23 September 2025

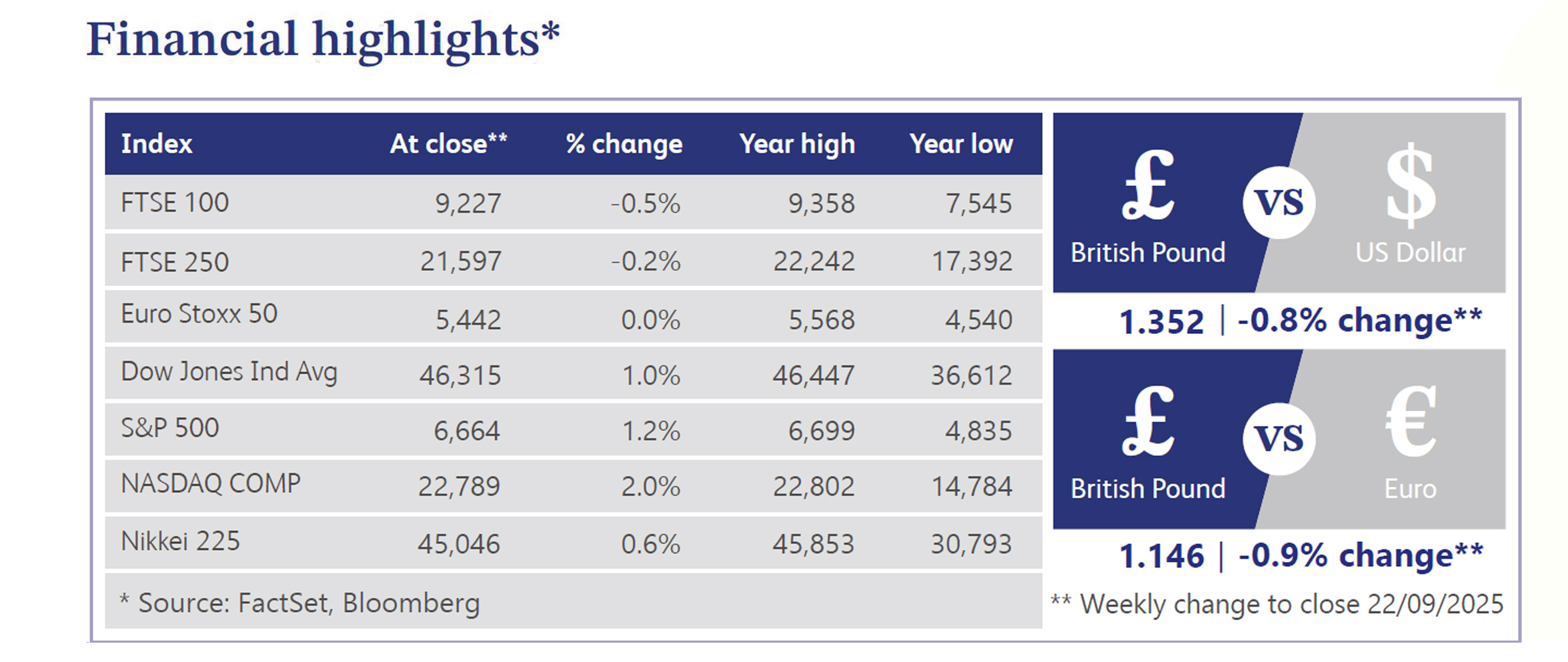

The UK economy continues to flash mixed signals, leaving the Bank of England (“BoE”) at the centre of investor attention. Governor Andrew Bailey stressed that interest rate cuts are “not yet over,” acknowledging softness in the labour market but remaining cautious over persistent inflation risks. The Monetary Policy Committee (“MPC”) voted 7–2 to hold the base rate at 4%, while slowing quantitative tightening (“QT”) to £70 billion annually from £100 billion to calm gilt market volatility. Economic data provided a similarly uneven picture. Retail sales surprised positively with a 0.5% month-on-month rise, driven by strong clothing demand, yet consumer confidence weakened as borrowing pressures and elevated prices weighed on households. Wage growth, now at its slowest pace in three years, underscores the fragile backdrop, while August government borrowing of £18 billion exceeded forecasts and highlighted fiscal strain.

The fiscal position itself looks increasingly precarious. August borrowing marked the highest level for the month in five years, far above the Office for Budget Responsibility’s (“OBR”) forecast of £12.5 billion, reflecting rising debt-servicing costs and limited progress on spending restraint. With revenue collection faltering and borrowing requirements intensifying, concerns over long-term fiscal sustainability are resurfacing. This leaves policymakers with limited flexibility, particularly as the economy struggles to generate momentum. For Chancellor Rachel Reeves, this means balancing pressure for growth-friendly measures with the risk of breaching fiscal credibility.

Markets, meanwhile, enter a crucial week. Interest rates are unlikely to change after August’s cut, though rising inflation has already tempered expectations of further easing this year. Beyond monetary policy, political focus is shifting to the listings market, with Reeves under pressure to introduce a stamp duty holiday on fresh stock market debuts to revive London’s subdued initial public offering (“IPO”) pipeline. Yet sentiment toward UK equities remains depressed. The latest Bank of America survey showed allocations at record lows, underscoring persistent investor caution.

Across the Atlantic, US equity markets extended their rally, with the S&P 500 and Nasdaq closing at record highs for a third consecutive week and the Russell 2000 breaking its 2021 peak. Technology led the advance, highlighted by Intel’s 22.8% surge, Tesla’s 7.6% gain and Alphabet’s 5.8% rise, while investment banks and industrials also performed strongly. Weakness was concentrated in homebuilders, chemicals and consumer discretionary names. The Federal Reserve (“Fed”) delivered a widely anticipated 0.25% cut, but the more dovish Summary of Economic Projections signalled 0.75% of easing for the year. This policy shift, coupled with upbeat corporate guidance and supportive macro data, bolstered sentiment, though risks remain around extended positioning, ongoing frictions with China and fiscal uncertainty.

UK housing markets highlighted their own divergences. Rightmove reported a 0.1% annual decline in asking prices, the first fall since January 2024, as supply reached a ten-year high and transactions increased. London’s construction sector faces deeper strains, with approvals slipping and restrictive planning policies raising the risk of collapse in new housing delivery. Meanwhile, landlords are selling properties ahead of rental reform, adding further pressure to an already uncertain market.

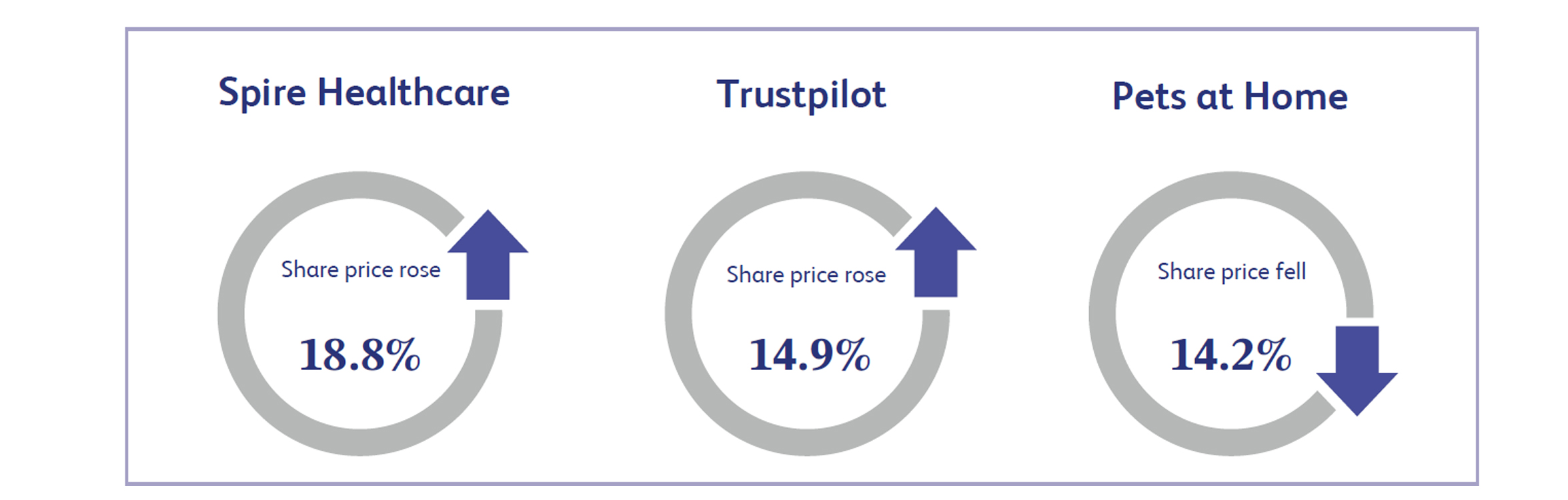

Spire Healthcare, a UK-based private hospital operator with 38 hospitals and over 50 clinics, surged 18.8% after confirming it is exploring strategic options, including a potential sale. The announcement, backed by financial adviser Rothschild & Co, followed reports that activist investors, including Harwood Capital, had been pushing for a sale. Shares hit a one-year-high, posting their biggest rally since May 2021. Investors welcomed the possibility of a premium takeover, reflecting confidence in the group’s strong asset base and private healthcare demand. The speculation around consolidation in the UK healthcare sector added to the positive momentum.

Trustpilot, which runs a global online review platform for businesses, climbed 14.9% after delivering stronger-than-expected first-half results. Industry analysts pointed to strong booking growth and a clear path to full-year profit outperformance, even as shares remain down 30% year-to-date. Analysts noted accelerating traction in the enterprise segment and expanding margins, while revenue momentum pointed to sustained mid-teens growth. Continued investment in platform development further boosted confidence. The results reassured investors that Trustpilot is executing effectively and moving toward profitability, driving renewed optimism and a sharp rebound in its share price.

Pets at Home, the UK’s largest pet care and retail group, fell 14.2% after announcing the abrupt departure of Chief Executive Officer Lyssa McGowan and cutting profit guidance. The company now expects underlying pre-tax profit of £90-100 million for fiscal 2026, down from £110-120 million previously. Industry analysts said McGowan’s exit reflected shareholder dissatisfaction after £1 billion in value was lost under her tenure. Subdued retail trading, weak strategic execution and investor concerns over leadership uncertainty pressured shares. Analysts warned the next CEO would face a challenging turnaround, fuelling sharp selling in the stock.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.