14 October 2025

The UK economy continued to show signs of strain this week as growth indicators stayed subdued and business confidence weakened. The construction Purchasing Managers' Index rose slightly to 46.2, though activity remained weak amid soft residential and civil engineering output. Business sentiment fell to a three-year low, weighed by tax and inflation concerns, while footfall and retail demand declined. Labour market data revealed slowing wage growth and rising candidate availability, reinforcing softer employment conditions. The Bank of England (“BoE”) warned of risks from stretched artificial intelligence-related (“AI”) valuations, while policymakers Catherine Mann and Huw Pill stressed the need for restrictive policy to ensure inflation returns to target.

The UK fiscal outlook remained under pressure ahead of November’s budget, as the Treasury criticised “wasteful spending” and stagnant productivity following the Office for Budget Responsibility’s latest forecasts. Reports suggest the watchdog’s downgrade to productivity could widen the fiscal gap by billions, with JP Morgan warning Chancellor Rachel Reeves may need £50 to £80 billion in new taxes during this parliamentary term to stay within fiscal rules. Major investors, including Pimco and BlackRock, urged Reeves to build a larger fiscal buffer than the current £9.9 billion, while the International Monetary Fund echoed similar concerns. Meanwhile, a £3 billion VAT correction offered limited relief. The Treasury has tightened access to emergency reserves, and debate continues over potential income tax rises, despite new data hinting at stronger underlying productivity.

Top UK fund managers urged the BoE to halt gilt sales, warning they are straining government debt and fuelling a negative feedback loop of higher borrowing costs and fiscal pressure. Meanwhile, London’s initial public offering momentum strengthened as digital bank Shawbrook announced a planned £2 billion listing, adding to a flurry of new floats. BoE Governor Andrew Bailey called for a “supportive investment environment” to unlock innovation-led productivity gains from AI and green technology. Separately, UK investors withdrew a record £3.64 billion from equity funds in the third quarter, while Rachel Reeves seeks to revive listings amid renewed concerns over shadow banking risks flagged by the FCA.

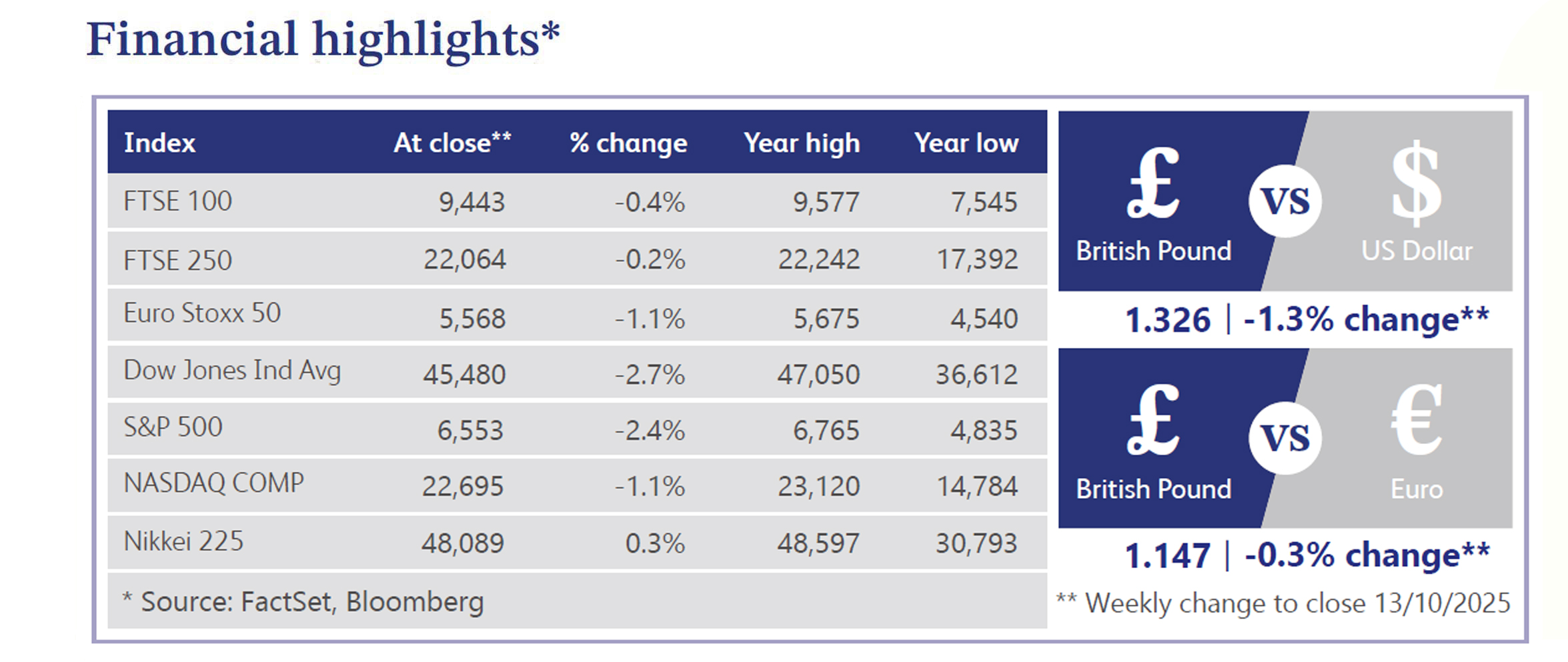

US equities fell for the week, with the S&P 500 and Russell 2000 posting their worst performances since May, while the Nasdaq saw its weakest since April. Losses were driven by trade tensions after President Trump threatened higher tariffs on China and cancelled plans to meet President Xi. Tech and consumer stocks led declines, though AMD (+30.5%) outperformed on AI optimism. Treasuries rallied, the dollar gained 1.3%, and gold hit a record above $4,000/oz. AI enthusiasm faded amid profit concerns, while labour market weakness, sticky inflation and fiscal uncertainty added to caution. The government shutdown extended into another week.

The Halifax house price index fell 0.3% month-on-month, pointing to lingering housing market softness despite lower mortgage rates. Binding contracts may be introduced to prevent vendors from withdrawing, potentially shortening transaction times. Meanwhile, the Royal Institute for Chartered Surveyors also reported subdued market activity, with sales expectations falling in September, the first negative reading in two years, and new buyer enquiries declining for a third consecutive month, reflecting weakening demand across most regions.

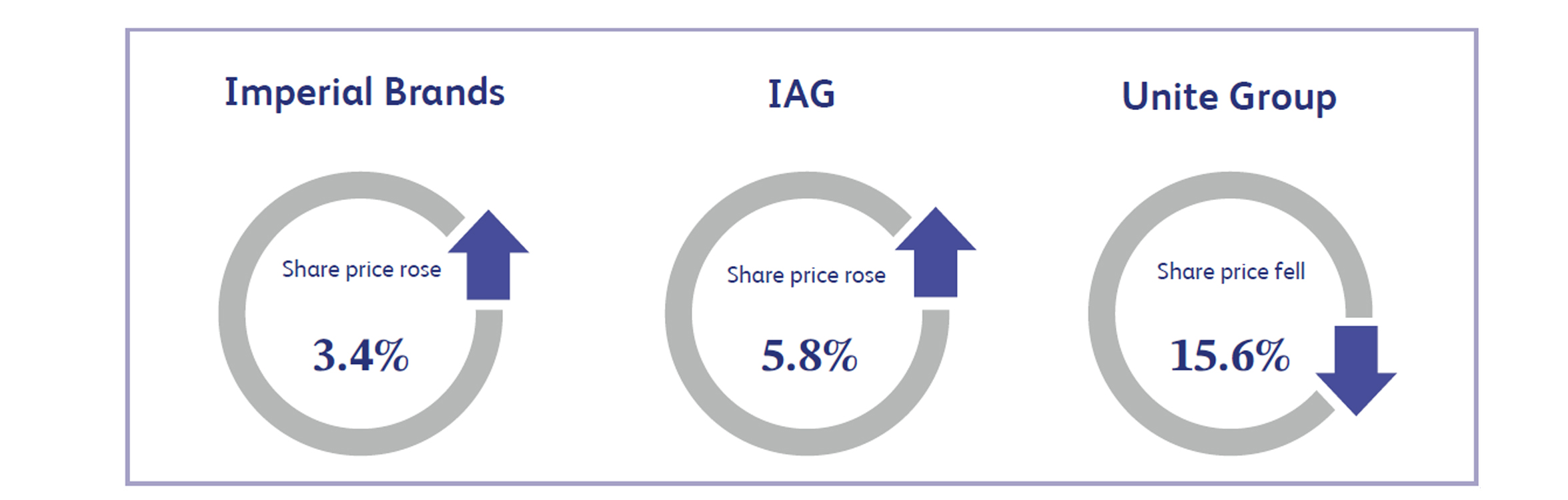

Imperial Brands is a UK-based tobacco company producing cigarettes and next generation nicotine products. Shares rose 3.4% after the company announced a £1.45 billion share buyback plan and reaffirmed its annual growth targets. The firm expects low-single digit revenue growth for both tobacco and next-generation products at constant currency, with adjusted operating profit growth matching last year’s pace. Strong pricing power and rising demand for smoking alternatives underpinned investor confidence, signalling the company’s ability to sustain earnings despite broader market pressures on traditional tobacco products.

IAG, which operates British Airways, Iberia, Aer Lingus and Vueling, gained 5.8% as airline stocks broadly rallied on optimism around travel recovery and growth in key markets. Shares were further supported by positive sentiment around IAG’s potential acquisition of a stake in Portuguese airline TAP, reflecting investor expectations that a strategic move could enhance its network and exposure to high-growth regions such as Brazil and Africa. Investors responded positively to IAG’s strategic positioning to integrate TAP, potentially enhancing scale, competitiveness and geographic diversification across South America, Africa, Europe and North America.

Unite Group, a UK-focused student accommodation provider operating purpose-built student housing across major cities, was down 15.6% after a trading update. Despite reporting a 95% occupancy rate and 4% rental growth, results underperformed last year’s 97.5% occupancy and 8.2% rental growth. The decline is largely due to fewer rooms being sold to UK students, who are more affected by affordability pressures, while sales to international students remained stable. Increased competition in regional cities also weighed on performance. Investors are monitoring how Unite adapts to new supply and shifting student demand in the wider student accommodation market.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.