30 September 2025

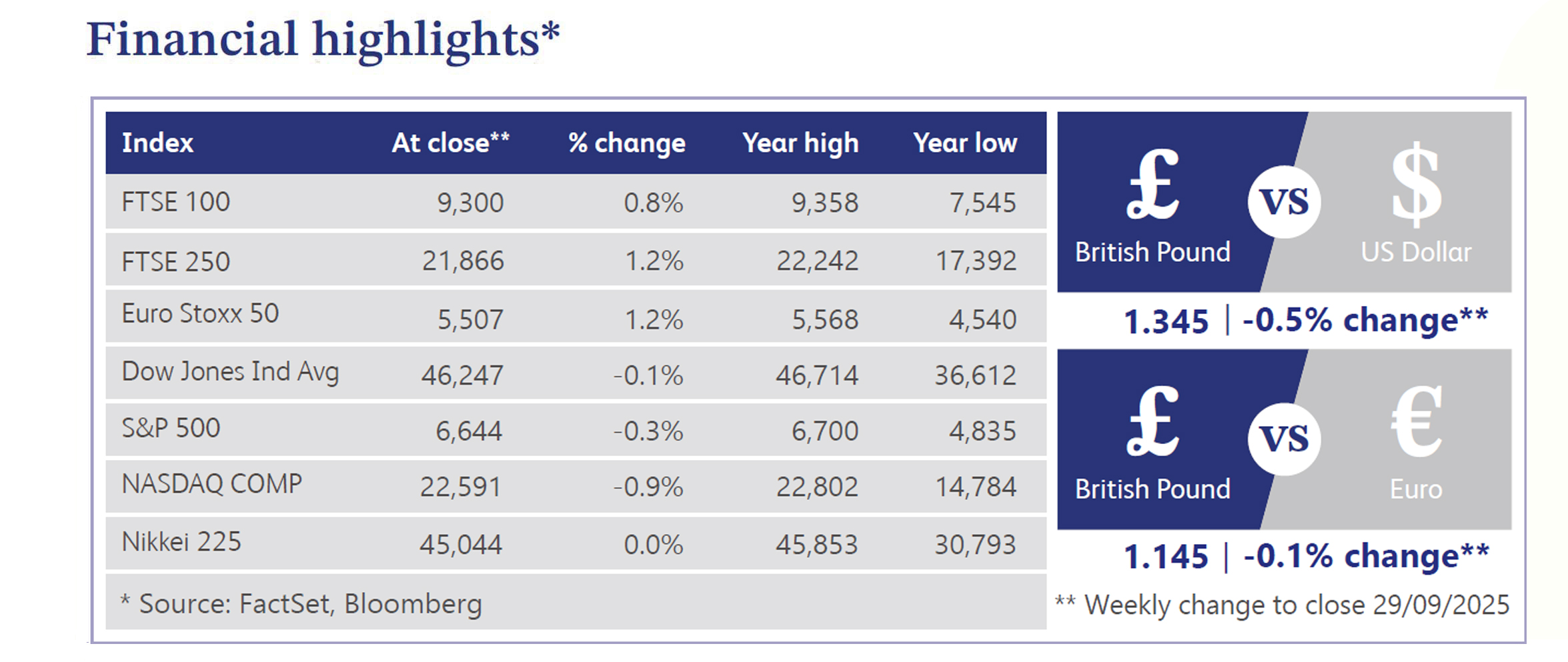

Global markets were mixed last week, with the US equity market ending lower. Investor optimism regarding the pace of future interest rate cuts was dampened by hawkish comments from several Federal Reserve ("Fed") officials. The S&P 500 finished the week lower, while the technology-heavy Nasdaq Composite fared worse, falling 0.9%. The Russell 2000 Index also registered its first weekly loss since early August. Fed Chair Jerome Powell noted on Tuesday that the economy is in a “challenging situation” due to near-term inflation risks and downside labour market risks. He also acknowledged that “equity prices are fairly highly valued.” Other regional Fed officials echoed these concerns, cautioning against further monetary policy easing amid persistently high inflation. Despite this, within the S&P 500, the energy sector rallied, advancing alongside oil prices in response to President Donald Trump’s call for European Union nations to cease purchases of Russian oil and gas. Most other sectors declined.

On the data front, the Fed’s preferred inflation measure, Core Personal Consumption Expenditures (“PCE”), remained steady, rising 0.2% from the previous month. On a year-on-year basis, the index rose 2.9%; both readings were in line with expectations. The second quarter estimate of gross domestic product (“GDP”) growth was revised upwards to an annual rate of 3.8% from the prior estimate of 3.3%, primarily driven by higher consumer spending. Meanwhile, S&P Global reported that its Flash US Manufacturing Purchasing Managers’ Index (“PMI”) for September stood at 52, down from August’s 53 but slightly ahead of consensus estimates. The services PMI also declined modestly to 53.9 from 54.5 in August. With both readings still signalling expansion, Chief Business Economist at S&P Global Market Intelligence, Chris Williamson, noted that the data are “consistent with the economy expanding at a 2.2% annualised rate in the third quarter.” However, with stronger-than-expected economic data and hawkish Fed commentary, US Treasuries generated negative returns, as short and intermediate term yields increased. The dollar remained unchanged over the week, while Brent Crude oil settled at $67.50 per barrel.

In the UK, the FTSE 100 rose 0.8%. However, the UK’s Composite PMI fell to 51 from a 12-month high of 53.5 in August. Activity in both the services and manufacturing sectors slowed, with manufacturing output declining at the fastest rate since March. Business confidence fell to the lowest level since June, reflecting uncertainty ahead of the November budget.

Elsewhere, the Eurostoxx 50 increased by 1.2%. The eurozone economy maintained a modest pace of growth in the third quarter, with an early reading of the Eurozone Composite PMI Output Index rising to a 16-month high of 51.2 in September from 51 in August. Services activity grew at the fastest pace this year, while manufacturing output expanded at a slower rate. Japanese equities ended the week fairly flat. Expectations of a near-term interest rate hike by the Bank of Japan (“BoJ”) were tempered by a lower-than-expected Tokyo area consumer inflation print.

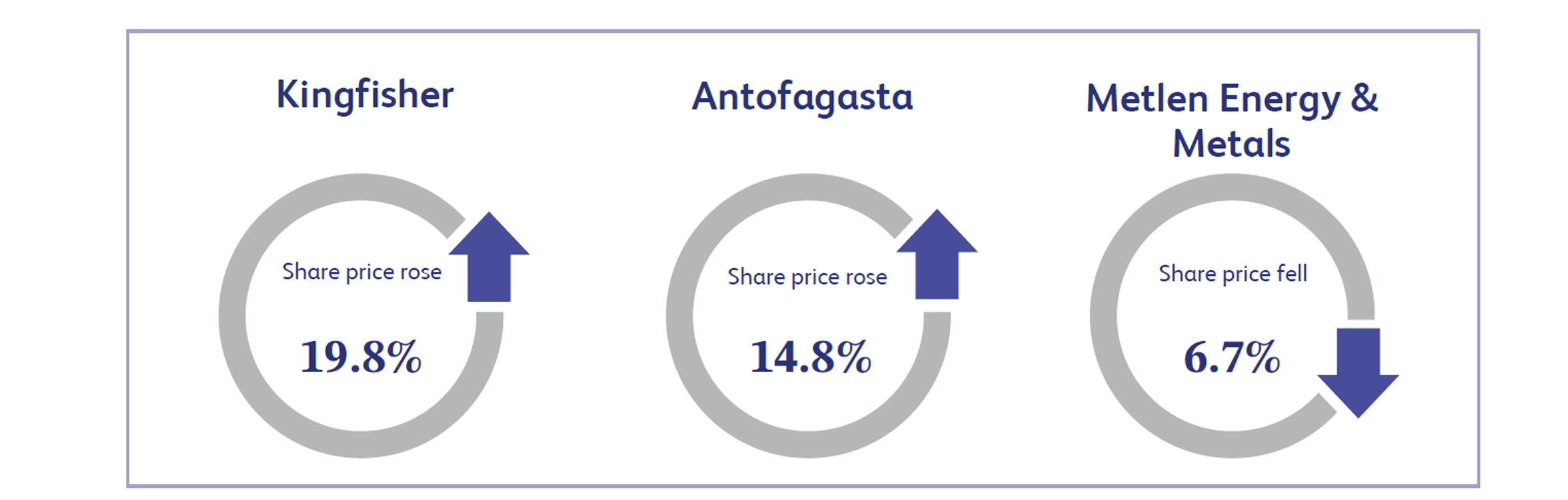

Kingfisher, the British owner of home improvement retailers including B&Q and Screwfix, recorded a notable share price increase of 19.8% following the release of its first half results. Although like-for-like growth remained largely stable at 1.9%, the outperformance was primarily driven by pre-tax profit rising 10%, above market expectations. This improved profitability was attributed to enhanced cost controls implemented by management. Management expects free cash flow to increase to at least £480 million this year. Furthermore, the company signalled confidence in its financial position by announcing intentions to complete its £300 million share repurchase programme by March, ahead of previous projections.

Antofagasta, the UK-listed Chilean mining company, experienced a sharp increase in its share price of 14.8% last week. The catalyst for the move was a sudden spike in global copper prices, which was sparked by news of supply disruptions across the market. Sentiment was further buoyed by warnings from US competitor Freeport-McMoRan regarding lower output from its mines. As a leading copper producer, Antofagasta's profitability is highly sensitive to the price of the metal, leading investors to anticipate higher future revenues and profits. This positive price action was reinforced by several analysts posting a consensus positive rating on the stock.

Metlen Energy & Metals, the recently added FTSE 100 energy and industrial group, saw its share price decline 6.7% last week. The stock has been under continuous pressure since its disappointing first half results were published earlier in the month. The report showed pre-tax profit was down 16% to approximately €291 million. This reduction in earnings occurred despite a robust 45% increase in sales. Weaker profitability, largely attributed to increasing costs, continues to weigh heavily on overall investor sentiment.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.