7 October 2025

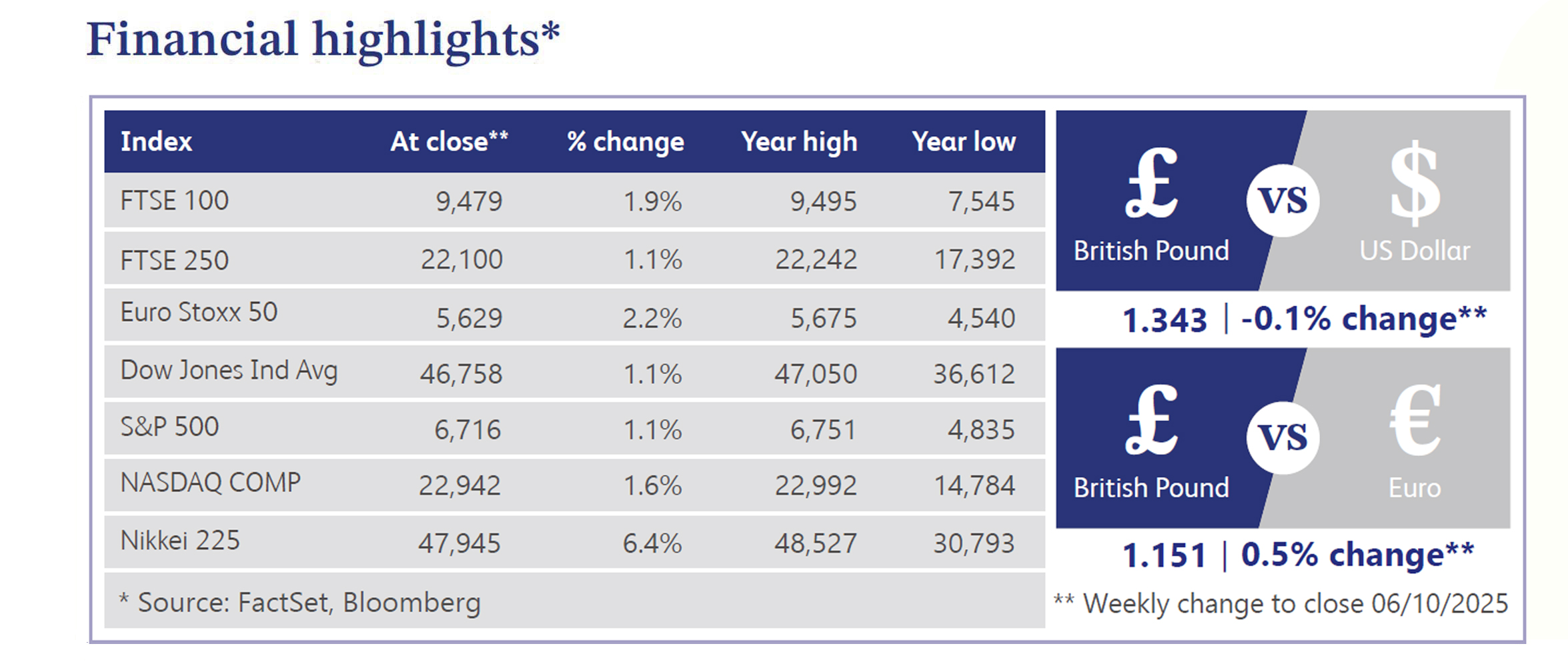

This week US equities recovered their losses from the prior week. The S&P 500 and Nasdaq reached new record highs, with broad-based gains across the market. Small-cap stocks, as measured by the Russell 2000 Index, outperformed the broader market, signalling a renewed investor appetite for riskier assets. Headlines were dominated by the partial US government shutdown, which began after funding lapsed. Markets largely shrugged off concerns about the economic impact. However analysts noted that the current political gridlock could lead to a longer than average shutdown this time around.

In a classic "bad news is good news" environment, equities appeared to draw support from a weaker-than-expected labour report. The private payrolls report for September showed a loss of jobs, the weakest reading since March 2023, reinforcing the softening labour market momentum. While the Institute of Supply Management (“ISM”) Manufacturing index was broadly in line with expectations, the ISM Services index missed its mark, with a decline in employment further supporting the case for monetary easing. Despite some Federal Reserve (“Fed”) officials striking a more cautious tone, the market is currently pricing in a greater than 90% probability of two additional rate cuts this year.

West Texas Intermediate (“WTI”) crude oil dropped over 7% after the Organization of the Petroleum Exporting Countries (“OPEC+”) signalled that it would boost production in November. Gold gained more than 3% to extend its strong year-to-date run, while copper jumped over 7%. The bond market saw a rally as well, with US Treasury yields decreasing across the curve, driven by the weak labour market data.

The UK’s FTSE 100 closed the week higher. The Bank of England is unlikely to provide further policy support in the near term, as inflation expectations remain elevated even as hiring intentions have dropped. The UK's fiscal outlook remains a key concern, with Chancellor Rachel Reeves facing a significant gap in public finances. While the Chancellor has recommitted to fiscal rules and dismissed raising income tax, payroll tax, VAT or corporation tax, the government will still need to implement sizable tax and spending measures. Meanwhile, the UK housing market showed mixed signals, with mortgage approvals dipping over the summer while house prices rebounded in September.

In Europe, the Euro Stoxx 50 increased, supported by a rally in technology stocks and expectations for lower US borrowing costs. However, the index was down on Monday after the newly elected French Prime Minister, Sébastien Lecornu, resigned after less than a month, citing a failure to reach a compromise with other parties to pass the budget. Eurozone headline inflation accelerated to 2.2% in September, from 2% in August, driven by rising services costs. European Central Bank (“ECB”) President, Christine Lagarde, noted that with policy rates at 2%, the bank is well-placed to respond to any new shocks, even as markets price in a less than 50% chance for another rate cut by the middle of next year. Japanese equities ended the week positive. Bank of Japan Governor, Kazuo Ueda, confirmed the central bank remains on a path to higher interest rates but provided few clues about the timing. He noted that US tariff volatility has weighed on Japanese exporters' earnings, but there have been no signs of broader economic effects.

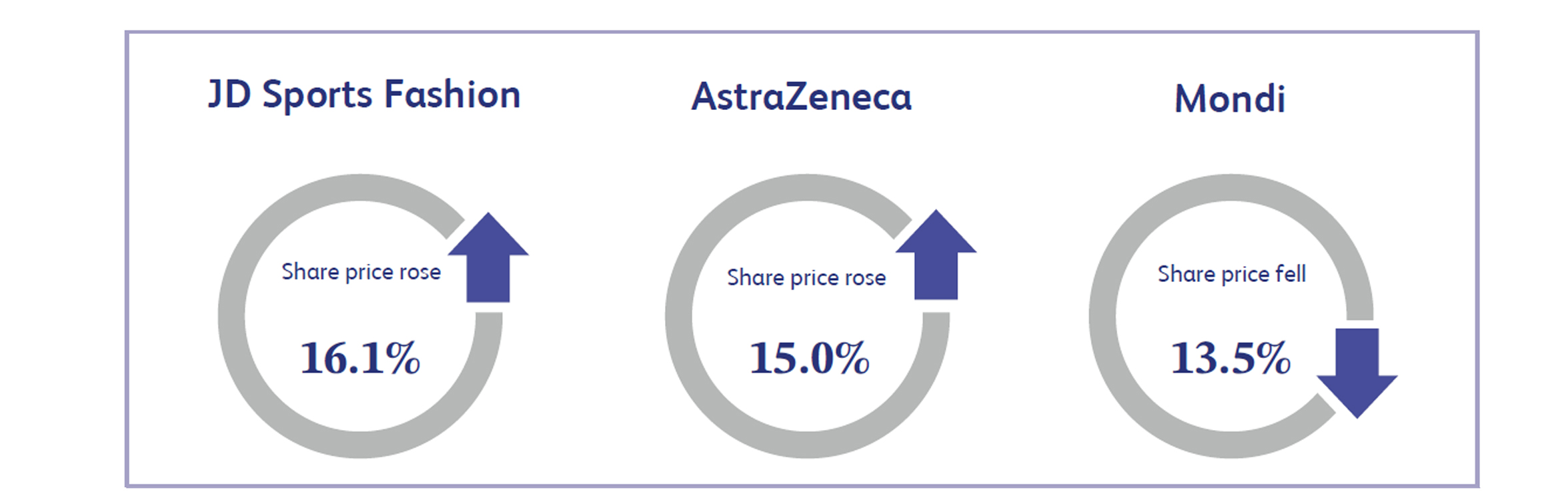

JD Sports Fashion, the UK-listed sports retailer, saw its share price increase by 16.1% last week. The rally was driven by renewed investor confidence and a positive "read across" from upbeat quarterly results from its key supplier, Nike. While the company's interim results showed like-for-like sales were down 2.5%, JD Sports’ long-term growth strategy is on track, as evidenced by its revenue and pre-tax profit being up due to strategic acquisitions. The company also announced a new £100 million share buyback programme, signalling management's belief that the stock is undervalued.

AstraZeneca, the British-Swedish multinational pharmaceutical and biotechnology company, saw its share price rise 15% last week. The surge was driven by its plan to elevate its New York listing to be on an equal footing with its primary London listing. This move comes as President Trump increases pressure on the pharmaceutical industry to invest in the US, a market that accounts for nearly half of AstraZeneca’s sales. By retaining its primary London listing, the company will remain subject to UK regulatory standards. The company has also announced plans to invest $50 billion in the US to help shield it from potential tariffs.

Mondi, the multinational packaging and paper group, saw its share price plunge by 13.5% over the past week. The decline was triggered by a disappointing third quarter trading update. The company's underlying earnings before interest, taxes, depreciation, and amortization (“EBITDA”) came in well below analysts’ expectations at €223 million. The poor performance was primarily attributed to weak demand, lower paper prices and a gloomy outlook for the remainder of the year. Mondi warned that challenging trading conditions are expected to persist, with demand confidence remaining fragile and markets still in oversupply.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.