28 July 2020

Bond markets made the news last week when 5-year US Treasury yields hit an all-time low of 0.26%, and the benchmark 10-year yield traded just a whisker above its 2020 lows. UK government bonds also hit record lows, with the 10-year gilt yield touching 0.12% during the week. While it’s not easy to disentangle genuine price action from the effects of central banks’ quantitative easing programmes, it’s probably safe to say that bond markets don’t believe in a V-shaped recovery. Very low bond yields signal very low expectations for economic growth - not unreasonably given record unemployment, company profits crashing, huge contractions in economic growth, unprecedented levels of debt and numbers of bankruptcies, plus world trade in disarray. The price of gold, another safe haven, told the same story as it reached all-time highs during the week, closing yesterday at $1,942 per ounce.

Despite lacklustre performance over the past week, the world’s stockmarkets do not recognise this picture, and hover in many cases around their highs for the year. If you’re waiting for this gap in expectations between bonds and equities to close, don’t hold your breath: when the gap last opened up, in February, it took a once-in-a-century global pandemic to close it, and that only lasted a couple of months. Moreover, equity investors can take comfort from comments characterising the US government’s strategy towards the stockmarket by Nancy Pelosi, Speaker of the House of Representatives (from an interview with CNN): “they're bolstering the stock market… there's a floor to the stock market. Everybody knows it's not going below a certain place”.

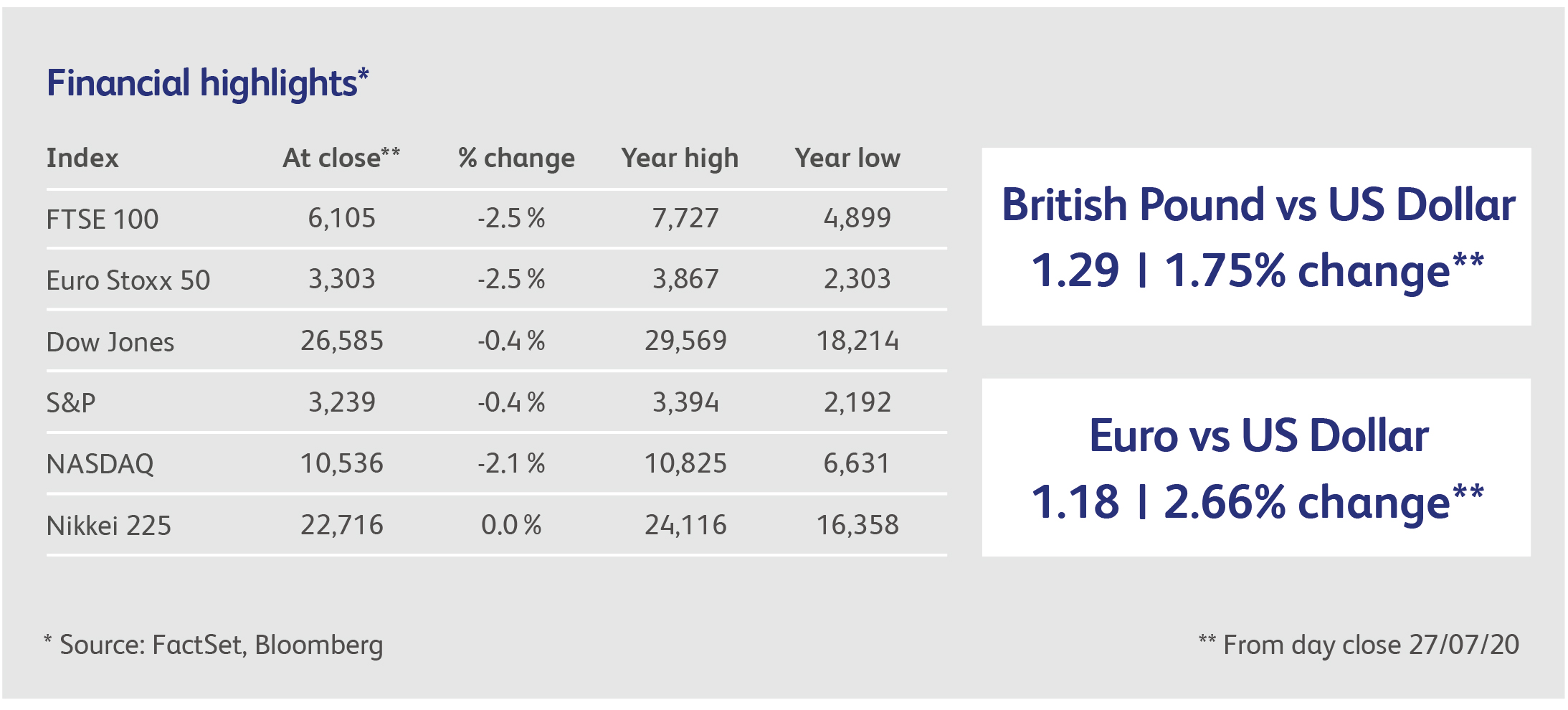

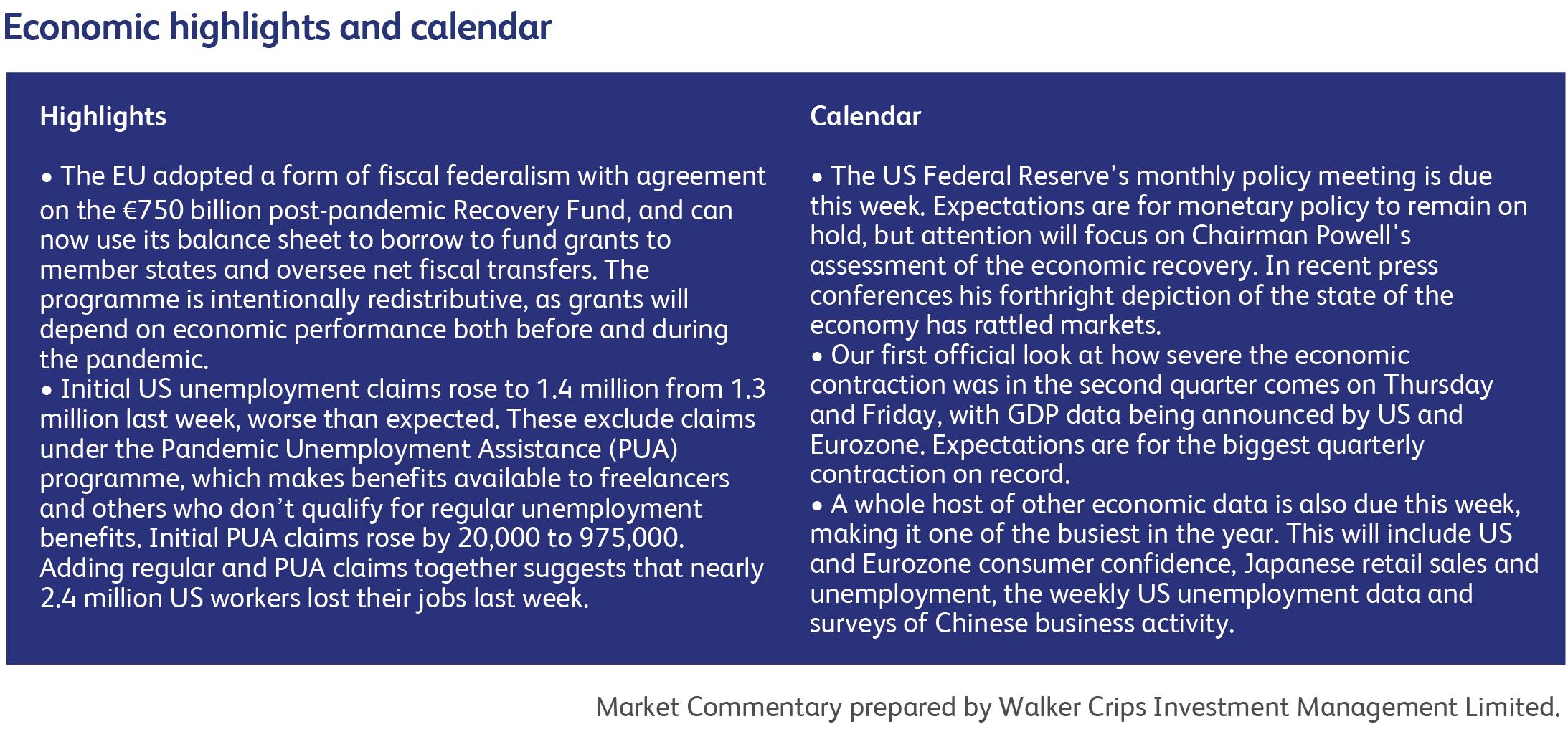

One unambiguously bright spot for investors has been the recent depreciation of the US dollar, which has alleviated the funding costs of countries and companies all over the world with debt denominated in dollars. The US dollar fell against all the major currencies last week and reached the lowest level against the Euro since October 2018. The dollar’s five-week slump on currency markets is the longest since late 2017/early 2018. The strongest major currency this year has been the Swedish krona, which often acts as a more volatile version of the Euro and has risen nearly 6% against the US dollar. Despite intervention by the Swiss National Bank, the Swiss Franc's 4.5% gain puts it in second place behind Sweden. Meanwhile, Norway sports the weakest of the major currencies, with almost a 4.7% decline, closely followed by Sterling's roughly 3.8% decline.

US-China relations frayed further, and another flashpoint was added to the already-long list, with the US ordering the sudden closure of China’s consulate in Houston. The exact reason is still unclear: the US State Department said the move was meant to "protect American intellectual property," but didn't elaborate. A top US diplomat for East Asia claimed the consulate was being used by the Chinese military to send spies into US universities. Senator Marco Rubio, who sits on the Foreign Relations Committee, called the facility a "massive spy centre." China responded by ordering the closure of the US consulate in Chengdu. In a week in which Spain reported hotel bookings in June down 95% from the previous year, the UK delivered another blow with the sudden imposition of quarantines on travellers from Spain. This is in response to a marked increase in Spanish Covid-19 cases, even after a hard and long lockdown. The tourism industry represents about 12% of the Spanish economy. Israel, Australia & Japan are also struggling to contain new outbreaks after long periods of apparent control.

Ryanair restricted its losses to a relatively modest €185 million for the quarter to June after managing to reduce operating costs by 85%. Government wage-support programs helped, and the Irish company’s workers took pay cuts to limit the number of permanent layoffs. Ryanair is offering 60% of its normal European schedule in August and 70% in September. Ryanair’s management said a second wave is its “biggest fear.” Ryanair's share price dropped 4% the day after news of Britain’s decision to impose a 14-day quarantine on holidaymakers returning from Spain. Low-cost rival EasyJet dropped 8% on the news.

Luxury conglomerate LVMH’s profit from recurring operations totalled €1.7 billion in the first half of the year, less than the €2.3 billion analysts expected. Revenue fell 38% on an organic basis in the three months through June, while the company reduced operating costs by 29%. LVMH still expects to make its planned purchase of Tiffany & Co.

The US is opening a national security investigation into TikTok, the popular lip-syncing and music video app that already has more than 500 million users. TikTok is owned by Chinese company ByteDance, and US authorities are worried about how that company handles the data it gathers on its 26 million US-based users, most of whom are under 25 years old.

Pfizer Inc. and BioNTech SE began a later-stage trial for their top coronavirus vaccine candidate and set an ambitious goal of submitting it for regulatory review as soon as October. The trial will involve up to 30,000 patients aged 18 to 85. The companies had previously announced positive data out of a different vaccine candidate, which had generated an immune response in early-stage trials.

This week will be a big one for corporate earnings announcements, with nearly 40% of the companies in the S&P 500 Index reporting. Thursday is worth keeping an eye on, with Amazon, Apple and Google all reporting after the US close.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.