15 September 2020

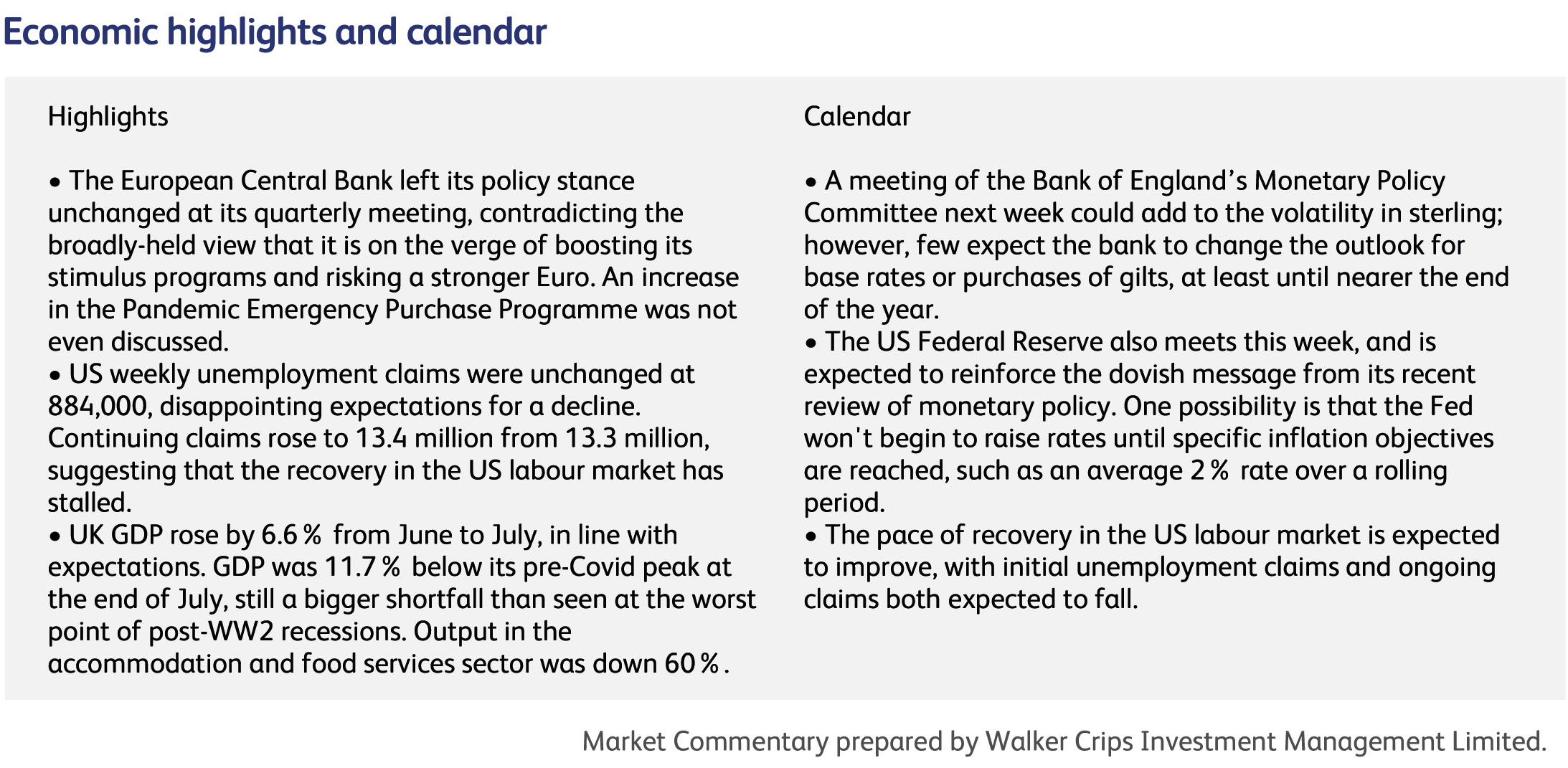

Stock markets appear to have weathered the bumpy ride of the last two weeks and, technology companies aside, have recovered most of their losses. This has happened despite the lack of a new pandemic stimulus programme in the US, an accumulation of polling evidence for a democratic victory in the US elections, a huge falling-out between the UK and the EU on Brexit, a rise in Covid cases across most of Europe, and the downward spiral in relations between China and the US.

There is now little prospect of a new stimulus package being passed in the US this side of the election: Republicans, White House and Democrats differ not only on the size, but also the details, and there are just a few weeks of legislative time on the calendar before Congress adjourns. With benefits declining for some of the 28 million people either formally unemployed or using a pandemic programme to sustain their income, the US recovery will lose momentum.

The latest Brexit furore looks set to surpass previous episodes in drama and high stakes. The most important issue, economically, is the question of state-aid. The EU wants a level playing field in labour and environmental regulation that would make it safe to give the UK tariff and quota-free access to its internal market for goods. The UK government has yet to publish

its proposed new state-aid regime, but has indicated that it wants maximum freedom to subsidise domestic companies and, indeed, that it may even do away entirely with domestic constraints on state aid. Inconveniently, the Withdrawal Agreement provides that, in a no-deal scenario, the Northern Ireland protocol would leave the UK bound by EU state aid law to the extent that it has any, even an indirect, effect on business in Northern Ireland.

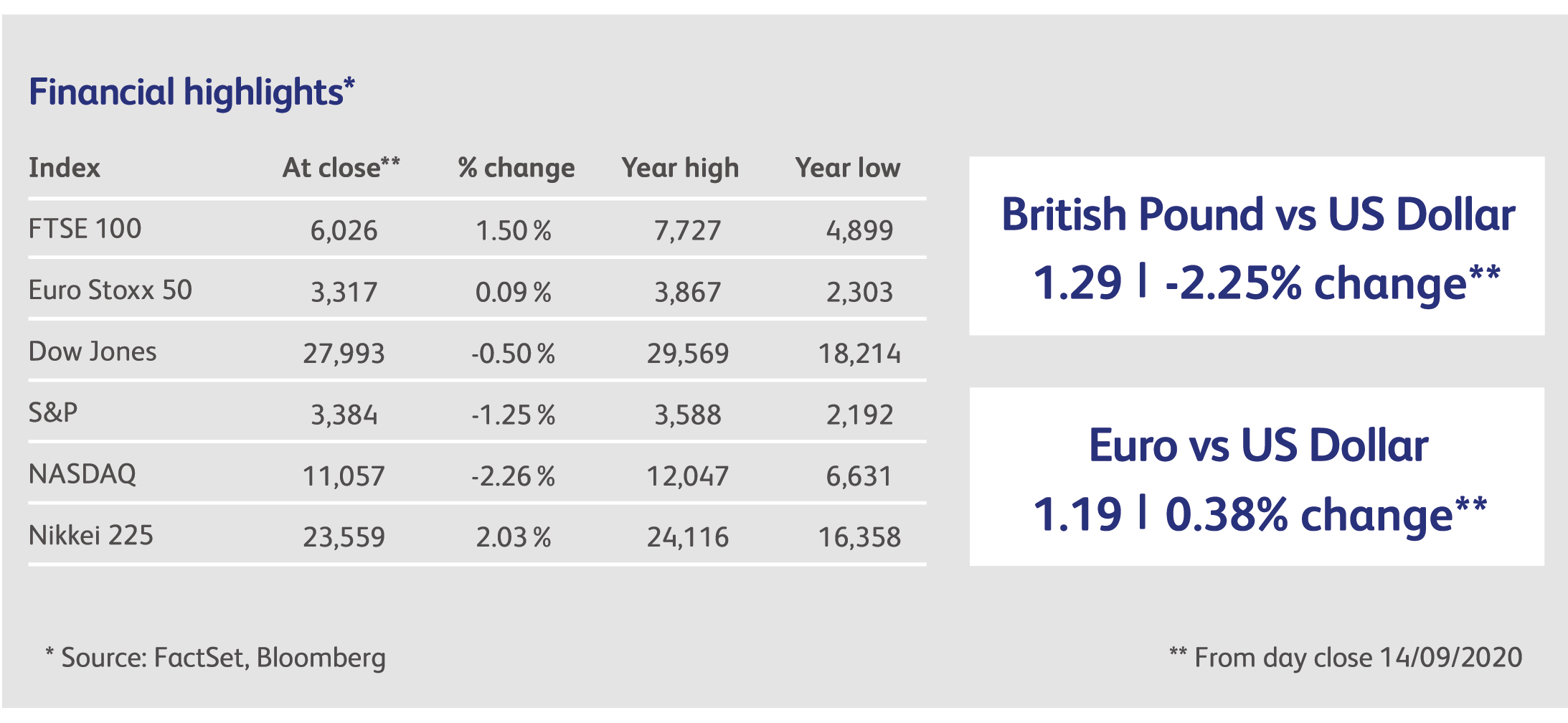

The most visible impact in capital markets has been the weakness in Sterling, falling from nearly $1.35 to, currently, above $1.28. It's a similar story against the Euro, where the pound is now in danger of retesting its all-time lows. Currency markets are effectively anticipating lower UK growth and more dovish monetary policy. Declining UK government bond yields support this view. But at least there is a plan: newspapers reported that the UK government plans to arrest any potential economic impact through the state-directed creation of "trillion-dollar" technology companies.

The return of the virus in the Eurozone has been relatively manageable, with lower hospitalisation and death rates. The jump in new cases can be explained by a significant increase in testing activity across the entire population and, moreover, public authorities are now using more-efficient local lockdowns to manage the spread. Nevertheless, local lockdowns still impose an economic cost, and even a behavioural shift in response to a Covid-19 resurgence can still be significant. Real-time indicators of economic activity fell significantly throughout August in Spain and France, consistent with their faster rates of increase in new virus cases, and there is a real risk that the recovery lost momentum. In any case, with the return of children to schools and students to universities, all these assumptions are about to be tested to the limit.

In Japan, Yoshihide Suga won the vote to replace Shinzo Abe as leader of the Liberal Democratic Party and is now prime minister in all but name. His victory was widely expected and is unlikely to change the course of economic policy, his having confirmed immediately after the vote that the country needs to "inherit and facilitate policies promoted by Prime Minister Abe".

Unsurprisingly, companies in Silicon Valley have been among the earliest adopters of voluntary working-from-home, but they are baulking at allowing their employees to actually move away from Silicon Valley. At software maker VMware, employees who take up the company's offer to become permanent remote workers will get a pay cut if they move away from Silicon Valley to less-expensive areas. Financial news service Bloomberg reported that employees who work at VMware's Palo Alto, California, headquarters and go to Denver, for example, must accept an 18% salary reduction. Leaving Silicon Valley for Los Angeles or San Diego means a reduction of 8%. Facebook and Twitter are among the other technology companies that have put in place, or are considering, similar pay policies. Facebook has publicly said it may cut employees' salaries depending on where they choose to move.

JP Morgan Chase wants employees to return to the office: management reported that the bank experienced a loss of productivity on Mondays and Fridays among employees working from home. That, along with worries that remote work lacks creative interactions, is why the biggest US bank is urging more workers to return to offices over the coming weeks.

ARM Holdings, the UK-based computer chip designer, which Japanese conglomerate Softbank Group bought only four years ago is to be sold to Nvidia Corp. in a $40 billion deal. Under the terms of the deal Softbank Group are set to receive $21.5 billion in common stock from Nvidia Corp and $12 billion in cash, with additional cash payments in the future if certain financial performance targets are met. It has been greeted with opposition and unease in the chip industry as ARM Holdings supplies and designs intellectual property to most of the global semiconductor industry, licensing its technology to customers such as Intel Corp, Samsung Electronics Co Ltd and Qualcomm Inc, who increasingly compete with Nvidia Corp.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.