further weakening as September’s figure came in at -69 compared to forecasts of -63. However, there were signs of stabilisation attributed to more accessible home loans and the BoE's decision to pause interest rate hikes. Nevertheless, with rates expected to remain steady for an extended period, the outlook for house prices remains negative in the coming year.

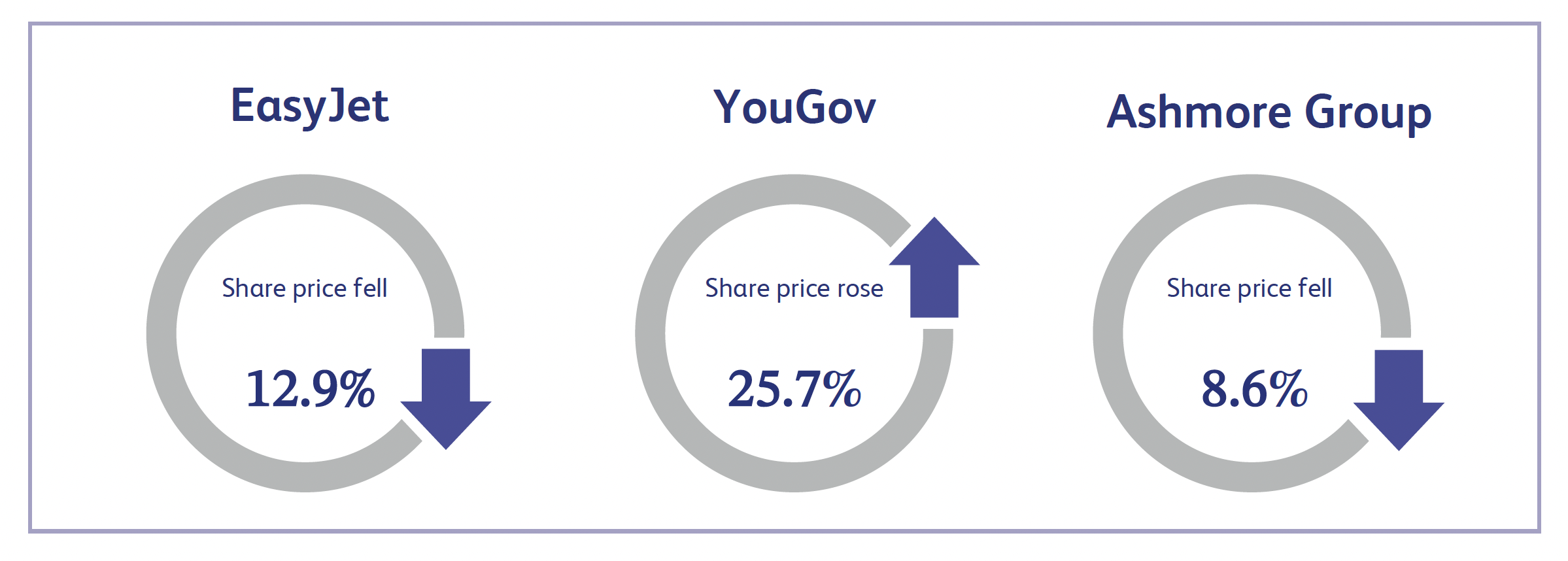

EasyJet, the low-cost airline, reported its fourth quarter trading update last week, which was a contributor to the company’s shares declining approximately 12.9%. The announcement was roughly in line with analyst expectations as the company expects its full year profit before tax figures to be between £440 million and £460 million. The trading update also included new medium term targets, resumption of its dividend and a proposed purchase of 157 aircraft from Airbus. Many analysts viewed these developments positively. However, the majority expected better performance, which resulted in the share price decline.

YouGov, the international research and data analytics company, saw its share price surge by approximately 25.7% last week after announcing its full year results. The company reported profit attributable to the owners for the 12 months ending 31 July of £34.5 million, an increase of 102% from the previous year’s figure of £17.1 million. Revenue also increased to £258.3 million compared to £221.1 million a year ago, demonstrating the positive momentum going into 2024 as the company benefits from a resurgence in technology spending by its clients.

Ashmore Group, the specialist emerging markets asset manager, reported a trading announcement last week which showed its assets under management decreased by $4.2 billion during the quarter ending 30 September 2023. This decrease consisted of $1.3 billion caused by negative investment performance and $2.9 billion due to net outflows. The net outflows for the company were at a similar level to the prior quarter, which demonstrates the institutional shift towards risk aversion given the current investment landscape. The share price decreased by approximately 8.6% following the news.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.