20 July 2021

There appears to be growing discord amongst the world’s central banks. Where once they acted in perfect harmony to prop up financial markets in their hours (and weeks… and months… and years) of need by providing vital life support, they now differ in their assessments of when exactly to stop the music (or at least lower the volume) and turn from “dovish” to “hawkish”.

There have been hawkish tones emanating from the Bank of England; the Reserve Bank of New Zealand has called an end to its quantitative easing programme; and the second largest economy in North America (Canada) has actually started to taper its asset purchase programmes. Despite the seemingly rising tide of inflation and the orderly queue of central bankers heading for the lifeboats, the Fed’s Jerome Powell unsurprisingly decided to once again stay on deck and say the labour market “still has a long way to go”. Having said that, whilst he also stood firm on his assertion that inflation is going to be transitory, at the same time he arguably gave markets some food for thought when he conceded that there remain a lot of unknowns and the Fed is “ready to act if needed”.

The Fed may be the biggest of ships and its ability is in no doubt, but how long it continues to be willing to chart its current course is open to debate, despite Powell’s repeated reassurances.

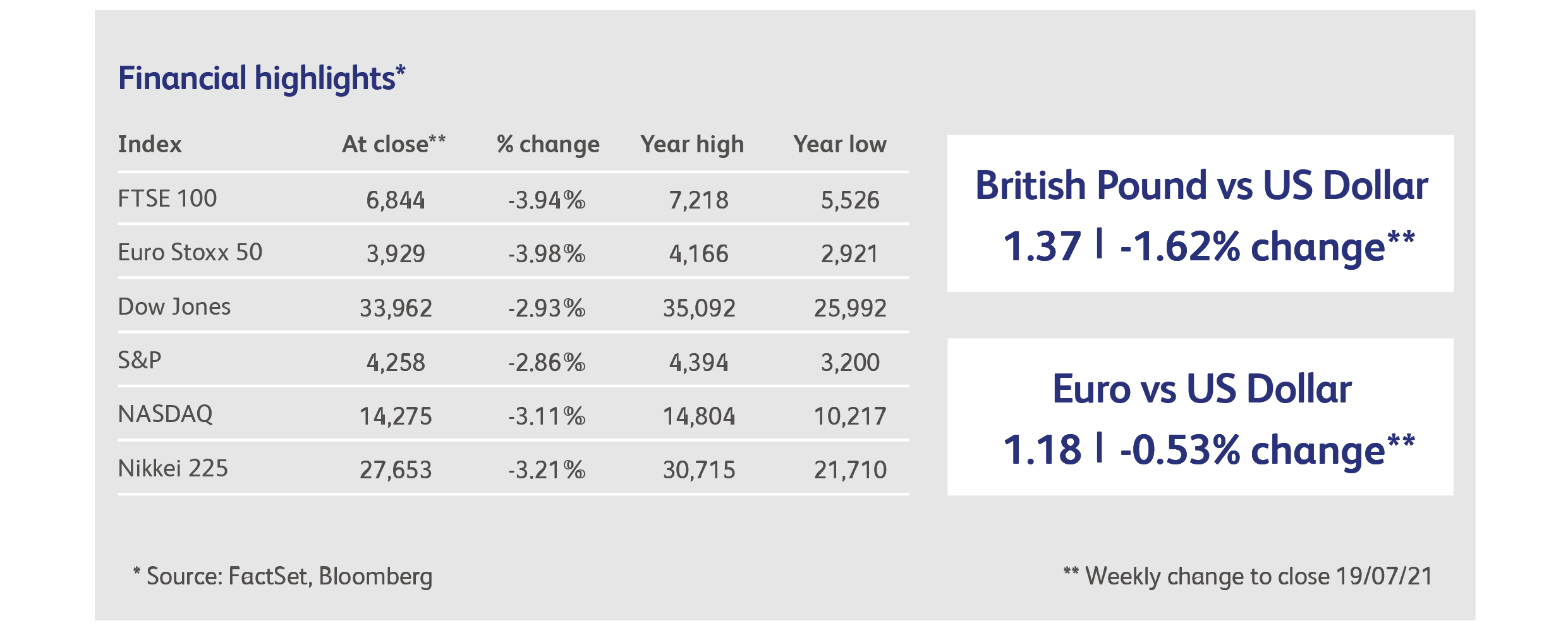

Indeed, global stocks suffered a wobble last week (which continued into this week) caused by a combination of inflation concerns and the spread of the coronavirus Delta variant. Despite a backdrop of relatively strong earnings, markets are inherently forward-looking discounting mechanisms and uncertainty is something that they can and will discount. Heavily.

Markets perhaps took last week’s reading from the University of Michigan’s Consumer Sentiment Index as somewhat of a warning shot. The Index has been seen as a bellwether for US consumer confidence for many years and when the reading of 80.8 came in for July (against a Bloomberg median projection of 86.5 and a reading of 85.5 in June), markets did not hesitate to react accordingly. It seems that some investors are waiting by the door as they may be keen to leave the party before the music stops.

In other news, the decision by OPEC+ to raise oil supply caused the price of black gold to slide and suffer its biggest one day $ price drop since March.

Reports suggest that more than 330 (mainly unvaccinated) Americans are still dying each day from Covid-19 (which is more than the number of Americans dying from a combination of influenza, gun crime and car accidents, according to Bloomberg). This backdrop of statistics caused US President Joe Biden to claim that social media platforms such as Facebook are “killing people” by spreading false information about Covid-19 vaccines. Whilst Mr Biden has since attempted to water down his remarks, it is perhaps another sign that he is not afraid to challenge America’s big tech companies if and when he thinks they deserve to be challenged.

Bill Ackman’s London-listed Pershing Square Holdings suffered a blow and saw its shares retreat over 4% in one day as he was forced to water down his plans to buy a $4bn stake in Universal Music Group via a SPAC (Special Purpose Acquisition Company) that he had set up in order to do the said deal. Concerns from the US securities market regulator (the Securities and Exchange Commission) as well as his own investors, forced the activist fund manager to change his plans and instead look to buy a 10% stake via Pershing Square.

Staying on the SPAC theme, it has been reported that Ermenegildo Zegna (the Italian luxury fashion brand) is planning to list on the New York Stock Exchange via a SPAC and will have an expected market value of $2.5bn. The family-owned business is keen to expand in both China and the US and they believe the listing will help them to achieve that by not only raising its profile but also raising vital funds with which to selectively add niche labels to its stable of menswear brands.

Highlights

There were signs of life in Japanese inflation as consumer prices rose for the first time since August 2020. Whilst posting only a modest 0.2% year-on-year increase in June, the fact that even Japan’s prices can be woken from their slumber is perhaps a sign of just how far-reaching the vaccine-induced consumption/inflationary pressures really are.

The Chinese Central Bank confounded expectations for a cut by maintaining its benchmark interest rate at 3.85%. Markets had been primed to expect a first cut in 15 months after last week’s news of the cut in the reserve requirement ratio (RRR) for banks. The move on RRR was seen by many as a bid by the authorities to support small and medium-sized companies and ultimately prevent the country’s recovery from the pandemic from stalling.

Calendar

All eyes will be on the ECB on Thursday as it holds its monetary policy meeting. ECB President Christine Lagarde has promised that the Bank will review its forward guidance and communicate in a different – perhaps clearer - way going forward (specifically, they will adopt a new 2% inflation target over the medium term, which differs marginally but crucially from the previous target of “below but close to 2%”).

Friday sees the release of UK retail sales data for June 2021. After May’s YoY reading of +24.6% missed expectations of +29.0%, consensus expects +9.6% for the year to June. As the UK economy continues to unlock and questions of medical health continue to be debated, retail sales data may be a key indicator of the health of the economic recovery.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.