26 August 2025

The S&P 500 index rallied on Friday to close 0.29% higher, recovering some ground after four consecutive days of losses. The technology sector led the decline earlier in the week as the artificial intelligence (“AI”) sector came under pressure, with the so-called “Magnificent Seven” stocks suffering a three-day sell-off. Concerns over future profitability combined with stretched valuations acted as the trigger, following research from the Massachusetts Institute of Technology indicating that 95% of organisations are achieving no returns from AI. Sentiment was further weighed by comments from OpenAI chief executive Sam Altman, who cautioned that an AI bubble may be forming.

The week concluded with the Federal Reserve’s (“Fed”) annual symposium, where Chair Jerome Powell acknowledged the challenges posed by persistent inflationary pressures and signs of emerging weakness in the labour market. He noted that the unusual combination of soft labour demand and declining labour supply, in part due to lower immigration, is increasing downside risks to employment. Powell described the current interest rate range between 4.25% and 4.50% as restrictive and suggested the balance of risks is shifting in a way that may justify an adjustment in policy. Markets responded by increasing expectations of the scale of rate cuts, which rose to 56 basis points. The 10-year Treasury yield declined on Friday alongside a softer dollar index, while gold advanced and crude oil increased to around $64 per barrel.

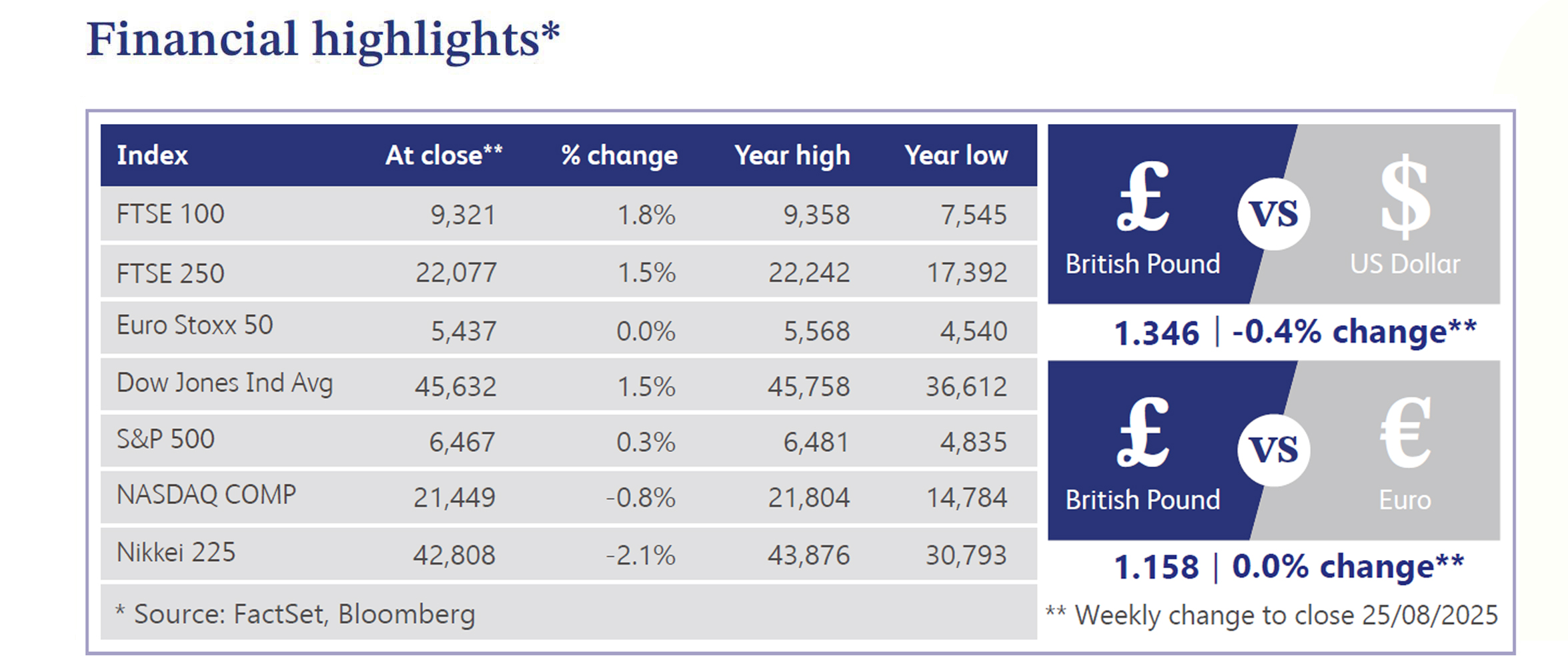

In the UK, the FTSE 100 rose 1.8% over the week. Inflation accelerated more than expected to 3.8% in July, driven by higher food prices and airfares, raising doubts over whether further interest rate cuts will be delivered this year to support weak growth. Services inflation, a key measure for the Bank of England’s (“BoE”) rate-setters, climbed from 4.7% in June to 5% in July, exceeding the central bank’s forecast. The higher-than-expected figure dampened the likelihood of a September rate cut, with markets now pricing in roughly a 50% chance of another quarter point reduction this year. The BoE highlighted that part of the upward pressure on prices reflects retailers passing on higher costs from April’s increase in employers’ national insurance contributions and the minimum wage.

Elsewhere, the Eurostoxx 50 was flat, supported by hopes of lower borrowing costs in the United States. Eurozone business activity expanded for a third consecutive month in August as new orders returned to growth after fourteen months of contraction. The Composite Purchasing Managers' Index (“PMI”) Output Index rose to 51.1 from 50.9 in July, led by manufacturing, which grew at its fastest pace in more than three years. However, consumer confidence weakened in August and remains well below its long-term average. In Japan, the Topix slipped 0.22% as appetite for risk assets was restrained by the sell-off in US technology shares.

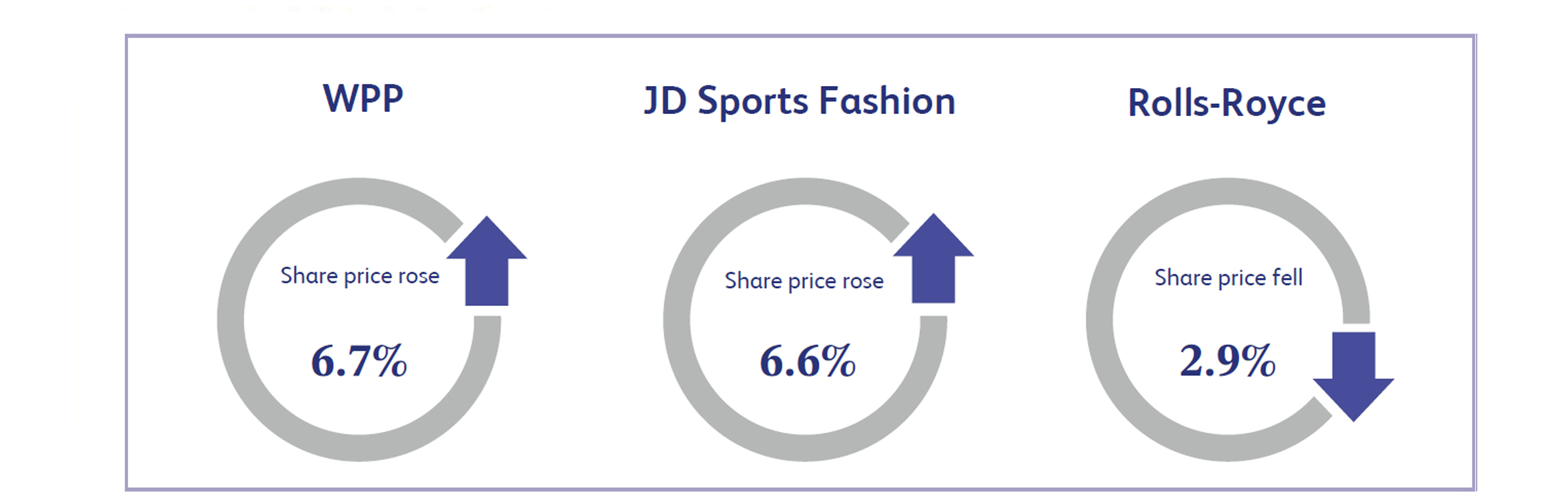

WPP, the British advertising group, rose 6.7% last week despite the absence of any material change to fundamentals. The shares have been in decline over the past year and touched a five-year-low earlier this month after first-half results showed pre-tax profit had fallen 71% to £98 million. The sector continues to face pressure from weaker corporate advertising budgets amid uncertainty over US trade policy, as well as intensifying competition and the growing use of artificial intelligence in marketing. The rebound reflects more of a technical recovery than a reassessment of underlying prospects.

JD Sports Fashion, the British sports and fashion retailer, gained 6.6% after Deutsche Bank raised its price target from 85 pence to 100 pence, citing an improved risk-reward profile. The stock has been under pressure over the past year, with earnings consistently landing at the lower end of guidance as subdued consumer demand weighed on performance. Shares recently touched a five-year-low, but the broker noted signs that the cycle of earnings downgrades may be nearing an end, alongside scope for renewed growth from its partnership with Nike. The upgrade helped restore confidence in the retailer’s ability to stabilise performance.

Rolls-Royce, the British aerospace and defence company, slipped 2.9% amid speculation that progress in peace talks between the United States and Russia could eventually dampen defence spending. Reports of discussions between the two presidents in Alaska prompted concerns that military budgets may shrink if a path to resolution emerges. The stock, which has been on a strong run and reached an all-time-high earlier this month, remains sensitive to shifts in geopolitical risk. Shares partially recovered after the lack of detail surrounding the talks reassured investors that any move towards a truce is likely to be gradual.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.