26 March 2024

Market News

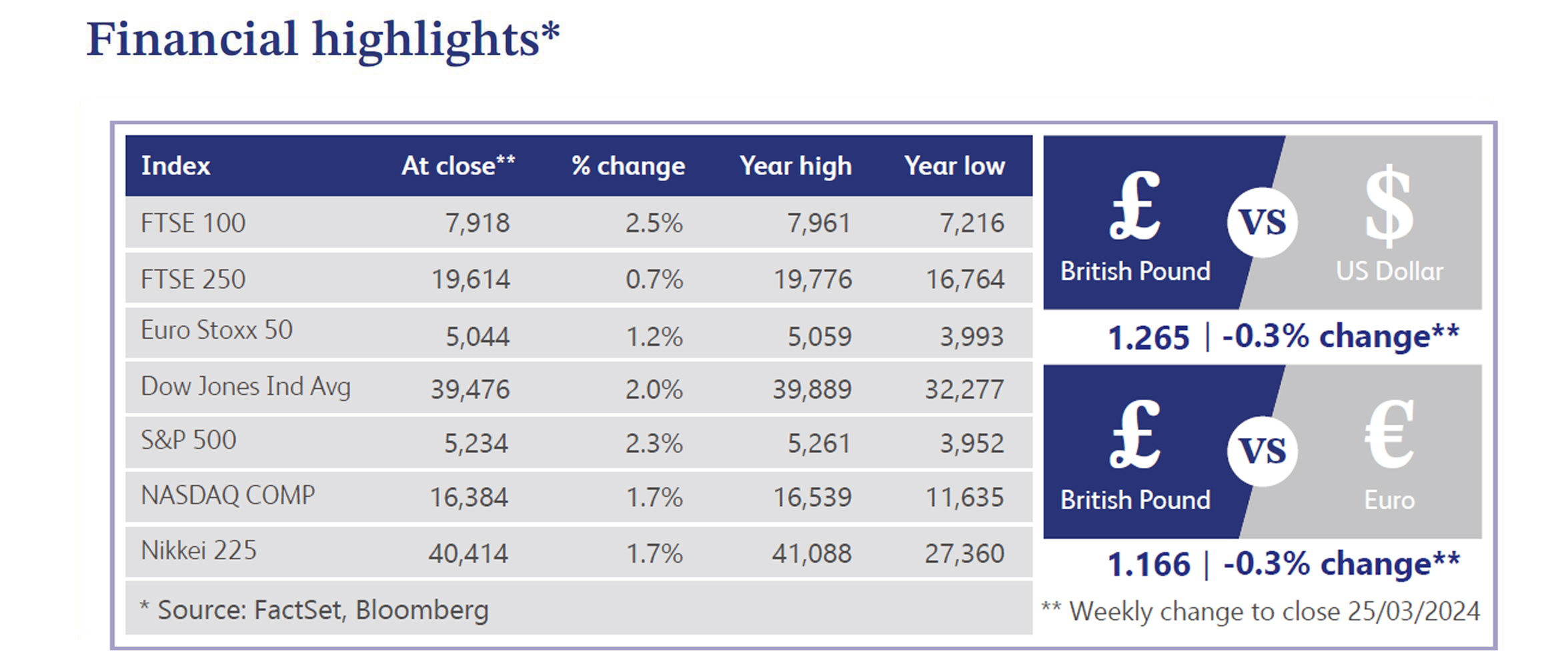

The Bank of England ("BOE") last week announced its decision to maintain the benchmark interest rate at 5.25%, signalling a cautious approach amidst evolving economic conditions. However, recent developments in the UK's economic landscape have sparked speculation about potential shifts in monetary policy. With headline inflation easing to 3.4% in February, slightly below the BOE's forecast, attention turns to the central bank's stance on interest rate cuts.

There appears to be a growing anticipation that interest rate cuts might arrive sooner than previously expected, with market pricing indicating a substantial probability of such moves as early as June. BOE Governor, Andrew Bailey, commented there could be the possibility of interest rate cuts which have fuelled speculations about the central bank's future course of action. A CityAM poll of economists reveals a consensus leaning towards a rate cut in June, reflecting the evolving sentiment among analysts.

Amidst evolving monetary policy expectations, indications of broader economic growth are emerging. Lloyds Bank's monthly economic tracker highlights a notable expansion in economic activity across various sectors in February, marking the strongest performance since April 2023. However, the projection for pay awards this year has been revised downward to 4%, signalling a cautious approach by UK employers amidst lingering uncertainties.

Despite the moderation in pay growth, recent data showing wage increases at their slowest pace since October 2022 underscores the ongoing challenges in the labour market. The outlook for economic growth remains optimistic, supported by positive trends in key economic indicators. But, there still appears to be some concerns regarding the sustainability of recovery momentum amidst global economic headwinds.

Confidence in the UK housing market remains robust, with asking prices experiencing a significant uptick, driven by favourable market conditions and easing mortgage rates. However, the rental market presents a contrasting picture, with rental costs rising at the fastest pace since 2015, posing affordability challenges for tenants.

Against the backdrop of anticipation for potential rate cuts by the BOE, mortgage lenders have begun adjusting their rates downwards, aiming to capitalise on the favourable inflation outlook and stimulate housing market activity. This strategic response aims to make borrowing more affordable for homebuyers. For instance, the Telegraph reported that Natwest has reduced rates on remortgage deals by up to 0.24% and trackers by up to 0.40%. These adjustments signal a proactive approach from lenders to support housing market liquidity and consumer confidence. As mortgage rates trend lower, housing stocks may attract increased investor interest, reinforcing positive sentiment in the housing market.

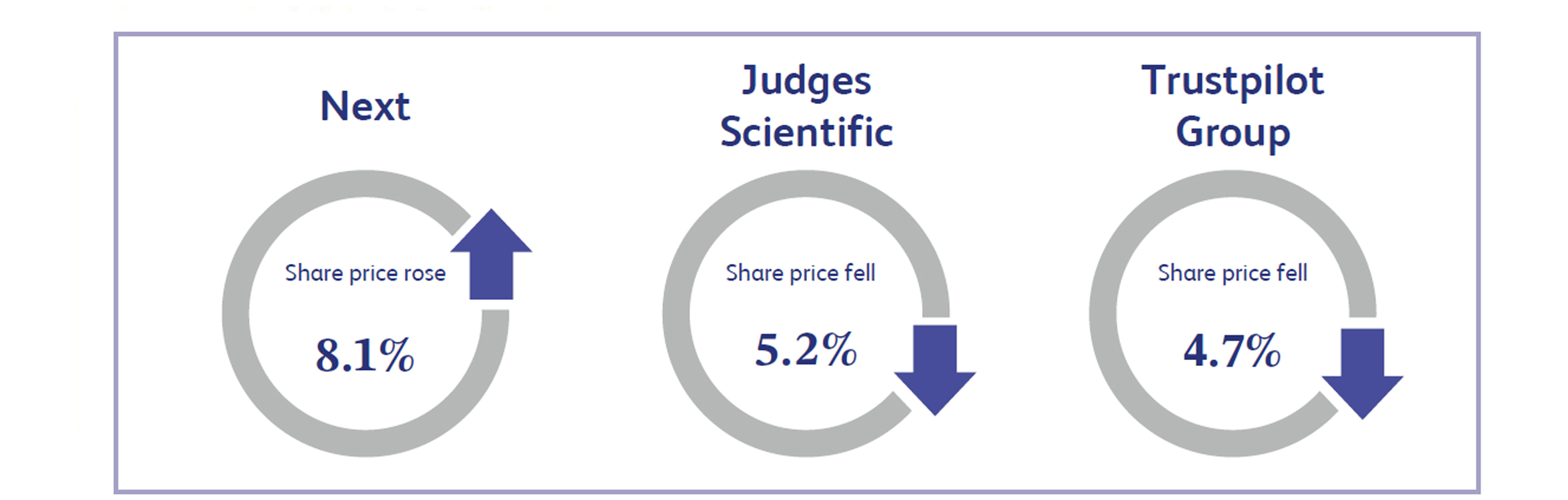

Next, the UK based clothing, homeware, and beauty product retailer, announced its final results last week which saw its share price close the week approximately 8.1% higher. The company reported a strong year with the business outperforming management’s initial expectations. Next’s profit before tax increased 5% compared to last year, to a record high of £918 million, alongside cash flow remaining strong resulting in the company returning £425 million to shareholders throughout the year via dividends and share buybacks. Analysts appeared to believe that the outlook continues to look favourable for Next, contributing to the positive share price reaction.

Judges Scientific, the UK based company primarily involved in acquiring and developing companies within the scientific instrument sector, saw its share price close the week approximately 5.2% lower after the company reported its latest results. The company reported a mixed set of results, with revenues for the year increasing 20% to £136.1 million and a final dividend per share of 68p, compared to 59p in the previous year. However, despite these reasonably positive figures, the company’s statutory profit before tax was £13.4 million, a decline of 16% compared to last year’s figure of £16 million. The company’s basic earnings per share also declined to 145.8 pence per share compared to last year's figure of 196.1 pence. The market generally viewed this negatively, resulting in the negative sentiment towards the share price.

Trustpilot Group, the UK based digital platform bringing businesses and consumers together, reported its latest financial results last week which saw the company’s share price end the week approximately 4.7% lower. It appeared the company’s results were largely positive with revenue increasing 18% year on year to $176 million, alongside annual recurring revenue increasing 22% to $197 million. However, the negative share price reaction appeared to be as a result of its largest shareholder selling part of its holding within the company, which the market viewed poorly.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.