22 July 2025

Last week UK economic data painted a mixed picture, with inflation and labour market dynamics pulling in opposite directions. Headline inflation unexpectedly rose to 3.6% in June, driven by higher food and wage costs, prompting criticism of Labour’s tax policy. However, unemployment climbed to a four-year high of 4.7%, while job hiring fell sharply and wage growth moderated - bolstering expectations for a potential Bank of England (“BoE”) rate cut in August. BoE Governor Andrew Bailey signalled a willingness to ease policy if labour weakness persists, although policymaker Catherine Mann warned inflation remains above target. Meanwhile, Bailey voiced concerns over Donald Trump’s tariff plans, citing risks to global economic stability, and stressed the International Monetary Fund’s (“IMF”) role in addressing imbalances.

Chancellor Rachel Reeves’ pro-growth Mansion House agenda hit a reality check as the Office for Budget Responsibility (“OBR”) warned public finances are unsustainable, warning of debt risks and fragile investor confidence. Spending U-turns could cut fiscal headroom by £20–30 billion, with Bank of America forecasting tax hikes this autumn. Wealth taxes remain unconfirmed, but fairness-driven measures were hinted at. Reeves paused controversial Individual Savings Account (“ISA”) reforms amid backlash and plans mortgage reforms to boost homeownership. Trade tensions grew as British Ambassador to the United States, Peter Mandelson, said Trump’s UK tariffs may be permanent, while a new investment concierge service aims to attract affected firms. Reeves pledged financial regulation reforms to boost the City of London’s competitiveness, and the UK signed a landmark trade deal with India.

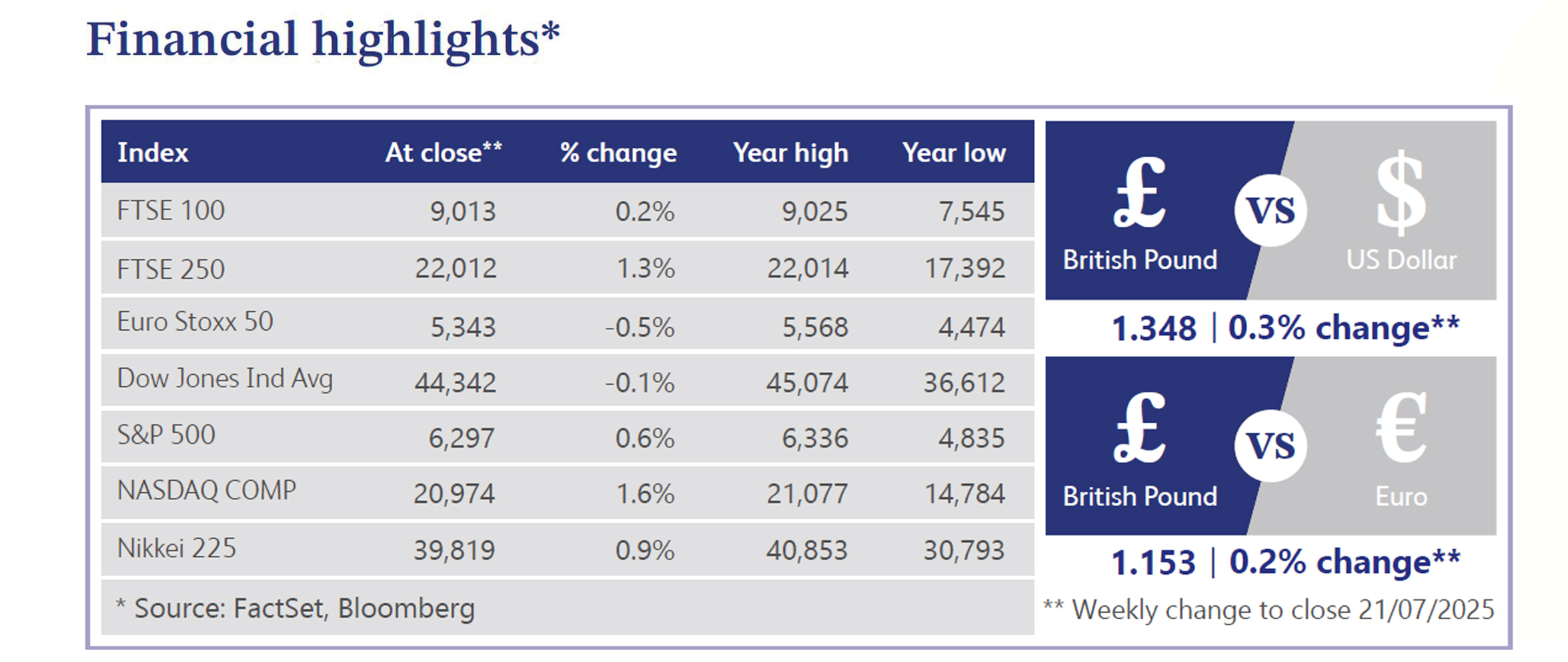

The FTSE 100 surged past 9,000 last week, lifted by investor rotation away from US markets amid tariff tensions and policy risks under Trump. Strong gains in defence, financials and mining stocks helped, as global investors saw UK equities as undervalued safe havens. Chancellor Reeves launched an initial public offering (“IPO”) taskforce to revive London listings following the worst first half year for fundraising in 28 years. Regulatory reforms and a potential UK-US trade deal also supported the sentiment. The FTSE is now up nearly 10% year-to-date, outperforming European peers, though weak domestic growth and past outflows remain key headwinds for long-term capital market recovery.

US equities ended the week mostly higher, with the S&P 500 and Nasdaq hitting record highs. Big tech led gains - Tesla rose 5.2% and Nvidia 4.5%. Outperformers included Chinese tech, banks and airlines, while laggards included energy and homebuilders. Despite a flatter Federal Reserve (“Fed”) rate cut path - now pricing just 0.42% in 2025 - equities were buoyed by rate stabilisation and strong macro data, including jobless claims and retail sales. Treasuries steepened, with 30-year yields above 5%. Trump’s attacks on the Fed and tariff threats weighed on sentiment, though Commodity Trading Advisors (“CTAs”) buying, easing buyback blackout, and resilient consumer sentiment offered key support to the bullish narrative.

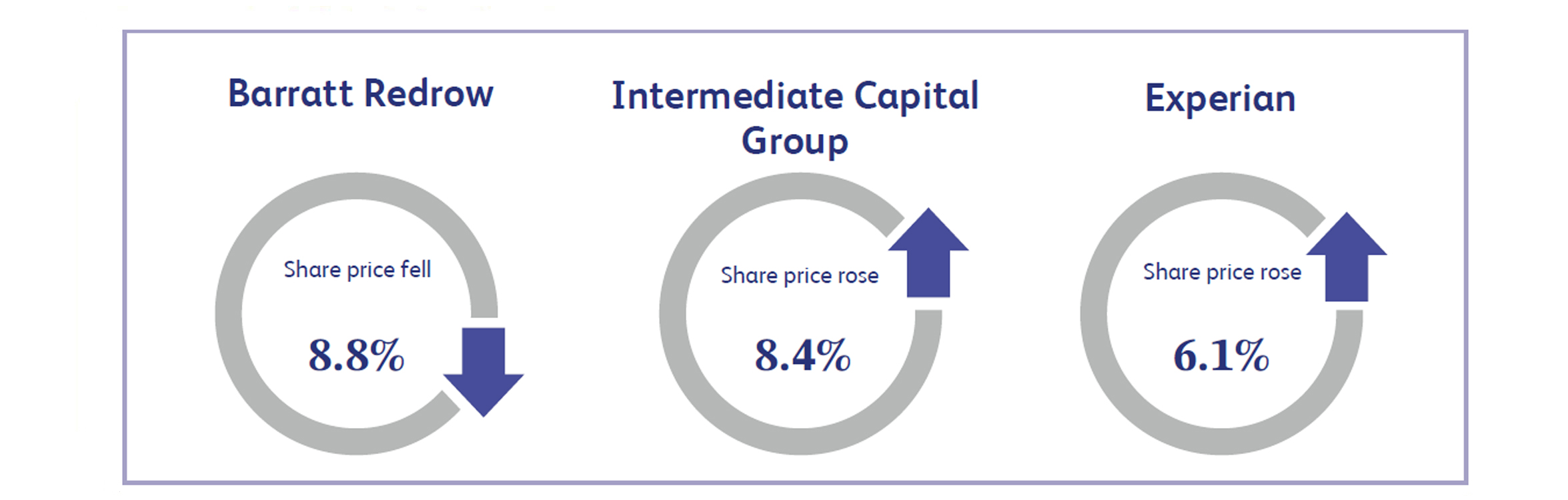

Barratt Redrow, a UK-focused residential and commercial property developer, fell 8.8% after reporting weaker-than-expected Fiscal Year (“FY”) 2025 home completions below its guidance. FY26 projections also missed RBC Capital’s estimate. RBC cut FY26 profit forecasts by 15%, citing delays in the UK planning system and flat gross margins. New regulations may help but won’t take effect until autumn, while social housing contracts remain a bottleneck. RBC maintained an “outperform” rating, calling the pullback a buying opportunity, though the price target was reduced due to near-term execution risks.

Intermediate Capital Group (“ICG”), a global alternative asset manager providing flexible capital solutions, gained 8.4% following a strong fiscal first quarter update. The firm raised $3.4 billion in the quarter, exceeding 60% of first half consensus expectations, while assets under management (“AUM”) jumped from $101 billion to $122.6 billion year-on-year. Berenberg reiterated a “buy” rating, highlighting ICG’s brand strength, scale potential and diversified model. The results signal robust institutional demand and position the firm well for continued growth in alternatives. The performance reinforces ICG’s credibility as macro uncertainty continues to drive investor preference toward scalable and established alternative asset platforms.

Experian, a global data and analytics firm specialising in credit and decision automation, rose 6.1% to a record high after a strong first quarter update. Organic revenue rose 8%, beating the consensus, led by 9% growth in North America. Total revenue growth reached 12%, and FY26 guidance was reaffirmed. Business-to-business (“B2B”) demand remains strong across regions, particularly in financial services. Analysts, including Jefferies, responded positively, citing Experian’s recurring revenue model and international strength. The stock is up approximately 20% year-to-date, supported by consistent execution and resilience across business lines.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.