29 July 2025

UK economic sentiment remains subdued as Deloitte reported their UK consumer confidence index fell by 2.6 points to -10.4 by the end of last quarter and is now at its lowest level since the first quarter of 2024. The steepest declines were seen in perceptions of job security, which fell by 4.8%, and concerns over debt, down 3.7%. The Consumer Price Index (“CPI”) came in at 3.6% from 3.4% the month before. We see concerns of inflation acceleration as retailers warned that Chancellor Rachel Reeves’ proposed business rate hike from 2026 could push up food prices. Other economic indicators also pointed to weakness, with the July flash Purchasing Managers' Index (“PMI”) signalling a loss of momentum as the composite reading declined. Retail sales posted a modest 0.9% month-on-month recovery in June, but underlying volumes remained weak. However, the job market showed tentative improvement, with London leading a modest rise in vacancies. The Confederation of British Industry (“CBI”) also flagged softer industrial orders but improving optimism. Markets now expect two Bank of England (“BoE”) rate cuts by year-end, despite inflation likely remaining above target through the third quarter.

Chancellor Reeves weighed a £5 billion Bitcoin sale to ease fiscal pressures while rejecting calls for a wealth tax, instead planning to extend income tax threshold freezes and review capital gains tax (“CGT”). Pension reforms gained momentum, with an early retirement age review and potential cuts to tax-free lump sums. Deputy Prime Minister Angela Rayner pushed for a tourist tax despite Treasury opposition. Retailers urged the reinstatement of VAT-free shopping for EU visitors. Reeves promoted the UK-India trade deal, citing financial sector benefits, though its GDP boost is minimal. Meanwhile, the UK deepened ties with Australia and eyed contributions to the EU’s Security Action for Europe (“SAFE”) defence fund.

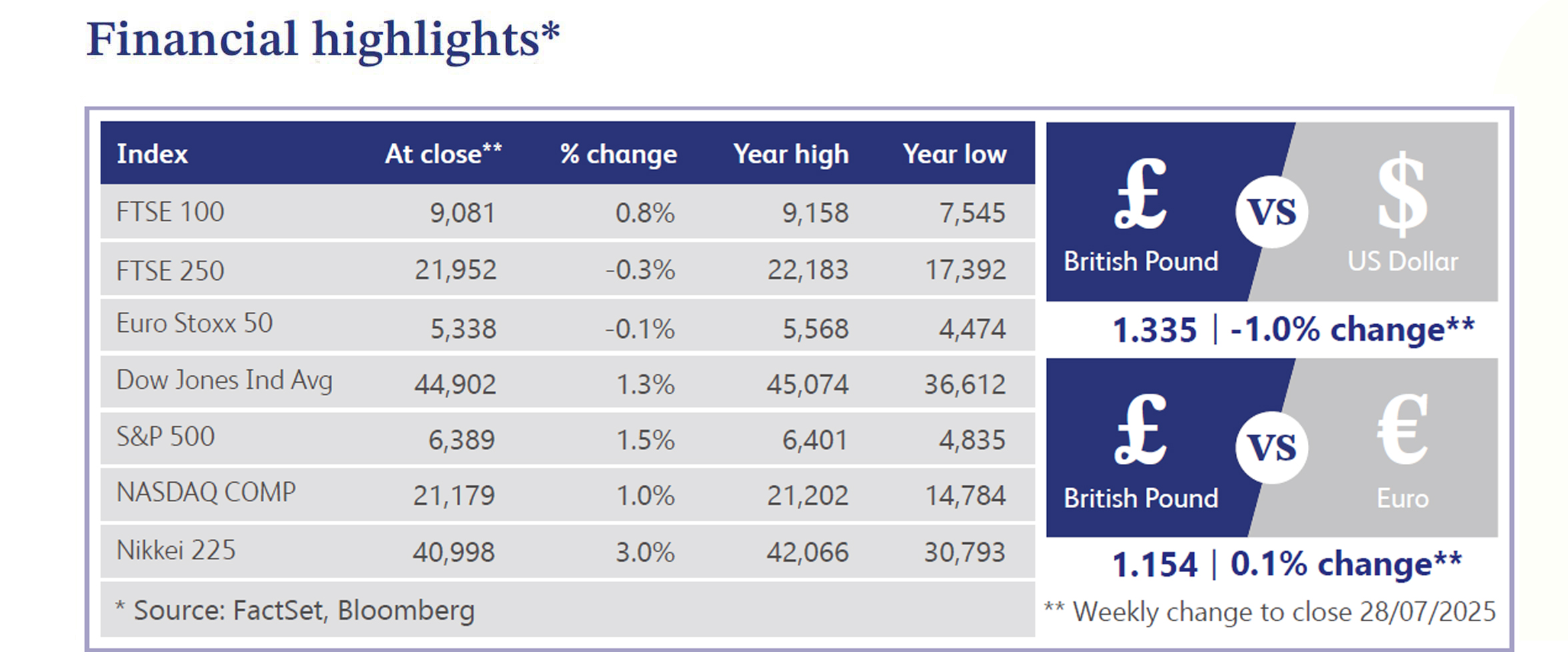

UK markets saw mixed signals, with EY Parthenon reporting UK profit warnings hit a record, with 46% in the second quarter linked to geopolitical risks - up from 4% a year ago. UK dividends fell 1.4% in the second quarter on weaker special dividends and currency effects, while surveys showed persistent caution by retail investors despite widespread pension participation. However, the FTSE 100 touched a record high, boosted by global trade optimism and strong corporate updates. Attention shifted to upcoming bank earnings, with Lloyds and NatWest expected to post solid profits. The BoE also came under pressure from analysts to halt or reduce long-end gilt sales, with Governor Andrew Bailey attributing rising yields to global policy uncertainty.

US equities ended higher, with the S&P 500 and Nasdaq posting fresh record highs, led by Big Tech, retail-favourite names, and strength in sectors like MedTech, homebuilders and REITs. Second quarter earnings were in focus; results beat expectations, though only by small margins. Google outperformed, while Tesla, Texas Instruments and Intel disappointed. Trade optimism grew ahead of President Trump’s 1st August deadline, with deals struck in Asia and progress with the EU. Treasuries flattened, the dollar weakened and WTI crude oil fell 1.3%. Caution lingers amid rising tariffs, soft macro data, elevated valuations and mixed corporate messaging despite ongoing mergers and acquisitions (“M&A”) and rate cut hopes.

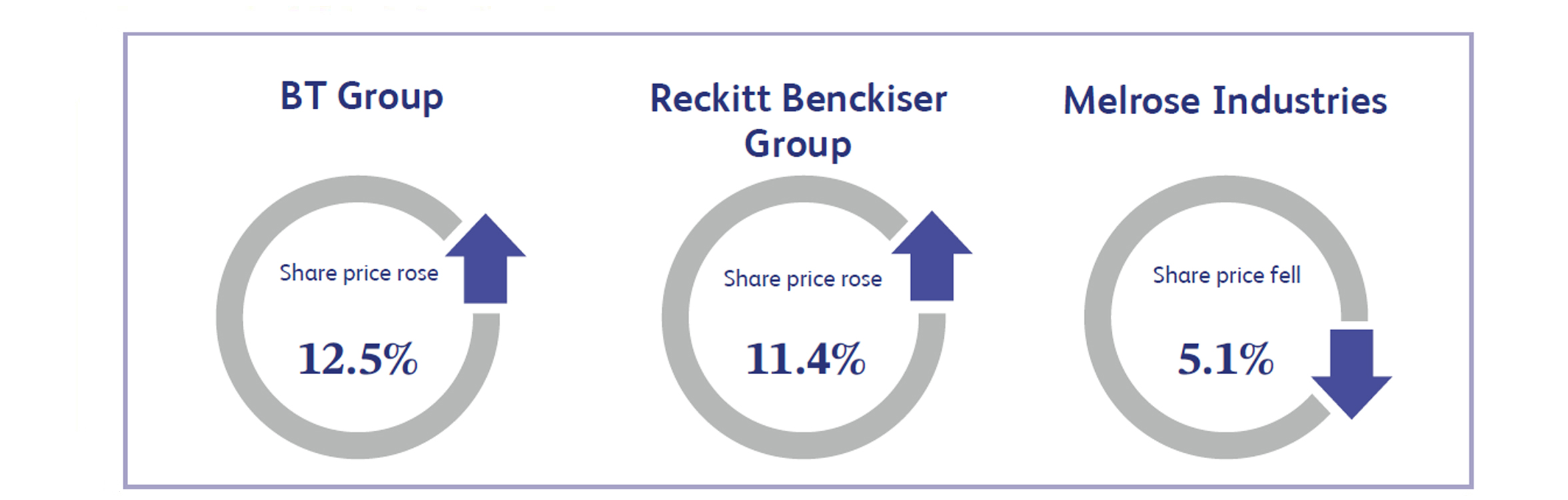

BT Group, the UK’s largest broadband and mobile provider, surged 12.5% last week, reaching its highest level since October 2019. The rally followed news of Patricia Cobian’s appointment as its next chief financial officer (“CFO”) - its first female CFO. Cobian, currently CFO at rival Virgin Media O2, brings two decades of telecom and corporate finance experience and is expected to take over from long-standing CFO Simon Lowth next year. Investors welcomed the leadership change, anticipating fresh strategic direction and operational improvement. BT shares are now up 42% year-to-date, making it one of the FTSE 100’s top performers.

Reckitt Benckiser Group, a major consumer goods firm known for brands like Dettol and Nurofen, rose 11.4% last week after raising its full-year revenue forecast. The upgrade followed stronger-than-expected second-quarter results, with solid performance in its core health and hygiene segments. Investor sentiment was further lifted by optimism over EU - US trade developments, supporting sector-wide gains. The upbeat outlook helped ease prior concerns over cost inflation and market share pressure, driving renewed investor confidence in the company’s brand strength and pricing power.

Melrose Industries, which designs and manufactures aerospace components, fell 5.1% last week following a downgrade from “Buy” to “Overweight” by RBC Capital. The rating change came as the company flagged a likely slowdown in its Swedish defence segment in 2025, after an exceptional 74% growth in 2024. The segment represents about 12% of its engine business, and investors appeared cautious despite Melrose's positive long-term outlook, including involvement in major defence programmes such as the US Next Generation Air Dominance and Europe’s Future Combat Air System. The downgrade and growth moderation outlook weighed on sentiment.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.