20 September 2022Market News The Stock Focus Dell Highlights J Calendar T Important information Thi

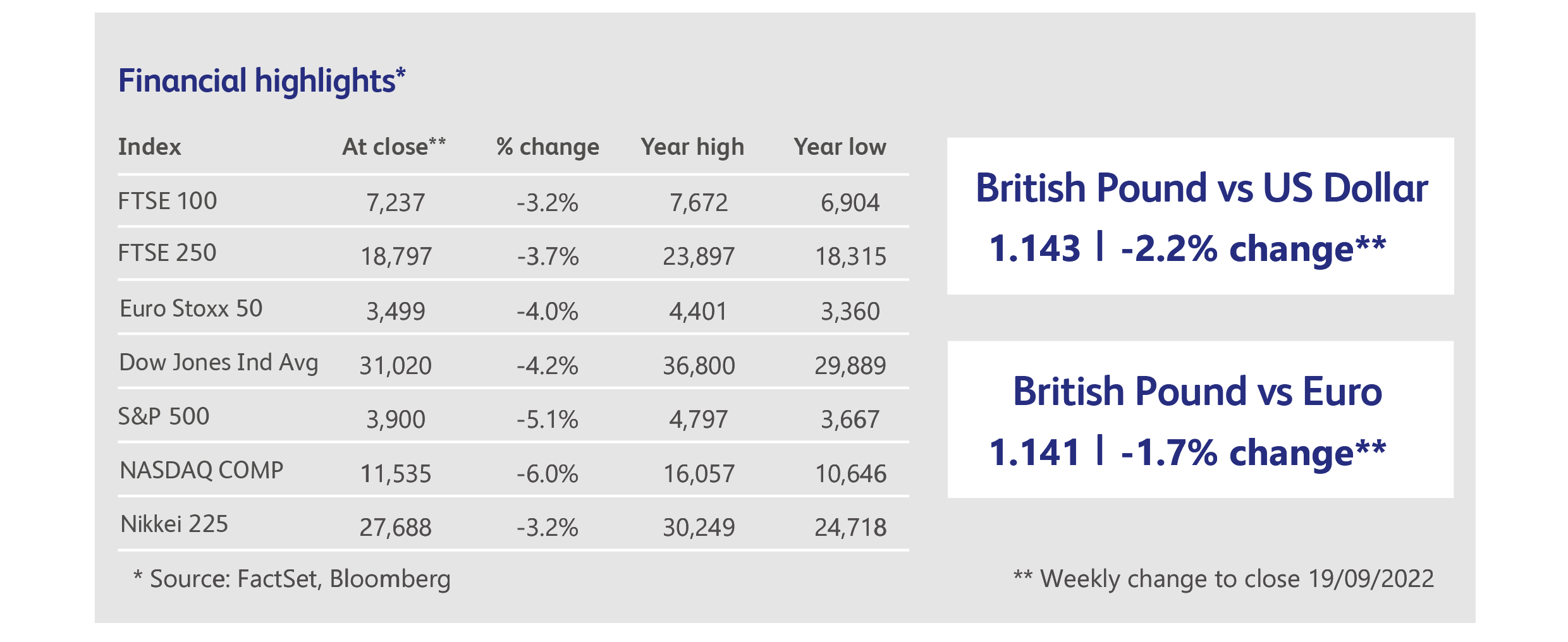

Bad inflation data from the US wiped out a promising, four-day rally with such violence that new lows for the year are looming for many assets. US inflation fell to 8.3% in August from 8.5% in July, a decline to be fair, but not the decline the market was looking for. In fact, aside from the expected moderation in food and fuel prices, there were hefty gains in goods and services as diverse as new cars and trucks, vehicle repair, dental charges and hospital services. Some optimists had been hoping for signs that inflation would soon roll over: the hope was margins would fall from their current, unsustainable levels as supply chains normalise; the strong dollar and lower inflation outside the US, especially in China, would wear down import prices; rent inflation would follow the sharp drop in house prices and rents downwards, and a gradual moderation in wage gains would reduce inflation across an array of services that are sensitive to labour costs. While few doubt the logic of this reasoning, which applies both in the US and elsewhere, the inflation figures pushed out the date that this normalisation will commence. In the short-term, meanwhile, any chance of a 0.5% hike at this week’s Federal Reserve meeting has gone.

The S&P 500 had its worst day since the depths of the pandemic, falling by 4.3%. The impact on stock markets was even worse than Fed Chairman Powell’s infamous speech of two weeks ago, which set the current downtrend running. Investors even started to price-in the possibility that the Fed could raise rates by a full percentage point at its meeting this week, which would represent the highest increase in borrowing costs since 1984. The sell-off was particularly costly for Apple, the world’s most valuable company, which lost $154bn in market value, the sixth worst loss of market value in a single day in US stock market history. Apple’s one-day loss was more than the entire market value of about 90% of companies in the S&P 500 index.

Markets had still not recovered their poise when they were rocked by a profit warning from package delivery company Fedex Corp. The profit shortfall was one of the biggest setbacks in the company’s history: despite maintaining revenues at or around the expectations of analysts, profit missed analysts’ expectations by a third. That was enough to send Fedex shares down over 20%, their worst daily performance in four decades, but it was also enough to spook markets generally, given Fedex’s sensitivity to global business activity. The company’s management pointed to particular weakness in Asia and Europe, and warned that conditions could deteriorate further. Whereas investors’ concerns had hitherto largely been directed towards consumer spending (since Walmart’s first profit warning in May), the Fedex news now transmits those concerns to business spending.

As has been the case since the start of the year, the US dollar benefited from the rout in risky assets, surging by nearly 2% on average against other major currencies. These included the pound, which subsequently fell to its lowest level against the dollar since 1985. The fact that this occurred on the 30th anniversary of “Black Wednesday,” when the UK crashed out of the European Exchange Rate Mechanism, was not lost on market commentators.

In what may be a sign of things to come, it was reported the German government is in talks to nationalise the utility company Uniper. The firm, which owns energy assets in Europe and Russia, had already seen its market value eroded from EUR16 billion down to EUR1.4 billion. The German government is also rumoured to have set its sights on other companies within the energy sector.

Amazon was hit with another anti-monopoly lawsuit, this time from the state of California, which alleges that “Amazon coerces merchants into agreements that keep prices artificially high”, such as by preventing them offering lower prices on other e-commerce websites. The company recently paid a fine in Washington state for illegal price-fixing with third-party sellers, and is being investigated by the US Federal Trade Commission on several counts, including for its acquisition activity.

Shares in Starbucks enjoyed a robust week, rising by 2.5% despite the difficult market conditions. The shares are now up over 30% since their trough in May, as consumers prioritise their caffeine habit over other forms of spending. Last week the company announced a three-year plan in which it upgraded its outlook for revenues and profit, and now expects organic growth of 7-9% per annum versus its prior forecast of 4-5%.

European fund managers may be facing a mass downgrade of their environmental fund ratings after a study found that many had not adhered to EU guidelines that came in 18 months ago. The new ratings will reflect that fact that most funds are not purely seeking out sustainable investments, despite having a top ESG rating. Fund managers have complained that they do not have enough data to comply with the new regulations, and that the regulations are continually being tweaked.

Highlights

Calendar

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.