.jpg)

31 August 2021

The biggest move of the week accompanied the US Federal Reserve Chairman Jerome Powell’s speech at the annual gathering of central bankers and finance ministers at Jackson Hole. Markets had become increasingly nervous in the run-up to the speech, after several regional Fed governors gave interviews in which they argued for an immediate winding down of the Fed’s $120 billion-a-month asset purchase programme. In the event, Powell provided ample reassurance that this would not be the case. Moreover, he reiterated his view that the current bout of inflation is only temporary and, not only would the asset purchases continue in the near-term, but any “tapering” of asset purchases would not be accompanied by higher interest rates. It was a useful reminder that those governors who talk to the press outside of the Fed’s meetings are doing so because their voices are not being heard inside the meetings.

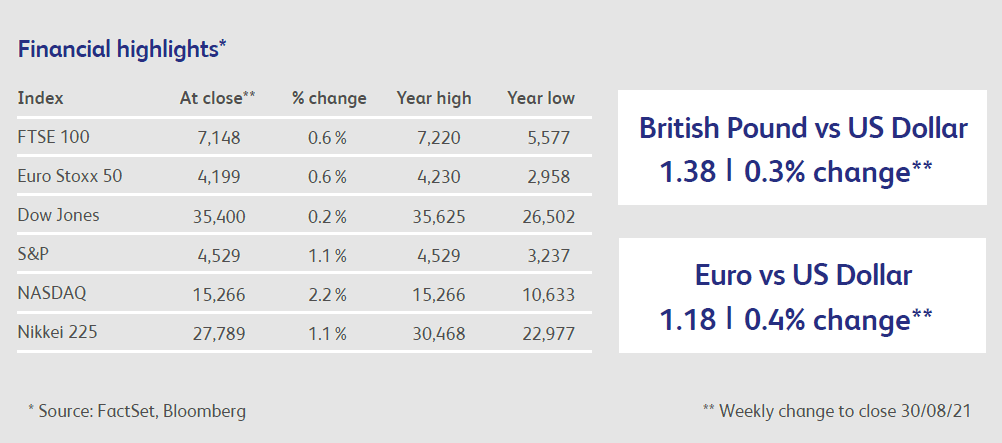

Markets rejoiced in the news that the Goldilocks scenario will last a little bit longer than thought: a big post-pandemic rebound in the economy, record levels of corporate profits, and ultra-loose monetary policy providing maximum support. US stock market indices were, naturally, the most buoyant: the S&P 500 equity index closed at a record high, as did the tech-heavy Nasdaq, and the more speculative small-cap Russell 2000 index soared by nearly 3%. Yields in the corporate bond market tightened after a period of weakness, and even US government bonds enjoyed a rally, presumably on the basis that their biggest buyer is still active. The dollar fell by half a per cent, sending dollar-sensitive emerging market equities up by a similar amount. Unlike his regional colleagues, Chairman Powell simply refuses to pick a fight with markets, even if that means running more inflation risk and further inflating asset-price bubbles. Everything is priced for perfection, but perfection is exactly what the Fed is determined to deliver.

In China, meanwhile, bubbles are most certainly being pricked. The Chinese government is taking advantage of sky-high prices and investors’ animal spirits to right a series of perceived wrongs. The online entertainment sector was in the firing line this week, with online “Fan Community” websites asked to clean up their act and prevent children from signing up. More importantly, Chairman Xi wants to level up Chinese society, and has recently been pushing the goal of “Common Prosperity”. Reading between the lines, this seems to imply that workers’ rights are going to be prioritised, and that the private sector in China, and especially the ultra-rich, will be paying more taxes. Chinese e-commerce giant Pinduoduo got the message, pledging to donate $1.5 billion in corporate profits to Chinese farmers.

The policy follows on naturally from the authorities’ recent targeting of an internet billionaire who dared to criticise Chinese regulators, and recent investigations into the shady practices of internet companies themselves. But will it work? Socially, and in terms of the Party’s authority, it looks like an attempt to reign in an industry that threatens to become uncontrollable. Economically, it attempts to address a long-running imbalance between the lack of wealth of workers and households in China, relative to its huge government sector. However, by asking the private sector to foot the bill, the policy risks undermining productivity and economic growth. From an investor’s point of view, it’s hard to avoid the conclusion that “capitalism with Chinese characteristics” is finished.

Everyone was a winner as Manchester United announced the return of Cristiano Ronaldo after more than ten years. The football club’s shares rose by as much as 9% after his transfer was announced from Italian club Juventus. Juventus’ share price also rallied upon his departure, presumably because the saving in wages is worth more than his value to the team: it is thought that Ronaldo’s current contract pays him about EUR30 million a year.

Some pandemic-era business models may already have run their course. When stay-at-home exercise specialist Peloton announced its results last week, it also disclosed a 172% increase in sales and marketing expenditure, a price cut for its cheapest exercise bike, a disappointing forecast, a subpoena by the US Justice Department for documents related to injuries on its equipment and the disclosure of a “material weakness” in its accounting. The stock fell 9%.

The UK Debt Management Office announced details of its inaugural Sovereign Green Bond (“green gilt”), which will be used to finance projects with clearly defined environmental benefits. The bond is scheduled for launch in the week commencing 20 September, and will have a 12-year maturity. The coupon is yet to be disclosed.

So-called “meme-stocks” were back in the news, after American retail investors ganged up to squeeze short positions out of Support.com, a software company specialising in online outsourcing. Retail interest in the company had begun to foment over the past month, as filings revealed an unusually large number of short positions. This week, the meme-stock crowd struck, driving the price up as much as 190% and forcing shorts to cover their positions. The company’s market value rose from $490 million to as much as $1.4 billion in a few hours. Meanwhile, the enablers of meme-stocks became the new focus of the SEC (the US securities regulator) after it announced an investigation into the “digital engagement practices” used by stock-trading mobile phone app providers Robinhood Markets and Webull Financial. As the SEC’s chairman euphemistically put it, “In many cases, these features may encourage investors to trade more often”.

Highlights

Calendar

Having benefited from the Fed’s dovishness last week, investors will be focused this week on the US employment data. The expectation is that 750,000 jobs will have been created during August, down from 943,000 the previous month. The downshift is due to the less favourable time of year and the lower impact expected from local governments. The unemployment rate is expected to fall by two tenths of a percent to 5.2%.

More Chinese business surveys, this time with a bias towards the private (rather than state-owned) sector, will be scrutinised for evidence that the slowdown in service sector activity is genuine. Investors will be gauging whether the slowdown is big enough to spur the government into another round of stimulus.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.